| HS Code | Official Doc | Tariff Rate | Origin | Destination | Effective Date |

|---|---|---|---|---|---|

| 3921904010 | Doc | 34.2% | CN | US | 2025-05-12 |

| 4807009400 | Doc | 55.0% | CN | US | 2025-05-12 |

| 3920995000 | Doc | 60.8% | CN | US | 2025-05-12 |

| 4411940080 | Doc | 55.0% | CN | US | 2025-05-12 |

| 3921905050 | Doc | 34.8% | CN | US | 2025-05-12 |

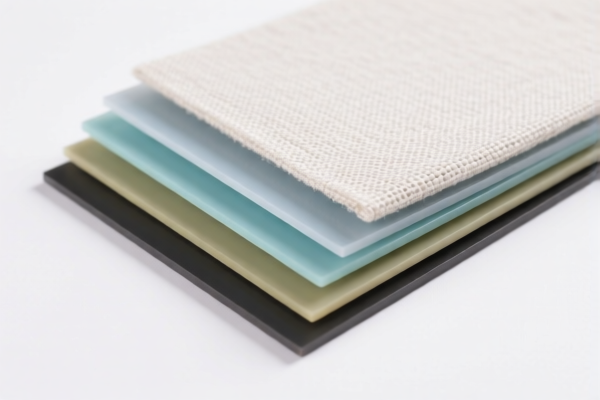

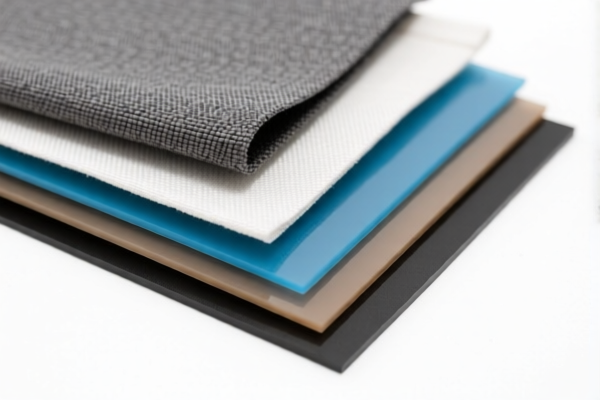

Here is the structured classification and tariff information for Textile Composite Plastic Sheets for Packaging, based on the provided HS codes and tax details:

✅ HS CODE: 3921904010

Description: Flexible plastic sheets, plates, films, foils, and strips reinforced with paper

Total Tax Rate: 34.2%

- Base Tariff: 4.2%

- Additional Tariff: 0.0%

- April 11, 2025 Special Tariff: 30.0% (applies after April 11, 2025)

- Anti-dumping duties: Not applicable for this category

- Note: This code applies to plastic sheets reinforced with paper, which may be relevant if your product includes paper reinforcement.

✅ HS CODE: 4807009400

Description: Composite paper and paperboard, uncoated or unimpregnated, in rolls or sheets

Total Tax Rate: 55.0%

- Base Tariff: 0.0%

- Additional Tariff: 25.0%

- April 11, 2025 Special Tariff: 30.0% (applies after April 11, 2025)

- Anti-dumping duties: Not applicable

- Note: This code applies to composite paper or paperboard, which may be relevant if your product includes paper-based composite layers.

✅ HS CODE: 3920995000

Description: Laminated, supported, or otherwise combined with other materials, non-cellulose plastics and non-reinforced plastic sheets

Total Tax Rate: 60.8%

- Base Tariff: 5.8%

- Additional Tariff: 25.0%

- April 11, 2025 Special Tariff: 30.0% (applies after April 11, 2025)

- Anti-dumping duties: Not applicable

- Note: This code applies to plastic sheets combined with other materials, which may be relevant if your product is a composite of plastic and other materials.

✅ HS CODE: 4411940080

Description: Other wood or wood fiber boards, with a density not exceeding 0.5 g/cm³

Total Tax Rate: 55.0%

- Base Tariff: 0.0%

- Additional Tariff: 25.0%

- April 11, 2025 Special Tariff: 30.0% (applies after April 11, 2025)

- Anti-dumping duties: Not applicable

- Note: This code applies to wood-based composite boards, which may be relevant if your product includes wood or fiberboard components.

✅ HS CODE: 3921905050

Description: Other plastic sheets, plates, films, foils, and strips

Total Tax Rate: 34.8%

- Base Tariff: 4.8%

- Additional Tariff: 0.0%

- April 11, 2025 Special Tariff: 30.0% (applies after April 11, 2025)

- Anti-dumping duties: Not applicable

- Note: This code applies to other plastic sheets, which may be relevant if your product is a standard plastic sheet without reinforcement.

📌 Proactive Advice for You:

- Verify the material composition of your product (e.g., whether it contains paper, wood, or other composites) to ensure correct HS code classification.

- Check the unit price to determine if any preferential tariff rates apply (e.g., under free trade agreements).

- Confirm required certifications (e.g., CE, RoHS, or other product compliance standards) depending on the destination market.

- Monitor the April 11, 2025 deadline for additional tariffs—this could significantly increase your import costs if not accounted for in advance.

Let me know if you need help selecting the most accurate HS code for your specific product. Here is the structured classification and tariff information for Textile Composite Plastic Sheets for Packaging, based on the provided HS codes and tax details:

✅ HS CODE: 3921904010

Description: Flexible plastic sheets, plates, films, foils, and strips reinforced with paper

Total Tax Rate: 34.2%

- Base Tariff: 4.2%

- Additional Tariff: 0.0%

- April 11, 2025 Special Tariff: 30.0% (applies after April 11, 2025)

- Anti-dumping duties: Not applicable for this category

- Note: This code applies to plastic sheets reinforced with paper, which may be relevant if your product includes paper reinforcement.

✅ HS CODE: 4807009400

Description: Composite paper and paperboard, uncoated or unimpregnated, in rolls or sheets

Total Tax Rate: 55.0%

- Base Tariff: 0.0%

- Additional Tariff: 25.0%

- April 11, 2025 Special Tariff: 30.0% (applies after April 11, 2025)

- Anti-dumping duties: Not applicable

- Note: This code applies to composite paper or paperboard, which may be relevant if your product includes paper-based composite layers.

✅ HS CODE: 3920995000

Description: Laminated, supported, or otherwise combined with other materials, non-cellulose plastics and non-reinforced plastic sheets

Total Tax Rate: 60.8%

- Base Tariff: 5.8%

- Additional Tariff: 25.0%

- April 11, 2025 Special Tariff: 30.0% (applies after April 11, 2025)

- Anti-dumping duties: Not applicable

- Note: This code applies to plastic sheets combined with other materials, which may be relevant if your product is a composite of plastic and other materials.

✅ HS CODE: 4411940080

Description: Other wood or wood fiber boards, with a density not exceeding 0.5 g/cm³

Total Tax Rate: 55.0%

- Base Tariff: 0.0%

- Additional Tariff: 25.0%

- April 11, 2025 Special Tariff: 30.0% (applies after April 11, 2025)

- Anti-dumping duties: Not applicable

- Note: This code applies to wood-based composite boards, which may be relevant if your product includes wood or fiberboard components.

✅ HS CODE: 3921905050

Description: Other plastic sheets, plates, films, foils, and strips

Total Tax Rate: 34.8%

- Base Tariff: 4.8%

- Additional Tariff: 0.0%

- April 11, 2025 Special Tariff: 30.0% (applies after April 11, 2025)

- Anti-dumping duties: Not applicable

- Note: This code applies to other plastic sheets, which may be relevant if your product is a standard plastic sheet without reinforcement.

📌 Proactive Advice for You:

- Verify the material composition of your product (e.g., whether it contains paper, wood, or other composites) to ensure correct HS code classification.

- Check the unit price to determine if any preferential tariff rates apply (e.g., under free trade agreements).

- Confirm required certifications (e.g., CE, RoHS, or other product compliance standards) depending on the destination market.

- Monitor the April 11, 2025 deadline for additional tariffs—this could significantly increase your import costs if not accounted for in advance.

Let me know if you need help selecting the most accurate HS code for your specific product.

Customer Reviews

No reviews yet.