| HS Code | Official Doc | Tariff Rate | Origin | Destination | Effective Date |

|---|---|---|---|---|---|

| 3921901950 | Doc | 60.3% | CN | US | 2025-05-12 |

| 3921901100 | Doc | 59.2% | CN | US | 2025-05-12 |

| 3921902900 | Doc | 59.4% | CN | US | 2025-05-12 |

| 3921901500 | Doc | 61.5% | CN | US | 2025-05-12 |

| 3921901100 | Doc | 59.2% | CN | US | 2025-05-12 |

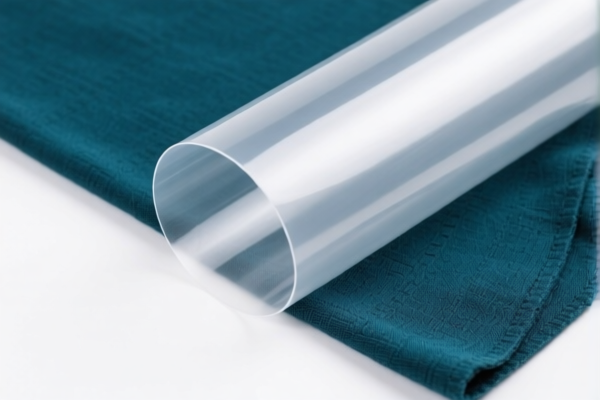

Product Name: Textile Composite Plastic Shielding Films

Classification HS Codes and Tax Details:

🔍 HS Code: 3921901950

Description: Other plastic sheets, plates, films, foils, and strips combined with textile materials, with a weight not exceeding 1.492 kg/m².

- Total Tax Rate: 60.3%

- Breakdown:

- Base Tariff: 5.3%

- Additional Tariff: 25.0%

- Special Tariff after April 11, 2025: 30.0%

- Note: This code applies to general composite products of plastic and textile materials, not limited to specific fiber types.

🔍 HS Code: 3921901100

Description: Other plastic sheets, plates, films, foils, and strips combined with textile materials, with a weight not exceeding 1.492 kg/m², where synthetic fibers make up the majority of the textile component and plastic accounts for more than 70% of the product.

- Total Tax Rate: 59.2%

- Breakdown:

- Base Tariff: 4.2%

- Additional Tariff: 25.0%

- Special Tariff after April 11, 2025: 30.0%

- Note: This code is more favorable than 3921901950, but only applies if the product meets the specific fiber and plastic composition criteria.

🔍 HS Code: 3921902900

Description: Films combining plastic with textile materials.

- Total Tax Rate: 59.4%

- Breakdown:

- Base Tariff: 4.4%

- Additional Tariff: 25.0%

- Special Tariff after April 11, 2025: 30.0%

- Note: This code is for films specifically, and may be more suitable for shielding films used in electronics or protective applications.

🔍 HS Code: 3921901500

Description: Plastic sheets, plates, films, foils, and strips combined with textile materials, with a weight not exceeding 1.492 kg/m², where synthetic fibers make up the majority of the textile component.

- Total Tax Rate: 61.5%

- Breakdown:

- Base Tariff: 6.5%

- Additional Tariff: 25.0%

- Special Tariff after April 11, 2025: 30.0%

- Note: This code has the highest base tariff among the listed options, so it's important to ensure the product does not fall under this category unless it specifically meets the criteria.

🔍 HS Code: 3921901100 (Duplicate Entry)

Note: This code appears twice in the list. The second entry is a duplicate of the first 3921901100 code. Ensure that the product description and composition match the correct HS code to avoid misclassification.

⚠️ Important Reminders:

- Verify Material Composition: Confirm the exact percentage of plastic and textile components, especially the type of synthetic fiber used (e.g., polyester, nylon).

- Check Unit Price and Weight: Ensure the product weight per square meter does not exceed 1.492 kg, as this is a critical classification criterion.

- Certifications Required: Some products may require specific certifications (e.g., RoHS, REACH) for import compliance.

- April 11, 2025 Tariff Alert: All listed codes are subject to an additional 30% tariff after this date. Plan accordingly for cost estimation and compliance.

- Anti-Dumping Duties: Not applicable for this product category, but always verify with the latest customs updates.

✅ Proactive Advice:

- Consult a customs broker or classification expert if the product composition is complex or unclear.

- Request a detailed product specification sheet from the supplier to ensure accurate HS code selection.

- Monitor policy updates related to import tariffs and trade agreements, especially after April 11, 2025.

Product Name: Textile Composite Plastic Shielding Films

Classification HS Codes and Tax Details:

🔍 HS Code: 3921901950

Description: Other plastic sheets, plates, films, foils, and strips combined with textile materials, with a weight not exceeding 1.492 kg/m².

- Total Tax Rate: 60.3%

- Breakdown:

- Base Tariff: 5.3%

- Additional Tariff: 25.0%

- Special Tariff after April 11, 2025: 30.0%

- Note: This code applies to general composite products of plastic and textile materials, not limited to specific fiber types.

🔍 HS Code: 3921901100

Description: Other plastic sheets, plates, films, foils, and strips combined with textile materials, with a weight not exceeding 1.492 kg/m², where synthetic fibers make up the majority of the textile component and plastic accounts for more than 70% of the product.

- Total Tax Rate: 59.2%

- Breakdown:

- Base Tariff: 4.2%

- Additional Tariff: 25.0%

- Special Tariff after April 11, 2025: 30.0%

- Note: This code is more favorable than 3921901950, but only applies if the product meets the specific fiber and plastic composition criteria.

🔍 HS Code: 3921902900

Description: Films combining plastic with textile materials.

- Total Tax Rate: 59.4%

- Breakdown:

- Base Tariff: 4.4%

- Additional Tariff: 25.0%

- Special Tariff after April 11, 2025: 30.0%

- Note: This code is for films specifically, and may be more suitable for shielding films used in electronics or protective applications.

🔍 HS Code: 3921901500

Description: Plastic sheets, plates, films, foils, and strips combined with textile materials, with a weight not exceeding 1.492 kg/m², where synthetic fibers make up the majority of the textile component.

- Total Tax Rate: 61.5%

- Breakdown:

- Base Tariff: 6.5%

- Additional Tariff: 25.0%

- Special Tariff after April 11, 2025: 30.0%

- Note: This code has the highest base tariff among the listed options, so it's important to ensure the product does not fall under this category unless it specifically meets the criteria.

🔍 HS Code: 3921901100 (Duplicate Entry)

Note: This code appears twice in the list. The second entry is a duplicate of the first 3921901100 code. Ensure that the product description and composition match the correct HS code to avoid misclassification.

⚠️ Important Reminders:

- Verify Material Composition: Confirm the exact percentage of plastic and textile components, especially the type of synthetic fiber used (e.g., polyester, nylon).

- Check Unit Price and Weight: Ensure the product weight per square meter does not exceed 1.492 kg, as this is a critical classification criterion.

- Certifications Required: Some products may require specific certifications (e.g., RoHS, REACH) for import compliance.

- April 11, 2025 Tariff Alert: All listed codes are subject to an additional 30% tariff after this date. Plan accordingly for cost estimation and compliance.

- Anti-Dumping Duties: Not applicable for this product category, but always verify with the latest customs updates.

✅ Proactive Advice:

- Consult a customs broker or classification expert if the product composition is complex or unclear.

- Request a detailed product specification sheet from the supplier to ensure accurate HS code selection.

- Monitor policy updates related to import tariffs and trade agreements, especially after April 11, 2025.

Customer Reviews

No reviews yet.