| HS Code | Official Doc | Tariff Rate | Origin | Destination | Effective Date |

|---|---|---|---|---|---|

| 3921904010 | Doc | 34.2% | CN | US | 2025-05-12 |

| 3921905050 | Doc | 34.8% | CN | US | 2025-05-12 |

| 3920995000 | Doc | 60.8% | CN | US | 2025-05-12 |

| 4411932000 | Doc | 1.9¢/kg + 1.5%+55.0% | CN | US | 2025-05-12 |

| 4807009400 | Doc | 55.0% | CN | US | 2025-05-12 |

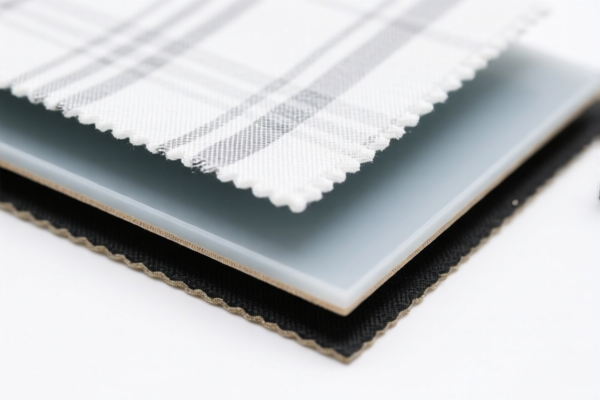

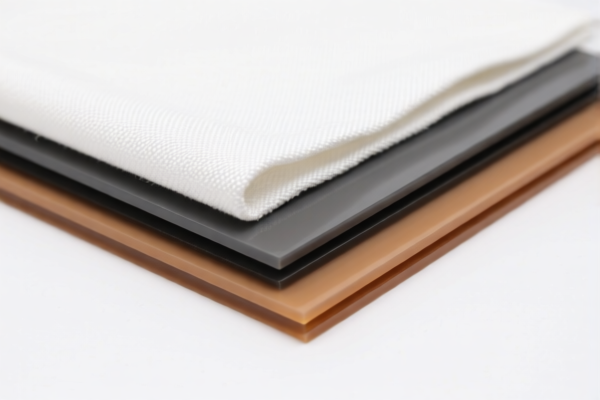

Here is the structured classification and tariff information for Textile Composite Plastic Sheets for Construction, based on the provided HS codes and tax details:

✅ HS CODE: 3921904010

Product Description:

- Building use paper-plastic composite board, made with paper reinforcement, flexible plastic sheet.

Tariff Summary:

- Base Tariff Rate: 4.2%

- Additional Tariff (before April 11, 2025): 0.0%

- Additional Tariff (after April 11, 2025): 30.0%

- Total Tax Rate: 34.2%

Key Notes:

- This is the most suitable code for paper-reinforced plastic composite boards used in construction.

- April 11 Special Tariff applies after April 11, 2025.

✅ HS CODE: 3921905050

Product Description:

- Plastic composite material board, other plastic sheets, films, foils, and strips.

Tariff Summary:

- Base Tariff Rate: 4.8%

- Additional Tariff (before April 11, 2025): 0.0%

- Additional Tariff (after April 11, 2025): 30.0%

- Total Tax Rate: 34.8%

Key Notes:

- Applicable for general plastic composite boards not specifically paper-reinforced.

- April 11 Special Tariff applies after April 11, 2025.

✅ HS CODE: 3920995000

Product Description:

- Composite plastic sheets, made by laminating, supporting, or combining with other materials, non-cellular and non-reinforced plastic sheets.

Tariff Summary:

- Base Tariff Rate: 5.8%

- Additional Tariff (before April 11, 2025): 25.0%

- Additional Tariff (after April 11, 2025): 30.0%

- Total Tax Rate: 60.8%

Key Notes:

- Higher tax rate due to additional tariffs already applied.

- April 11 Special Tariff applies after April 11, 2025.

✅ HS CODE: 4411932000

Product Description:

- Building use composite structural board, made of wood or wood fiber board for walls, ceilings, or other building components.

Tariff Summary:

- Base Tariff Rate: 1.9¢/kg + 1.5%

- Additional Tariff (before April 11, 2025): 25.0%

- Additional Tariff (after April 11, 2025): 30.0%

- Total Tax Rate: 1.9¢/kg + 1.5% + 55.0%

Key Notes:

- This code is for wood-based composite boards, not plastic.

- April 11 Special Tariff applies after April 11, 2025.

- Not recommended for plastic composite sheets.

✅ HS CODE: 4807009400

Product Description:

- Building use composite paperboard, made by bonding multiple layers of paper or cardboard with adhesive.

Tariff Summary:

- Base Tariff Rate: 0.0%

- Additional Tariff (before April 11, 2025): 25.0%

- Additional Tariff (after April 11, 2025): 30.0%

- Total Tax Rate: 55.0%

Key Notes:

- This is for paper-based composite boards, not plastic.

- April 11 Special Tariff applies after April 11, 2025.

- Not recommended for plastic composite sheets.

📌 Proactive Advice for Users:

- Verify Material Composition: Ensure the product is paper-reinforced plastic or plastic composite to match the correct HS code (e.g., 3921904010 or 3921905050).

- Check Unit Price and Tax Calculation: For codes with 1.9¢/kg (e.g., 4411932000), ensure the tax is calculated correctly based on weight.

- Confirm Required Certifications: Some products may require import permits, product standards, or environmental compliance documents.

- Monitor April 11, 2025 Policy Changes: Be aware of the 30% additional tariff that will apply after this date for most of the listed codes.

Let me know if you need help with certification requirements or customs documentation for these products. Here is the structured classification and tariff information for Textile Composite Plastic Sheets for Construction, based on the provided HS codes and tax details:

✅ HS CODE: 3921904010

Product Description:

- Building use paper-plastic composite board, made with paper reinforcement, flexible plastic sheet.

Tariff Summary:

- Base Tariff Rate: 4.2%

- Additional Tariff (before April 11, 2025): 0.0%

- Additional Tariff (after April 11, 2025): 30.0%

- Total Tax Rate: 34.2%

Key Notes:

- This is the most suitable code for paper-reinforced plastic composite boards used in construction.

- April 11 Special Tariff applies after April 11, 2025.

✅ HS CODE: 3921905050

Product Description:

- Plastic composite material board, other plastic sheets, films, foils, and strips.

Tariff Summary:

- Base Tariff Rate: 4.8%

- Additional Tariff (before April 11, 2025): 0.0%

- Additional Tariff (after April 11, 2025): 30.0%

- Total Tax Rate: 34.8%

Key Notes:

- Applicable for general plastic composite boards not specifically paper-reinforced.

- April 11 Special Tariff applies after April 11, 2025.

✅ HS CODE: 3920995000

Product Description:

- Composite plastic sheets, made by laminating, supporting, or combining with other materials, non-cellular and non-reinforced plastic sheets.

Tariff Summary:

- Base Tariff Rate: 5.8%

- Additional Tariff (before April 11, 2025): 25.0%

- Additional Tariff (after April 11, 2025): 30.0%

- Total Tax Rate: 60.8%

Key Notes:

- Higher tax rate due to additional tariffs already applied.

- April 11 Special Tariff applies after April 11, 2025.

✅ HS CODE: 4411932000

Product Description:

- Building use composite structural board, made of wood or wood fiber board for walls, ceilings, or other building components.

Tariff Summary:

- Base Tariff Rate: 1.9¢/kg + 1.5%

- Additional Tariff (before April 11, 2025): 25.0%

- Additional Tariff (after April 11, 2025): 30.0%

- Total Tax Rate: 1.9¢/kg + 1.5% + 55.0%

Key Notes:

- This code is for wood-based composite boards, not plastic.

- April 11 Special Tariff applies after April 11, 2025.

- Not recommended for plastic composite sheets.

✅ HS CODE: 4807009400

Product Description:

- Building use composite paperboard, made by bonding multiple layers of paper or cardboard with adhesive.

Tariff Summary:

- Base Tariff Rate: 0.0%

- Additional Tariff (before April 11, 2025): 25.0%

- Additional Tariff (after April 11, 2025): 30.0%

- Total Tax Rate: 55.0%

Key Notes:

- This is for paper-based composite boards, not plastic.

- April 11 Special Tariff applies after April 11, 2025.

- Not recommended for plastic composite sheets.

📌 Proactive Advice for Users:

- Verify Material Composition: Ensure the product is paper-reinforced plastic or plastic composite to match the correct HS code (e.g., 3921904010 or 3921905050).

- Check Unit Price and Tax Calculation: For codes with 1.9¢/kg (e.g., 4411932000), ensure the tax is calculated correctly based on weight.

- Confirm Required Certifications: Some products may require import permits, product standards, or environmental compliance documents.

- Monitor April 11, 2025 Policy Changes: Be aware of the 30% additional tariff that will apply after this date for most of the listed codes.

Let me know if you need help with certification requirements or customs documentation for these products.

Customer Reviews

No reviews yet.