| HS Code | Official Doc | Tariff Rate | Origin | Destination | Effective Date |

|---|---|---|---|---|---|

| 3921901950 | Doc | 60.3% | CN | US | 2025-05-12 |

| 4202122150 | Doc | 75.0% | CN | US | 2025-05-12 |

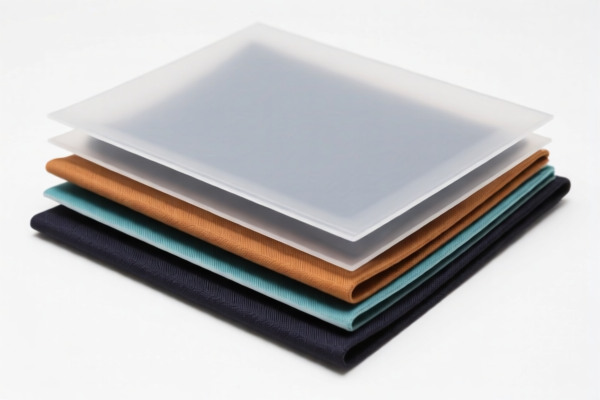

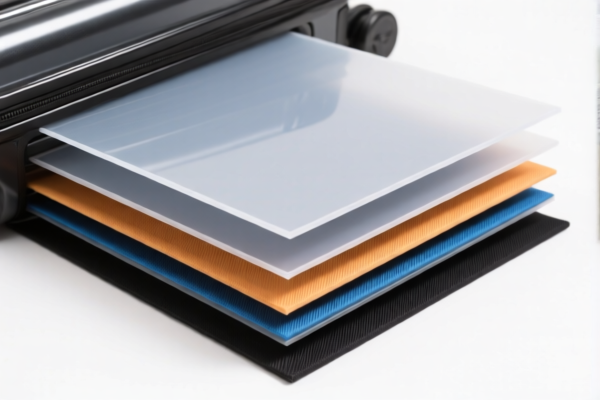

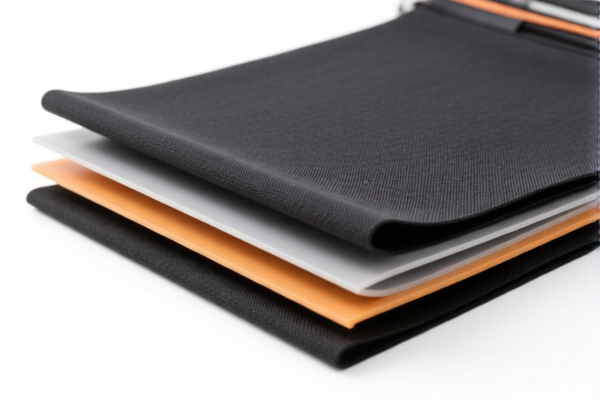

Product Classification and Tax Information for Textile Composite Plastic Sheets (for Luggage)

Here is the detailed classification and tariff information for your product:

✅ HS CODE: 3921901950

Description: Composite textile plastic material used for luggage, classified under HS CODE 3921.90.19.50.

- Base Tariff Rate: 5.3%

- Additional Tariff (General): 25.0%

- Special Tariff after April 11, 2025: 30.0%

- Total Tax Rate: 60.3%

✅ HS CODE: 4202122150

Description: Plastic travel cases, classified under plastic-made boxes and suitcases.

- Base Tariff Rate: 20.0%

- Additional Tariff (General): 25.0%

- Special Tariff after April 11, 2025: 30.0%

- Total Tax Rate: 75.0%

⚠️ Important Notes:

- April 11 Special Tariff: A 30% additional tariff is imposed on both classifications after April 11, 2025. This is a time-sensitive policy and must be considered in your customs planning.

- Anti-dumping duties: Not specifically mentioned for this product, but always verify if any anti-dumping or countervailing duties apply based on the country of origin.

- Material and Certification: Confirm the exact composition of the textile composite plastic sheets (e.g., percentage of plastic vs. textile) and whether any certifications (e.g., safety, environmental compliance) are required for import.

📌 Proactive Advice:

- Verify Material Composition: Ensure the product is correctly classified based on its primary material (plastic vs. textile composite).

- Check Unit Price: Tariff rates may vary based on the declared value and whether the product is considered "luxury" or "mass-produced."

- Consult Customs Authority: For the most up-to-date and accurate classification, especially if the product is a new or modified version.

- Document Compliance: Maintain records of product specifications, certifications, and any applicable trade agreements to support customs declarations.

Let me know if you need help with further classification or documentation! Product Classification and Tax Information for Textile Composite Plastic Sheets (for Luggage)

Here is the detailed classification and tariff information for your product:

✅ HS CODE: 3921901950

Description: Composite textile plastic material used for luggage, classified under HS CODE 3921.90.19.50.

- Base Tariff Rate: 5.3%

- Additional Tariff (General): 25.0%

- Special Tariff after April 11, 2025: 30.0%

- Total Tax Rate: 60.3%

✅ HS CODE: 4202122150

Description: Plastic travel cases, classified under plastic-made boxes and suitcases.

- Base Tariff Rate: 20.0%

- Additional Tariff (General): 25.0%

- Special Tariff after April 11, 2025: 30.0%

- Total Tax Rate: 75.0%

⚠️ Important Notes:

- April 11 Special Tariff: A 30% additional tariff is imposed on both classifications after April 11, 2025. This is a time-sensitive policy and must be considered in your customs planning.

- Anti-dumping duties: Not specifically mentioned for this product, but always verify if any anti-dumping or countervailing duties apply based on the country of origin.

- Material and Certification: Confirm the exact composition of the textile composite plastic sheets (e.g., percentage of plastic vs. textile) and whether any certifications (e.g., safety, environmental compliance) are required for import.

📌 Proactive Advice:

- Verify Material Composition: Ensure the product is correctly classified based on its primary material (plastic vs. textile composite).

- Check Unit Price: Tariff rates may vary based on the declared value and whether the product is considered "luxury" or "mass-produced."

- Consult Customs Authority: For the most up-to-date and accurate classification, especially if the product is a new or modified version.

- Document Compliance: Maintain records of product specifications, certifications, and any applicable trade agreements to support customs declarations.

Let me know if you need help with further classification or documentation!

Customer Reviews

No reviews yet.