| HS Code | Official Doc | Tariff Rate | Origin | Destination | Effective Date |

|---|---|---|---|---|---|

| 3921901500 | Doc | 61.5% | CN | US | 2025-05-12 |

| 3921902900 | Doc | 59.4% | CN | US | 2025-05-12 |

| 3921901950 | Doc | 60.3% | CN | US | 2025-05-12 |

| 3921901100 | Doc | 59.2% | CN | US | 2025-05-12 |

| 3921901500 | Doc | 61.5% | CN | US | 2025-05-12 |

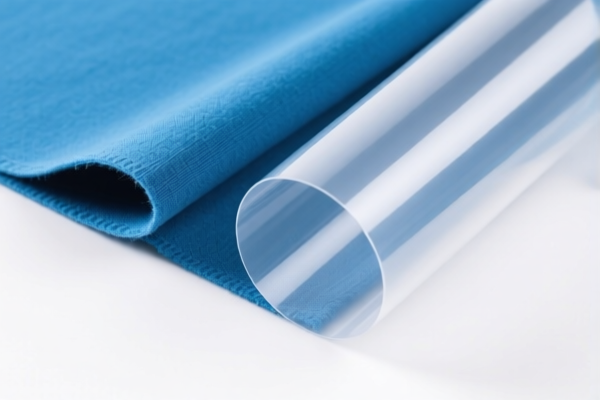

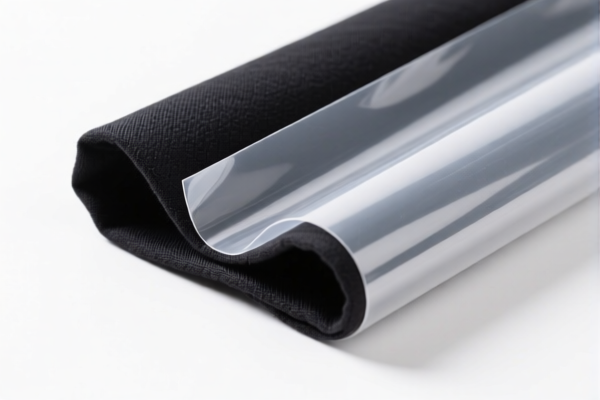

Product Classification: Textile Composite Plastic Thermoformed Films

HS CODEs and Tax Details (as of current regulations):

- HS CODE: 3921902900

- Description: Plastic films combined with textile materials

- Total Tax Rate: 59.4%

-

Breakdown:

- Base Tariff: 4.4%

- Additional Tariff: 25.0%

- Special Tariff after April 11, 2025: 30.0%

-

HS CODE: 3921901500

- Description: Composite plastic films with textile fibers

- Total Tax Rate: 61.5%

-

Breakdown:

- Base Tariff: 6.5%

- Additional Tariff: 25.0%

- Special Tariff after April 11, 2025: 30.0%

-

HS CODE: 3921901950

- Description: Textile composite plastic packaging film

- Total Tax Rate: 60.3%

-

Breakdown:

- Base Tariff: 5.3%

- Additional Tariff: 25.0%

- Special Tariff after April 11, 2025: 30.0%

-

HS CODE: 3921901100

- Description: Textile composite plastic packaging film

- Total Tax Rate: 59.2%

-

Breakdown:

- Base Tariff: 4.2%

- Additional Tariff: 25.0%

- Special Tariff after April 11, 2025: 30.0%

-

HS CODE: 3920992000

- Description: Composite plastic films (general category)

- Total Tax Rate: 59.2%

- Breakdown:

- Base Tariff: 4.2%

- Additional Tariff: 25.0%

- Special Tariff after April 11, 2025: 30.0%

📌 Key Notes and Recommendations:

-

April 11, 2025 Special Tariff:

A 30.0% additional tariff will be applied to all the above HS codes after April 11, 2025. This is a time-sensitive policy and should be factored into cost planning. -

Anti-Dumping Duties:

If the product contains iron or aluminum components, anti-dumping duties may apply. Confirm the composition of the product to avoid unexpected charges. -

Material and Certification Verification:

- Verify the material composition (e.g., percentage of textile vs. plastic) to ensure correct HS code classification.

-

Check if certifications (e.g., RoHS, REACH, or specific import permits) are required for the product type and destination country.

-

Unit Price and Classification:

The final HS code may depend on the unit price and intended use (e.g., industrial vs. consumer). Ensure the product description aligns with the selected HS code.

✅ Proactive Advice:

- Consult a customs broker or HS code expert for final classification, especially if the product has mixed materials or dual uses.

-

Keep documentation (e.g., material breakdown, invoices, and product specifications) ready for customs inspection. Product Classification: Textile Composite Plastic Thermoformed Films

HS CODEs and Tax Details (as of current regulations): -

HS CODE: 3921902900

- Description: Plastic films combined with textile materials

- Total Tax Rate: 59.4%

-

Breakdown:

- Base Tariff: 4.4%

- Additional Tariff: 25.0%

- Special Tariff after April 11, 2025: 30.0%

-

HS CODE: 3921901500

- Description: Composite plastic films with textile fibers

- Total Tax Rate: 61.5%

-

Breakdown:

- Base Tariff: 6.5%

- Additional Tariff: 25.0%

- Special Tariff after April 11, 2025: 30.0%

-

HS CODE: 3921901950

- Description: Textile composite plastic packaging film

- Total Tax Rate: 60.3%

-

Breakdown:

- Base Tariff: 5.3%

- Additional Tariff: 25.0%

- Special Tariff after April 11, 2025: 30.0%

-

HS CODE: 3921901100

- Description: Textile composite plastic packaging film

- Total Tax Rate: 59.2%

-

Breakdown:

- Base Tariff: 4.2%

- Additional Tariff: 25.0%

- Special Tariff after April 11, 2025: 30.0%

-

HS CODE: 3920992000

- Description: Composite plastic films (general category)

- Total Tax Rate: 59.2%

- Breakdown:

- Base Tariff: 4.2%

- Additional Tariff: 25.0%

- Special Tariff after April 11, 2025: 30.0%

📌 Key Notes and Recommendations:

-

April 11, 2025 Special Tariff:

A 30.0% additional tariff will be applied to all the above HS codes after April 11, 2025. This is a time-sensitive policy and should be factored into cost planning. -

Anti-Dumping Duties:

If the product contains iron or aluminum components, anti-dumping duties may apply. Confirm the composition of the product to avoid unexpected charges. -

Material and Certification Verification:

- Verify the material composition (e.g., percentage of textile vs. plastic) to ensure correct HS code classification.

-

Check if certifications (e.g., RoHS, REACH, or specific import permits) are required for the product type and destination country.

-

Unit Price and Classification:

The final HS code may depend on the unit price and intended use (e.g., industrial vs. consumer). Ensure the product description aligns with the selected HS code.

✅ Proactive Advice:

- Consult a customs broker or HS code expert for final classification, especially if the product has mixed materials or dual uses.

- Keep documentation (e.g., material breakdown, invoices, and product specifications) ready for customs inspection.

Customer Reviews

No reviews yet.