| HS Code | Official Doc | Tariff Rate | Origin | Destination | Effective Date |

|---|---|---|---|---|---|

| 3921902900 | Doc | 59.4% | CN | US | 2025-05-12 |

| 3921902510 | Doc | 61.5% | CN | US | 2025-05-12 |

| 3921902550 | Doc | 61.5% | CN | US | 2025-05-12 |

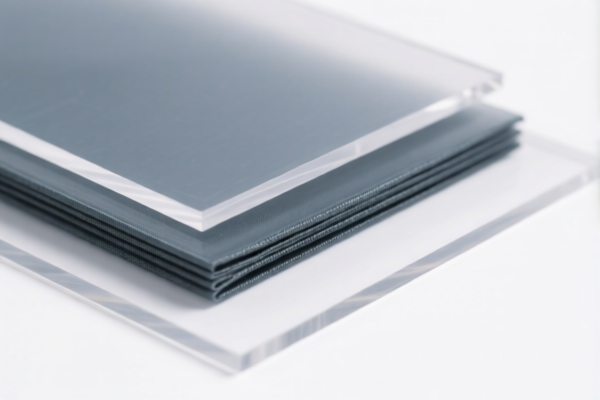

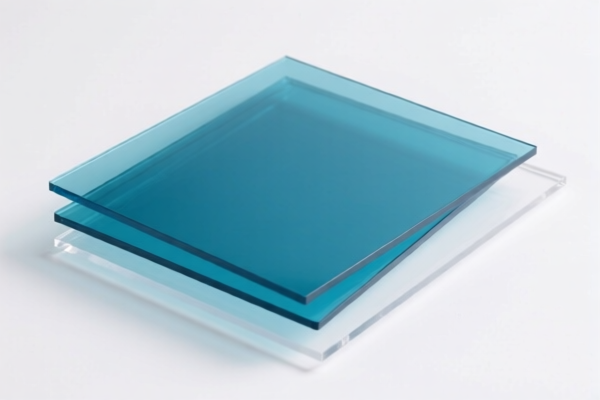

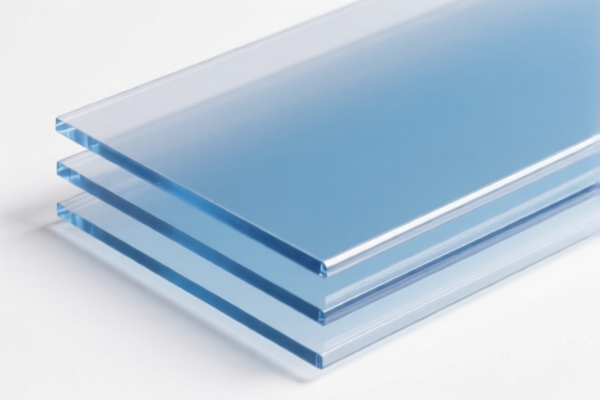

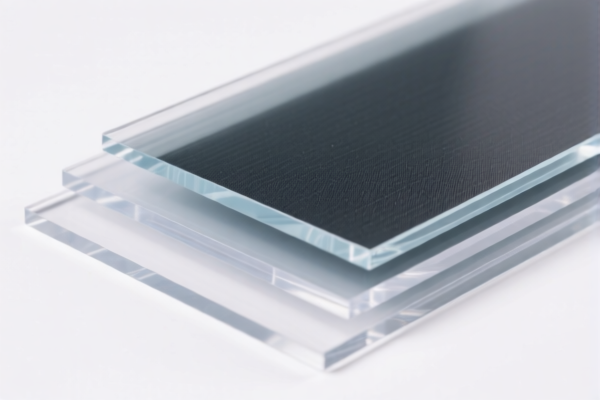

Product Name: Textile Composite Plastic Translucent Boards

Classification HS Code Analysis:

- HS CODE: 3921902900

- Description: Other plastic sheets, plates, films, foils and strips, composite with other materials, with a weight exceeding 1.492 kg/m², other plastic products

- Total Tax Rate: 59.4%

- Tax Breakdown:

- Base Tariff: 4.4%

- Additional Tariff: 25.0%

- Special Tariff after April 11, 2025: 30.0%

-

Notes: This code applies to composite plastic products with other materials, but not specifically for textile composites.

-

HS CODE: 3921902510

- Description: Composite materials of plastic and textile materials, with plastic weight exceeding 70%

- Total Tax Rate: 61.5%

- Tax Breakdown:

- Base Tariff: 6.5%

- Additional Tariff: 25.0%

- Special Tariff after April 11, 2025: 30.0%

-

Notes: This code is more specific to textile-plastic composites where plastic constitutes more than 70% of the weight.

-

HS CODE: 3921902550

- Description: Other plastic sheets, plates, films, foils and strips, combined with textile materials and with a weight exceeding 1.492 kg/m²: products where the textile component contains man-made fibers in greater weight than any other single textile fiber, and plastic weight exceeds 70%

- Total Tax Rate: 61.5%

- Tax Breakdown:

- Base Tariff: 6.5%

- Additional Tariff: 25.0%

- Special Tariff after April 11, 2025: 30.0%

- Notes: This code is for textile-plastic composites with specific fiber composition and weight requirements.

✅ Proactive Advice:

- Verify Material Composition: Ensure the product meets the specific weight and fiber composition criteria for the selected HS code (e.g., plastic weight >70%, textile fiber composition).

- Check Unit Price and Certification: Confirm the unit price and whether any certifications (e.g., textile or plastic content verification) are required for customs compliance.

- Monitor Tariff Changes: Be aware of the April 11, 2025 deadline for additional tariffs. If your product is imported after this date, the 30% special tariff will apply.

- Consider Anti-Dumping Duties: If the product contains iron or aluminum components, check for any applicable anti-dumping duties.

Let me know if you need help determining the most accurate HS code for your specific product.

Product Name: Textile Composite Plastic Translucent Boards

Classification HS Code Analysis:

- HS CODE: 3921902900

- Description: Other plastic sheets, plates, films, foils and strips, composite with other materials, with a weight exceeding 1.492 kg/m², other plastic products

- Total Tax Rate: 59.4%

- Tax Breakdown:

- Base Tariff: 4.4%

- Additional Tariff: 25.0%

- Special Tariff after April 11, 2025: 30.0%

-

Notes: This code applies to composite plastic products with other materials, but not specifically for textile composites.

-

HS CODE: 3921902510

- Description: Composite materials of plastic and textile materials, with plastic weight exceeding 70%

- Total Tax Rate: 61.5%

- Tax Breakdown:

- Base Tariff: 6.5%

- Additional Tariff: 25.0%

- Special Tariff after April 11, 2025: 30.0%

-

Notes: This code is more specific to textile-plastic composites where plastic constitutes more than 70% of the weight.

-

HS CODE: 3921902550

- Description: Other plastic sheets, plates, films, foils and strips, combined with textile materials and with a weight exceeding 1.492 kg/m²: products where the textile component contains man-made fibers in greater weight than any other single textile fiber, and plastic weight exceeds 70%

- Total Tax Rate: 61.5%

- Tax Breakdown:

- Base Tariff: 6.5%

- Additional Tariff: 25.0%

- Special Tariff after April 11, 2025: 30.0%

- Notes: This code is for textile-plastic composites with specific fiber composition and weight requirements.

✅ Proactive Advice:

- Verify Material Composition: Ensure the product meets the specific weight and fiber composition criteria for the selected HS code (e.g., plastic weight >70%, textile fiber composition).

- Check Unit Price and Certification: Confirm the unit price and whether any certifications (e.g., textile or plastic content verification) are required for customs compliance.

- Monitor Tariff Changes: Be aware of the April 11, 2025 deadline for additional tariffs. If your product is imported after this date, the 30% special tariff will apply.

- Consider Anti-Dumping Duties: If the product contains iron or aluminum components, check for any applicable anti-dumping duties.

Let me know if you need help determining the most accurate HS code for your specific product.

Customer Reviews

No reviews yet.