| HS Code | Official Doc | Tariff Rate | Origin | Destination | Effective Date |

|---|---|---|---|---|---|

| 3921902550 | Doc | 61.5% | CN | US | 2025-05-12 |

| 3921905050 | Doc | 34.8% | CN | US | 2025-05-12 |

| 3920995000 | Doc | 60.8% | CN | US | 2025-05-12 |

| 3921904010 | Doc | 34.2% | CN | US | 2025-05-12 |

| 3921902900 | Doc | 59.4% | CN | US | 2025-05-12 |

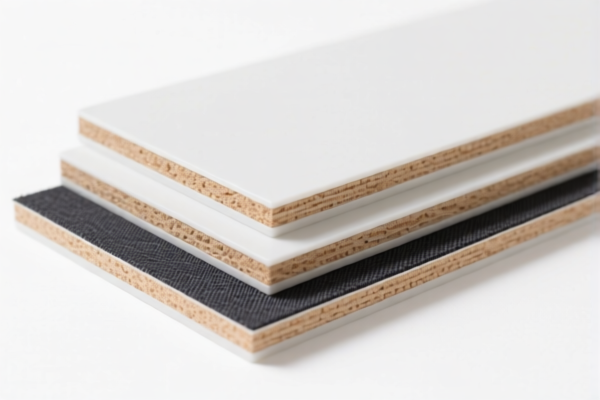

Product Classification: Textile Composite Plastic Thermoformed Boards

Based on the provided HS codes and descriptions, the classification of textile composite plastic thermoformed boards depends on specific characteristics such as weight per square meter, material composition, and type of composite. Below is a structured breakdown of the relevant HS codes and their associated tariff rates:

✅ HS CODE: 3921902550

Description:

- Applicable to plastic sheets, plates, films, foils, and strips combined with textile materials.

- Weight > 1.492 kg/m².

- Textile component must have man-made fibers (e.g., polyester, nylon) heavier than any other single textile fiber.

- Plastic content > 70% by weight.

Tariff Summary:

- Base Tariff: 6.5%

- Additional Tariff: 25.0%

- Special Tariff after April 11, 2025: 30.0%

- Total Tax Rate: 61.5%

✅ HS CODE: 3921902900

Description:

- Applicable to plastic sheets, plates, films, foils, and strips combined with other materials, including textile composites.

- Weight > 1.492 kg/m².

- Textile composites fall under this category.

Tariff Summary:

- Base Tariff: 4.4%

- Additional Tariff: 25.0%

- Special Tariff after April 11, 2025: 30.0%

- Total Tax Rate: 59.4%

✅ HS CODE: 3920995000

Description:

- Applicable to non-cellular and non-reinforced plastic sheets that are laminated, supported, or combined with other materials.

Tariff Summary:

- Base Tariff: 5.8%

- Additional Tariff: 25.0%

- Special Tariff after April 11, 2025: 30.0%

- Total Tax Rate: 60.8%

✅ HS CODE: 3921904010

Description:

- Applicable to flexible plastic sheets, plates, films, foils, and strips reinforced with paper.

Tariff Summary:

- Base Tariff: 4.2%

- Additional Tariff: 0.0%

- Special Tariff after April 11, 2025: 30.0%

- Total Tax Rate: 34.2%

✅ HS CODE: 3921905050

Description:

- Applicable to other plastic sheets, plates, films, foils, and strips not covered by the above categories.

Tariff Summary:

- Base Tariff: 4.8%

- Additional Tariff: 0.0%

- Special Tariff after April 11, 2025: 30.0%

- Total Tax Rate: 34.8%

⚠️ Important Notes and Recommendations:

-

April 11, 2025 Special Tariff:

A 30% additional tariff will be applied to all the above HS codes after April 11, 2025. This is a time-sensitive policy and must be accounted for in cost planning. -

Anti-Dumping Duties:

If the product contains iron or aluminum components, check for anti-dumping duties that may apply. These are not included in the base or additional tariffs listed above. -

Material Verification:

Confirm the exact composition of the product (e.g., percentage of plastic, textile, and other materials) to ensure correct classification. -

Certifications:

Some HS codes may require certifications (e.g., material composition, origin, or compliance with environmental standards). Verify with customs or a compliance expert. -

Unit Price and Weight:

Ensure the weight per square meter is accurately measured and documented, as this is a critical factor in classification.

📌 Proactive Advice:

- Double-check the product’s composition and weight to avoid misclassification and potential penalties.

- Consult a customs broker or classification expert if the product is close to the boundary between two HS codes.

- Monitor policy updates after April 11, 2025, as the special tariff may change or be extended.

Let me know if you need help with certification requirements or customs documentation for this product.

Product Classification: Textile Composite Plastic Thermoformed Boards

Based on the provided HS codes and descriptions, the classification of textile composite plastic thermoformed boards depends on specific characteristics such as weight per square meter, material composition, and type of composite. Below is a structured breakdown of the relevant HS codes and their associated tariff rates:

✅ HS CODE: 3921902550

Description:

- Applicable to plastic sheets, plates, films, foils, and strips combined with textile materials.

- Weight > 1.492 kg/m².

- Textile component must have man-made fibers (e.g., polyester, nylon) heavier than any other single textile fiber.

- Plastic content > 70% by weight.

Tariff Summary:

- Base Tariff: 6.5%

- Additional Tariff: 25.0%

- Special Tariff after April 11, 2025: 30.0%

- Total Tax Rate: 61.5%

✅ HS CODE: 3921902900

Description:

- Applicable to plastic sheets, plates, films, foils, and strips combined with other materials, including textile composites.

- Weight > 1.492 kg/m².

- Textile composites fall under this category.

Tariff Summary:

- Base Tariff: 4.4%

- Additional Tariff: 25.0%

- Special Tariff after April 11, 2025: 30.0%

- Total Tax Rate: 59.4%

✅ HS CODE: 3920995000

Description:

- Applicable to non-cellular and non-reinforced plastic sheets that are laminated, supported, or combined with other materials.

Tariff Summary:

- Base Tariff: 5.8%

- Additional Tariff: 25.0%

- Special Tariff after April 11, 2025: 30.0%

- Total Tax Rate: 60.8%

✅ HS CODE: 3921904010

Description:

- Applicable to flexible plastic sheets, plates, films, foils, and strips reinforced with paper.

Tariff Summary:

- Base Tariff: 4.2%

- Additional Tariff: 0.0%

- Special Tariff after April 11, 2025: 30.0%

- Total Tax Rate: 34.2%

✅ HS CODE: 3921905050

Description:

- Applicable to other plastic sheets, plates, films, foils, and strips not covered by the above categories.

Tariff Summary:

- Base Tariff: 4.8%

- Additional Tariff: 0.0%

- Special Tariff after April 11, 2025: 30.0%

- Total Tax Rate: 34.8%

⚠️ Important Notes and Recommendations:

-

April 11, 2025 Special Tariff:

A 30% additional tariff will be applied to all the above HS codes after April 11, 2025. This is a time-sensitive policy and must be accounted for in cost planning. -

Anti-Dumping Duties:

If the product contains iron or aluminum components, check for anti-dumping duties that may apply. These are not included in the base or additional tariffs listed above. -

Material Verification:

Confirm the exact composition of the product (e.g., percentage of plastic, textile, and other materials) to ensure correct classification. -

Certifications:

Some HS codes may require certifications (e.g., material composition, origin, or compliance with environmental standards). Verify with customs or a compliance expert. -

Unit Price and Weight:

Ensure the weight per square meter is accurately measured and documented, as this is a critical factor in classification.

📌 Proactive Advice:

- Double-check the product’s composition and weight to avoid misclassification and potential penalties.

- Consult a customs broker or classification expert if the product is close to the boundary between two HS codes.

- Monitor policy updates after April 11, 2025, as the special tariff may change or be extended.

Let me know if you need help with certification requirements or customs documentation for this product.

Customer Reviews

No reviews yet.