| HS Code | Official Doc | Tariff Rate | Origin | Destination | Effective Date |

|---|---|---|---|---|---|

| 3921902900 | Doc | 59.4% | CN | US | 2025-05-12 |

| 3921902550 | Doc | 61.5% | CN | US | 2025-05-12 |

| 3921902510 | Doc | 61.5% | CN | US | 2025-05-12 |

| 3921902900 | Doc | 59.4% | CN | US | 2025-05-12 |

| 3921902510 | Doc | 61.5% | CN | US | 2025-05-12 |

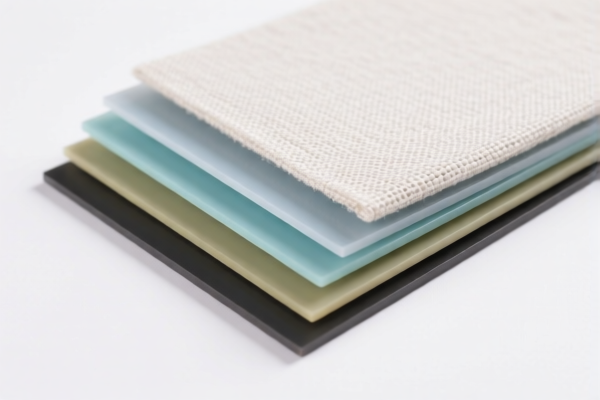

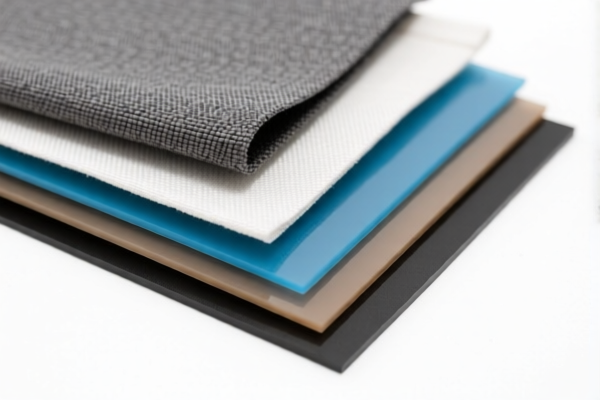

Product Classification: Textile Composite Plastic Sheets for Garment

HS CODEs and Tax Information Summary:

✅ HS CODE: 3921902900

Description:

- Plastic sheets, plates, films, foils, and strips combined with other materials, with a weight exceeding 1.492 kg/m².

- Textile composite plastic sheets fall under this category as they are combined with textile materials.

Tariff Summary:

- Base Tariff Rate: 4.4%

- Additional Tariff: 25.0%

- Special Tariff after April 11, 2025: 30.0%

- Total Tax Rate: 59.4%

✅ HS CODE: 3921902510

Description:

- Plastic sheets combined with textile materials, where plastic weight exceeds 70%.

Tariff Summary:

- Base Tariff Rate: 6.5%

- Additional Tariff: 25.0%

- Special Tariff after April 11, 2025: 30.0%

- Total Tax Rate: 61.5%

✅ HS CODE: 3921902550

Description:

- Plastic sheets combined with textile materials, with weight exceeding 1.492 kg/m², and artificial fibers (by weight) are the dominant textile component, with plastic weight exceeding 70%.

Tariff Summary:

- Base Tariff Rate: 6.5%

- Additional Tariff: 25.0%

- Special Tariff after April 11, 2025: 30.0%

- Total Tax Rate: 61.5%

✅ HS CODE: 3921905050

Description:

- Other plastic sheets, plates, films, foils, and strips (not covered by other subheadings in this group).

Tariff Summary:

- Base Tariff Rate: 4.8%

- Additional Tariff: 0.0%

- Special Tariff after April 11, 2025: 30.0%

- Total Tax Rate: 34.8%

📌 Key Notes and Recommendations:

-

April 11, 2025 Special Tariff:

A 30.0% additional tariff will be applied to all the above HS codes after April 11, 2025. This is a time-sensitive policy and must be considered in cost planning. -

Anti-dumping duties:

Not applicable for textile composite plastic sheets (not iron or aluminum products). -

Material and Composition Verification:

- Confirm the weight ratio of plastic vs. textile components.

- Ensure the total weight per square meter is above 1.492 kg/m² if applicable.

-

Identify the dominant textile fiber (e.g., artificial fibers) if using HS CODE 3921902550.

-

Certifications and Documentation:

- Verify if any customs certifications or product compliance documents are required for import.

- Ensure accurate product description and HS CODE selection to avoid classification errors and penalties.

🛠️ Proactive Advice:

- Double-check the composition of your product (plastic vs. textile weight) and total weight per square meter to ensure correct HS CODE selection.

- Consult with customs brokers or classification experts if the product is borderline between multiple HS CODEs.

- Plan for the April 11, 2025 tariff increase in your pricing and logistics strategy.

Product Classification: Textile Composite Plastic Sheets for Garment

HS CODEs and Tax Information Summary:

✅ HS CODE: 3921902900

Description:

- Plastic sheets, plates, films, foils, and strips combined with other materials, with a weight exceeding 1.492 kg/m².

- Textile composite plastic sheets fall under this category as they are combined with textile materials.

Tariff Summary:

- Base Tariff Rate: 4.4%

- Additional Tariff: 25.0%

- Special Tariff after April 11, 2025: 30.0%

- Total Tax Rate: 59.4%

✅ HS CODE: 3921902510

Description:

- Plastic sheets combined with textile materials, where plastic weight exceeds 70%.

Tariff Summary:

- Base Tariff Rate: 6.5%

- Additional Tariff: 25.0%

- Special Tariff after April 11, 2025: 30.0%

- Total Tax Rate: 61.5%

✅ HS CODE: 3921902550

Description:

- Plastic sheets combined with textile materials, with weight exceeding 1.492 kg/m², and artificial fibers (by weight) are the dominant textile component, with plastic weight exceeding 70%.

Tariff Summary:

- Base Tariff Rate: 6.5%

- Additional Tariff: 25.0%

- Special Tariff after April 11, 2025: 30.0%

- Total Tax Rate: 61.5%

✅ HS CODE: 3921905050

Description:

- Other plastic sheets, plates, films, foils, and strips (not covered by other subheadings in this group).

Tariff Summary:

- Base Tariff Rate: 4.8%

- Additional Tariff: 0.0%

- Special Tariff after April 11, 2025: 30.0%

- Total Tax Rate: 34.8%

📌 Key Notes and Recommendations:

-

April 11, 2025 Special Tariff:

A 30.0% additional tariff will be applied to all the above HS codes after April 11, 2025. This is a time-sensitive policy and must be considered in cost planning. -

Anti-dumping duties:

Not applicable for textile composite plastic sheets (not iron or aluminum products). -

Material and Composition Verification:

- Confirm the weight ratio of plastic vs. textile components.

- Ensure the total weight per square meter is above 1.492 kg/m² if applicable.

-

Identify the dominant textile fiber (e.g., artificial fibers) if using HS CODE 3921902550.

-

Certifications and Documentation:

- Verify if any customs certifications or product compliance documents are required for import.

- Ensure accurate product description and HS CODE selection to avoid classification errors and penalties.

🛠️ Proactive Advice:

- Double-check the composition of your product (plastic vs. textile weight) and total weight per square meter to ensure correct HS CODE selection.

- Consult with customs brokers or classification experts if the product is borderline between multiple HS CODEs.

- Plan for the April 11, 2025 tariff increase in your pricing and logistics strategy.

Customer Reviews

No reviews yet.