| HS Code | Official Doc | Tariff Rate | Origin | Destination | Effective Date |

|---|---|---|---|---|---|

| 3921902510 | Doc | 61.5% | CN | US | 2025-05-12 |

| 3921902550 | Doc | 61.5% | CN | US | 2025-05-12 |

| 3921902900 | Doc | 59.4% | CN | US | 2025-05-12 |

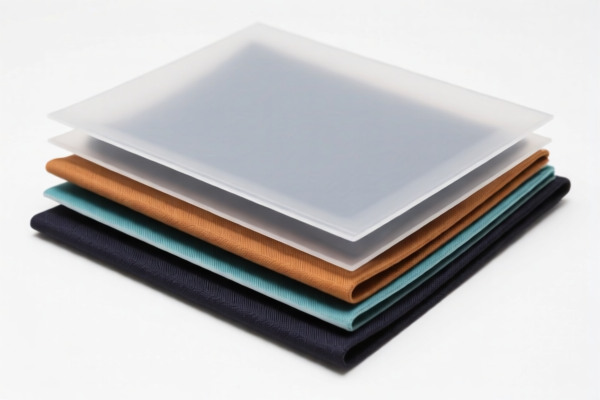

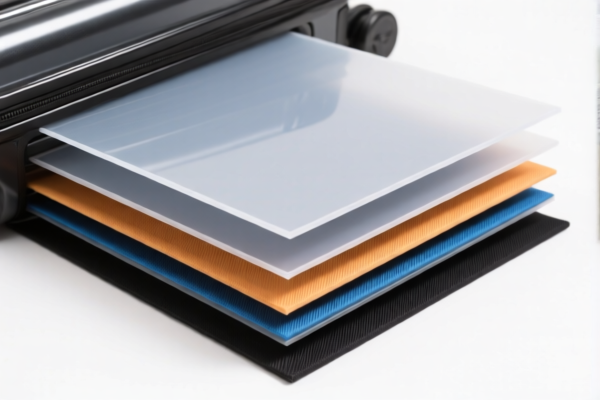

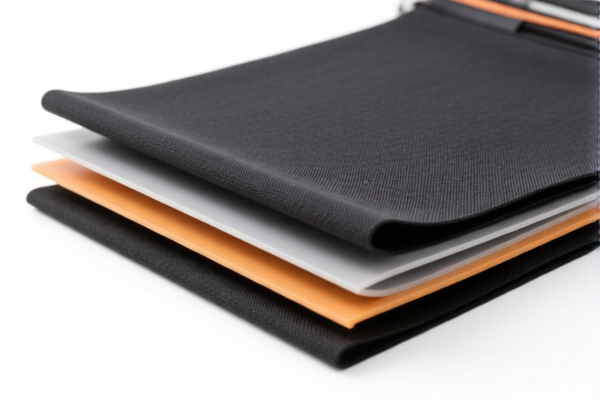

Product Classification: Textile Composite Plastic Sheets for Luggage

Below is the detailed classification and tariff information for the declared product based on the provided HS codes:

🔍 HS CODE: 3921902510

Description:

- Textile composite plastic sheets for luggage, where the plastic component weighs more than 70% of the total product.

Tariff Breakdown:

- Base Tariff Rate: 6.5%

- Additional Tariff (General): 25.0%

- Special Tariff (After April 11, 2025): 30.0%

- Total Tariff Rate: 61.5%

Key Notes: - This code applies specifically when plastic constitutes more than 70% of the product by weight. - Time-sensitive policy alert: Additional tariffs increase to 30.0% after April 11, 2025.

🔍 HS CODE: 3921902550

Description:

- Textile composite plastic sheets for luggage, where the total weight per square meter exceeds 1.492 kg.

Tariff Breakdown:

- Base Tariff Rate: 6.5%

- Additional Tariff (General): 25.0%

- Special Tariff (After April 11, 2025): 30.0%

- Total Tariff Rate: 61.5%

Key Notes: - This code applies based on weight per square meter, not the percentage of plastic. - Time-sensitive policy alert: Additional tariffs increase to 30.0% after April 11, 2025.

🔍 HS CODE: 3921902900

Description:

- Other plastic sheets, films, foils, or strips combined with other materials, where the total weight per square meter exceeds 1.492 kg.

Tariff Breakdown:

- Base Tariff Rate: 4.4%

- Additional Tariff (General): 25.0%

- Special Tariff (After April 11, 2025): 30.0%

- Total Tariff Rate: 59.4%

Key Notes: - This code is for other composite plastic products with a weight per square meter over 1.492 kg. - Time-sensitive policy alert: Additional tariffs increase to 30.0% after April 11, 2025.

📌 Proactive Advice for Importers:

- Verify the material composition (e.g., plastic percentage by weight) to determine the correct HS code.

- Check the weight per square meter if the product is classified under 3921902550 or 3921902900.

- Confirm the unit price to ensure compliance with customs valuation rules.

- Review required certifications (e.g., safety, environmental compliance) for textile and plastic composites.

- Monitor the April 11, 2025, deadline for potential tariff increases and adjust import strategies accordingly.

Let me know if you need help determining which HS code applies to your specific product. Product Classification: Textile Composite Plastic Sheets for Luggage

Below is the detailed classification and tariff information for the declared product based on the provided HS codes:

🔍 HS CODE: 3921902510

Description:

- Textile composite plastic sheets for luggage, where the plastic component weighs more than 70% of the total product.

Tariff Breakdown:

- Base Tariff Rate: 6.5%

- Additional Tariff (General): 25.0%

- Special Tariff (After April 11, 2025): 30.0%

- Total Tariff Rate: 61.5%

Key Notes: - This code applies specifically when plastic constitutes more than 70% of the product by weight. - Time-sensitive policy alert: Additional tariffs increase to 30.0% after April 11, 2025.

🔍 HS CODE: 3921902550

Description:

- Textile composite plastic sheets for luggage, where the total weight per square meter exceeds 1.492 kg.

Tariff Breakdown:

- Base Tariff Rate: 6.5%

- Additional Tariff (General): 25.0%

- Special Tariff (After April 11, 2025): 30.0%

- Total Tariff Rate: 61.5%

Key Notes: - This code applies based on weight per square meter, not the percentage of plastic. - Time-sensitive policy alert: Additional tariffs increase to 30.0% after April 11, 2025.

🔍 HS CODE: 3921902900

Description:

- Other plastic sheets, films, foils, or strips combined with other materials, where the total weight per square meter exceeds 1.492 kg.

Tariff Breakdown:

- Base Tariff Rate: 4.4%

- Additional Tariff (General): 25.0%

- Special Tariff (After April 11, 2025): 30.0%

- Total Tariff Rate: 59.4%

Key Notes: - This code is for other composite plastic products with a weight per square meter over 1.492 kg. - Time-sensitive policy alert: Additional tariffs increase to 30.0% after April 11, 2025.

📌 Proactive Advice for Importers:

- Verify the material composition (e.g., plastic percentage by weight) to determine the correct HS code.

- Check the weight per square meter if the product is classified under 3921902550 or 3921902900.

- Confirm the unit price to ensure compliance with customs valuation rules.

- Review required certifications (e.g., safety, environmental compliance) for textile and plastic composites.

- Monitor the April 11, 2025, deadline for potential tariff increases and adjust import strategies accordingly.

Let me know if you need help determining which HS code applies to your specific product.

Customer Reviews

No reviews yet.