| HS Code | Official Doc | Tariff Rate | Origin | Destination | Effective Date |

|---|---|---|---|---|---|

| 3921902900 | Doc | 59.4% | CN | US | 2025-05-12 |

| 3921901100 | Doc | 59.2% | CN | US | 2025-05-12 |

| 3921902550 | Doc | 61.5% | CN | US | 2025-05-12 |

| 3916100000 | Doc | 60.8% | CN | US | 2025-05-12 |

| 3921902550 | Doc | 61.5% | CN | US | 2025-05-12 |

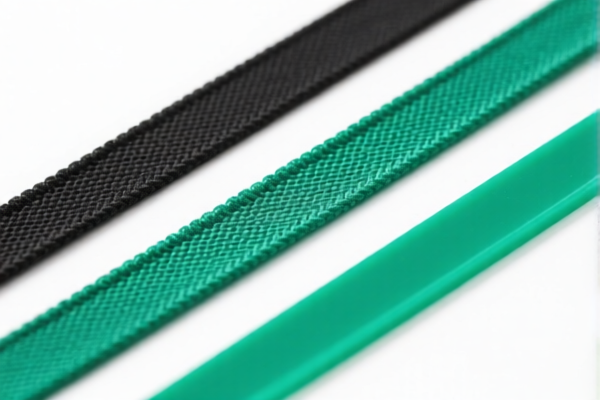

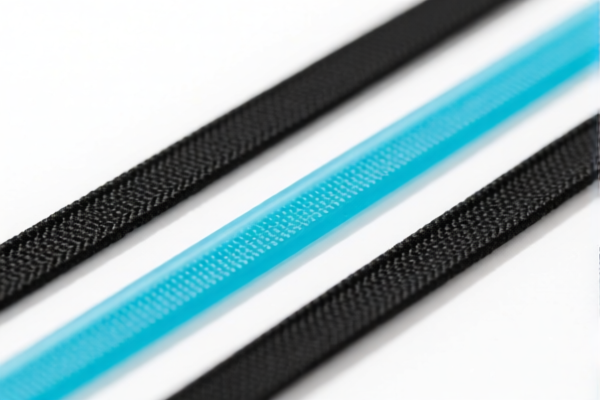

Product Classification and Tax Analysis for "Textile Composite Plastic Strips for Agricultural Covering"

Based on the provided HS codes and descriptions, the product "Textile Composite Plastic Strips for Agricultural Covering" may fall under the following classifications. Below is a structured breakdown of the relevant HS codes and their associated tax implications:

🔍 HS CODE: 3921902900

Description: Other plastic sheets, plates, films, foils and strips, combined with other materials, with a weight exceeding 1.492 kg/m².

Total Tax Rate: 59.4%

Tax Breakdown:

- Base Tariff: 4.4%

- Additional Tariff: 25.0%

- Special Tariff after April 11, 2025: 30.0%

Notes:

- This code applies to composite products with a total weight exceeding 1.492 kg/m².

- If your product is a textile-plastic composite with a total weight over this threshold, this may be the correct classification.

🔍 HS CODE: 3921901100

Description: Plastic combined with textile materials, with a weight not exceeding 1.492 kg/m², where synthetic fibers in the textile component exceed any other single fiber type, and plastic constitutes more than 70% of the total weight.

Total Tax Rate: 59.2%

Tax Breakdown:

- Base Tariff: 4.2%

- Additional Tariff: 25.0%

- Special Tariff after April 11, 2025: 30.0%

Notes:

- This code is for lighter composites (≤1.492 kg/m²) with a high plastic content (over 70%) and synthetic fiber dominance in the textile part.

- If your product is lighter and meets these fiber and weight criteria, this may be the correct code.

🔍 HS CODE: 3921902550

Description: Other plastic sheets, plates, films, foils and strips, combined with textile materials and with a weight exceeding 1.492 kg/m², where synthetic fibers in the textile component exceed any other single fiber type, and plastic constitutes more than 70% of the total weight.

Total Tax Rate: 61.5%

Tax Breakdown:

- Base Tariff: 6.5%

- Additional Tariff: 25.0%

- Special Tariff after April 11, 2025: 30.0%

Notes:

- This code is for heavier composites (>1.492 kg/m²) with a high plastic content (over 70%) and synthetic fiber dominance in the textile part.

- If your product is heavier and meets these fiber and weight criteria, this may be the correct code.

🔍 HS CODE: 3916100000

Description: Polyethylene plastic strips for agricultural irrigation.

Total Tax Rate: 60.8%

Tax Breakdown:

- Base Tariff: 5.8%

- Additional Tariff: 25.0%

- Special Tariff after April 11, 2025: 30.0%

Notes:

- This code is specific to polyethylene strips used in agricultural irrigation.

- If your product is a polyethylene strip used for irrigation, this may be the correct classification.

📌 Proactive Advice for Importers:

- Verify Material Composition: Confirm the exact composition of your product (e.g., plastic type, textile fiber type, and weight per square meter). This will help determine the correct HS code.

- Check Unit Price and Certification: Some HS codes may require specific certifications or documentation (e.g., for textile content or plastic composition).

- Monitor Tariff Changes: The April 11, 2025 special tariff applies to all the above codes. Ensure your import planning accounts for this increase.

- Consider Anti-Dumping Duties: If your product contains iron or aluminum components, check for applicable anti-dumping duties (not listed here, but may apply depending on origin and product specifics).

✅ Summary of Key Tax Changes (April 11, 2025):

| HS Code | Base Tariff | Additional Tariff | Special Tariff (after April 11, 2025) |

|---|---|---|---|

| 3921902900 | 4.4% | 25.0% | 30.0% |

| 3921901100 | 4.2% | 25.0% | 30.0% |

| 3921902550 | 6.5% | 25.0% | 30.0% |

| 3916100000 | 5.8% | 25.0% | 30.0% |

If you provide more details about the material composition, weight, and intended use, I can help you determine the most accurate HS code for your product. Product Classification and Tax Analysis for "Textile Composite Plastic Strips for Agricultural Covering"

Based on the provided HS codes and descriptions, the product "Textile Composite Plastic Strips for Agricultural Covering" may fall under the following classifications. Below is a structured breakdown of the relevant HS codes and their associated tax implications:

🔍 HS CODE: 3921902900

Description: Other plastic sheets, plates, films, foils and strips, combined with other materials, with a weight exceeding 1.492 kg/m².

Total Tax Rate: 59.4%

Tax Breakdown:

- Base Tariff: 4.4%

- Additional Tariff: 25.0%

- Special Tariff after April 11, 2025: 30.0%

Notes:

- This code applies to composite products with a total weight exceeding 1.492 kg/m².

- If your product is a textile-plastic composite with a total weight over this threshold, this may be the correct classification.

🔍 HS CODE: 3921901100

Description: Plastic combined with textile materials, with a weight not exceeding 1.492 kg/m², where synthetic fibers in the textile component exceed any other single fiber type, and plastic constitutes more than 70% of the total weight.

Total Tax Rate: 59.2%

Tax Breakdown:

- Base Tariff: 4.2%

- Additional Tariff: 25.0%

- Special Tariff after April 11, 2025: 30.0%

Notes:

- This code is for lighter composites (≤1.492 kg/m²) with a high plastic content (over 70%) and synthetic fiber dominance in the textile part.

- If your product is lighter and meets these fiber and weight criteria, this may be the correct code.

🔍 HS CODE: 3921902550

Description: Other plastic sheets, plates, films, foils and strips, combined with textile materials and with a weight exceeding 1.492 kg/m², where synthetic fibers in the textile component exceed any other single fiber type, and plastic constitutes more than 70% of the total weight.

Total Tax Rate: 61.5%

Tax Breakdown:

- Base Tariff: 6.5%

- Additional Tariff: 25.0%

- Special Tariff after April 11, 2025: 30.0%

Notes:

- This code is for heavier composites (>1.492 kg/m²) with a high plastic content (over 70%) and synthetic fiber dominance in the textile part.

- If your product is heavier and meets these fiber and weight criteria, this may be the correct code.

🔍 HS CODE: 3916100000

Description: Polyethylene plastic strips for agricultural irrigation.

Total Tax Rate: 60.8%

Tax Breakdown:

- Base Tariff: 5.8%

- Additional Tariff: 25.0%

- Special Tariff after April 11, 2025: 30.0%

Notes:

- This code is specific to polyethylene strips used in agricultural irrigation.

- If your product is a polyethylene strip used for irrigation, this may be the correct classification.

📌 Proactive Advice for Importers:

- Verify Material Composition: Confirm the exact composition of your product (e.g., plastic type, textile fiber type, and weight per square meter). This will help determine the correct HS code.

- Check Unit Price and Certification: Some HS codes may require specific certifications or documentation (e.g., for textile content or plastic composition).

- Monitor Tariff Changes: The April 11, 2025 special tariff applies to all the above codes. Ensure your import planning accounts for this increase.

- Consider Anti-Dumping Duties: If your product contains iron or aluminum components, check for applicable anti-dumping duties (not listed here, but may apply depending on origin and product specifics).

✅ Summary of Key Tax Changes (April 11, 2025):

| HS Code | Base Tariff | Additional Tariff | Special Tariff (after April 11, 2025) |

|---|---|---|---|

| 3921902900 | 4.4% | 25.0% | 30.0% |

| 3921901100 | 4.2% | 25.0% | 30.0% |

| 3921902550 | 6.5% | 25.0% | 30.0% |

| 3916100000 | 5.8% | 25.0% | 30.0% |

If you provide more details about the material composition, weight, and intended use, I can help you determine the most accurate HS code for your product.

Customer Reviews

No reviews yet.