| HS Code | Official Doc | Tariff Rate | Origin | Destination | Effective Date |

|---|---|---|---|---|---|

| 3921902550 | Doc | 61.5% | CN | US | 2025-05-12 |

| 3921902900 | Doc | 59.4% | CN | US | 2025-05-12 |

| 3921902510 | Doc | 61.5% | CN | US | 2025-05-12 |

| 3921902550 | Doc | 61.5% | CN | US | 2025-05-12 |

| 3921902900 | Doc | 59.4% | CN | US | 2025-05-12 |

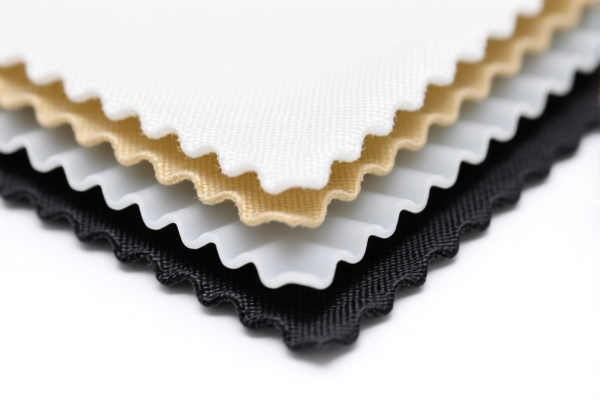

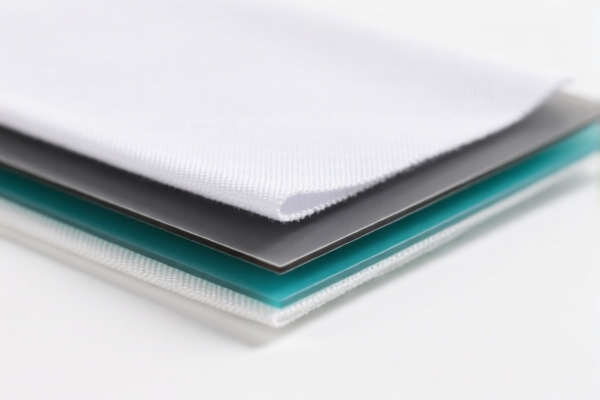

Product Classification: Textile Composite Plastic Sheets for Industrial Packaging

Below is the detailed customs classification and tariff information for the product "Textile Composite Plastic Sheets for Industrial Packaging" based on the provided HS codes and tax details.

HS CODE: 3921902550

Description: Textile composite plastic sheets for industrial packaging, classified under HS code 3921902550.

- Base Tariff Rate: 6.5%

- Additional Tariff (General): 25.0%

- Special Tariff (After April 2, 2025): 30.0%

- Total Tax Rate: 61.5%

- Note: This code appears twice in the input, but it is the same classification.

HS CODE: 3921902900

Description: Textile composite plastic sheets for industrial packaging, classified under HS code 3921902900.

- Base Tariff Rate: 4.4%

- Additional Tariff (General): 25.0%

- Special Tariff (After April 2, 2025): 30.0%

- Total Tax Rate: 59.4%

HS CODE: 3921902510

Description: Textile composite plastic sheets for industrial packaging, classified under HS code 3921902510.

- Base Tariff Rate: 6.5%

- Additional Tariff (General): 25.0%

- Special Tariff (After April 2, 2025): 30.0%

- Total Tax Rate: 61.5%

Key Observations and Tax Rate Changes:

-

April 2, 2025 Special Tariff:

A 30.0% additional tariff is imposed on all three HS codes after April 2, 2025. This is a time-sensitive policy and must be considered in cost planning and customs clearance. -

Tariff Differences Between Codes:

- 3921902550 and 3921902510 have the same total tax rate (61.5%), but the base tariff is 6.5% for both.

- 3921902900 has a lower base tariff (4.4%), resulting in a total tax rate of 59.4%.

Proactive Advice for Importers:

- Verify Material Composition: Ensure the product is correctly classified based on its material composition (e.g., textile content, type of plastic used, and bonding method).

- Check Unit Price and Certification: Confirm the unit price and whether any certifications (e.g., safety, environmental compliance) are required for import.

- Monitor Tariff Updates: Stay informed about tariff changes after April 2, 2025, as they may significantly impact the total cost.

- Consult Customs Broker: For accurate classification and compliance, consider working with a customs broker or trade compliance expert.

Summary Table:

| HS Code | Base Tariff | Additional Tariff | Special Tariff (After 2025.4.2) | Total Tax Rate |

|---|---|---|---|---|

| 3921902550 | 6.5% | 25.0% | 30.0% | 61.5% |

| 3921902900 | 4.4% | 25.0% | 30.0% | 59.4% |

| 3921902510 | 6.5% | 25.0% | 30.0% | 61.5% |

If you need further assistance with customs documentation, tariff calculation, or classification confirmation, feel free to provide more details about the product.

Product Classification: Textile Composite Plastic Sheets for Industrial Packaging

Below is the detailed customs classification and tariff information for the product "Textile Composite Plastic Sheets for Industrial Packaging" based on the provided HS codes and tax details.

HS CODE: 3921902550

Description: Textile composite plastic sheets for industrial packaging, classified under HS code 3921902550.

- Base Tariff Rate: 6.5%

- Additional Tariff (General): 25.0%

- Special Tariff (After April 2, 2025): 30.0%

- Total Tax Rate: 61.5%

- Note: This code appears twice in the input, but it is the same classification.

HS CODE: 3921902900

Description: Textile composite plastic sheets for industrial packaging, classified under HS code 3921902900.

- Base Tariff Rate: 4.4%

- Additional Tariff (General): 25.0%

- Special Tariff (After April 2, 2025): 30.0%

- Total Tax Rate: 59.4%

HS CODE: 3921902510

Description: Textile composite plastic sheets for industrial packaging, classified under HS code 3921902510.

- Base Tariff Rate: 6.5%

- Additional Tariff (General): 25.0%

- Special Tariff (After April 2, 2025): 30.0%

- Total Tax Rate: 61.5%

Key Observations and Tax Rate Changes:

-

April 2, 2025 Special Tariff:

A 30.0% additional tariff is imposed on all three HS codes after April 2, 2025. This is a time-sensitive policy and must be considered in cost planning and customs clearance. -

Tariff Differences Between Codes:

- 3921902550 and 3921902510 have the same total tax rate (61.5%), but the base tariff is 6.5% for both.

- 3921902900 has a lower base tariff (4.4%), resulting in a total tax rate of 59.4%.

Proactive Advice for Importers:

- Verify Material Composition: Ensure the product is correctly classified based on its material composition (e.g., textile content, type of plastic used, and bonding method).

- Check Unit Price and Certification: Confirm the unit price and whether any certifications (e.g., safety, environmental compliance) are required for import.

- Monitor Tariff Updates: Stay informed about tariff changes after April 2, 2025, as they may significantly impact the total cost.

- Consult Customs Broker: For accurate classification and compliance, consider working with a customs broker or trade compliance expert.

Summary Table:

| HS Code | Base Tariff | Additional Tariff | Special Tariff (After 2025.4.2) | Total Tax Rate |

|---|---|---|---|---|

| 3921902550 | 6.5% | 25.0% | 30.0% | 61.5% |

| 3921902900 | 4.4% | 25.0% | 30.0% | 59.4% |

| 3921902510 | 6.5% | 25.0% | 30.0% | 61.5% |

If you need further assistance with customs documentation, tariff calculation, or classification confirmation, feel free to provide more details about the product.

Customer Reviews

No reviews yet.