| HS Code | Official Doc | Tariff Rate | Origin | Destination | Effective Date |

|---|---|---|---|---|---|

| 3921902900 | Doc | 59.4% | CN | US | 2025-05-12 |

| 3921905050 | Doc | 34.8% | CN | US | 2025-05-12 |

| 3925900000 | Doc | 60.3% | CN | US | 2025-05-12 |

| 3920995000 | Doc | 60.8% | CN | US | 2025-05-12 |

| 3921904010 | Doc | 34.2% | CN | US | 2025-05-12 |

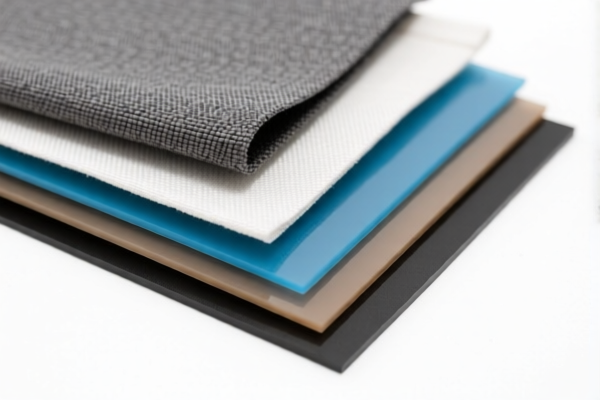

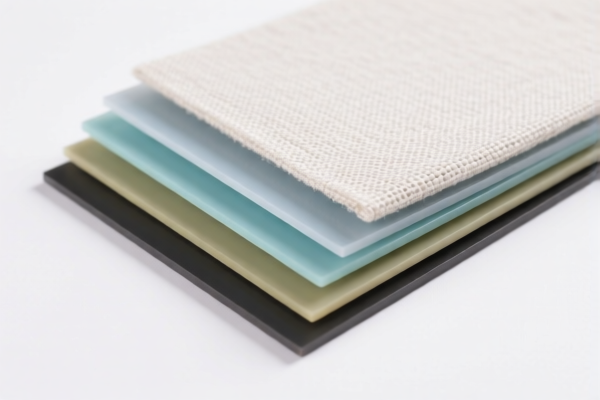

Here is the structured analysis and classification for Textile Composite Plastic Sheets for Home Decor, based on the provided HS codes and tariff details:

✅ HS CODE: 3921902900

Product Description: Plastic composite sheets combined with other materials, with a weight exceeding 1.492 kg/m².

Total Tax Rate: 59.4%

- Base Tariff: 4.4%

- Additional Tariff: 25.0%

- April 11 Special Tariff (after April 11, 2025): 30.0%

- Anti-dumping duties: Not specified for this code.

Key Notes:

- This code applies to heavier composite plastic sheets (over 1.492 kg/m²).

- Higher tax rate due to the additional 25% and 30% tariffs.

- Proactive Advice: Confirm the weight per square meter of the product to ensure correct classification.

✅ HS CODE: 3921905050

Product Description: Plastic decorative sheets, categorized under other plastic sheets, films, etc.

Total Tax Rate: 34.8%

- Base Tariff: 4.8%

- Additional Tariff: 0.0%

- April 11 Special Tariff (after April 11, 2025): 30.0%

- Anti-dumping duties: Not specified for this code.

Key Notes:

- Lower base tax compared to 3921902900.

- No additional tariff currently, but 30% will apply after April 11, 2025.

- Proactive Advice: Check if the product is lightweight (under 1.492 kg/m²) to qualify for this code.

✅ HS CODE: 3925900000

Product Description: Plastic decorative sheets classified under plastic building hardware products.

Total Tax Rate: 60.3%

- Base Tariff: 5.3%

- Additional Tariff: 25.0%

- April 11 Special Tariff (after April 11, 2025): 30.0%

- Anti-dumping duties: Not specified for this code.

Key Notes:

- Higher tax rate due to the 25% additional tariff.

- Proactive Advice: Confirm if the product is used for building or construction purposes, as this code is specific to building hardware.

✅ HS CODE: 3920995000

Product Description: General plastic sheets, including decorative types.

Total Tax Rate: 60.8%

- Base Tariff: 5.8%

- Additional Tariff: 25.0%

- April 11 Special Tariff (after April 11, 2025): 30.0%

- Anti-dumping duties: Not specified for this code.

Key Notes:

- Highest tax rate among the options.

- Proactive Advice: Ensure the product is not classified under a more specific code (e.g., 3921902900 or 3921904010) to avoid overpayment.

✅ HS CODE: 3921904010

Product Description: Paper-plastic composite decorative sheets (flexible, reinforced with paper).

Total Tax Rate: 34.2%

- Base Tariff: 4.2%

- Additional Tariff: 0.0%

- April 11 Special Tariff (after April 11, 2025): 30.0%

- Anti-dumping duties: Not specified for this code.

Key Notes:

- Lowest tax rate among all options.

- Proactive Advice: Confirm the material composition (e.g., paper reinforcement) to ensure correct classification.

📌 Summary of Tax Rate Changes (April 11, 2025):

- All codes will see an additional 30% tariff after April 11, 2025.

- Base rates vary from 4.2% to 5.8%, with additional tariffs ranging from 0% to 25%.

🛠️ Proactive Advice for Importers:

- Verify the product's weight per square meter to determine if it falls under 3921902900 or 3921905050.

- Check the material composition (e.g., paper reinforcement, textile content) to ensure correct HS code.

- Confirm the intended use (e.g., building vs. home decor) to avoid misclassification.

- Review required certifications (e.g., CE, RoHS) for compliance with local regulations.

- Plan for increased tariffs after April 11, 2025, and consider cost adjustments or alternative sourcing if necessary.

Let me know if you need help with certification requirements or customs documentation for this product. Here is the structured analysis and classification for Textile Composite Plastic Sheets for Home Decor, based on the provided HS codes and tariff details:

✅ HS CODE: 3921902900

Product Description: Plastic composite sheets combined with other materials, with a weight exceeding 1.492 kg/m².

Total Tax Rate: 59.4%

- Base Tariff: 4.4%

- Additional Tariff: 25.0%

- April 11 Special Tariff (after April 11, 2025): 30.0%

- Anti-dumping duties: Not specified for this code.

Key Notes:

- This code applies to heavier composite plastic sheets (over 1.492 kg/m²).

- Higher tax rate due to the additional 25% and 30% tariffs.

- Proactive Advice: Confirm the weight per square meter of the product to ensure correct classification.

✅ HS CODE: 3921905050

Product Description: Plastic decorative sheets, categorized under other plastic sheets, films, etc.

Total Tax Rate: 34.8%

- Base Tariff: 4.8%

- Additional Tariff: 0.0%

- April 11 Special Tariff (after April 11, 2025): 30.0%

- Anti-dumping duties: Not specified for this code.

Key Notes:

- Lower base tax compared to 3921902900.

- No additional tariff currently, but 30% will apply after April 11, 2025.

- Proactive Advice: Check if the product is lightweight (under 1.492 kg/m²) to qualify for this code.

✅ HS CODE: 3925900000

Product Description: Plastic decorative sheets classified under plastic building hardware products.

Total Tax Rate: 60.3%

- Base Tariff: 5.3%

- Additional Tariff: 25.0%

- April 11 Special Tariff (after April 11, 2025): 30.0%

- Anti-dumping duties: Not specified for this code.

Key Notes:

- Higher tax rate due to the 25% additional tariff.

- Proactive Advice: Confirm if the product is used for building or construction purposes, as this code is specific to building hardware.

✅ HS CODE: 3920995000

Product Description: General plastic sheets, including decorative types.

Total Tax Rate: 60.8%

- Base Tariff: 5.8%

- Additional Tariff: 25.0%

- April 11 Special Tariff (after April 11, 2025): 30.0%

- Anti-dumping duties: Not specified for this code.

Key Notes:

- Highest tax rate among the options.

- Proactive Advice: Ensure the product is not classified under a more specific code (e.g., 3921902900 or 3921904010) to avoid overpayment.

✅ HS CODE: 3921904010

Product Description: Paper-plastic composite decorative sheets (flexible, reinforced with paper).

Total Tax Rate: 34.2%

- Base Tariff: 4.2%

- Additional Tariff: 0.0%

- April 11 Special Tariff (after April 11, 2025): 30.0%

- Anti-dumping duties: Not specified for this code.

Key Notes:

- Lowest tax rate among all options.

- Proactive Advice: Confirm the material composition (e.g., paper reinforcement) to ensure correct classification.

📌 Summary of Tax Rate Changes (April 11, 2025):

- All codes will see an additional 30% tariff after April 11, 2025.

- Base rates vary from 4.2% to 5.8%, with additional tariffs ranging from 0% to 25%.

🛠️ Proactive Advice for Importers:

- Verify the product's weight per square meter to determine if it falls under 3921902900 or 3921905050.

- Check the material composition (e.g., paper reinforcement, textile content) to ensure correct HS code.

- Confirm the intended use (e.g., building vs. home decor) to avoid misclassification.

- Review required certifications (e.g., CE, RoHS) for compliance with local regulations.

- Plan for increased tariffs after April 11, 2025, and consider cost adjustments or alternative sourcing if necessary.

Let me know if you need help with certification requirements or customs documentation for this product.

Customer Reviews

No reviews yet.