| HS Code | Official Doc | Tariff Rate | Origin | Destination | Effective Date |

|---|---|---|---|---|---|

| 3921901500 | Doc | 61.5% | CN | US | 2025-05-12 |

| 3921902900 | Doc | 59.4% | CN | US | 2025-05-12 |

| 3921901950 | Doc | 60.3% | CN | US | 2025-05-12 |

| 3921901100 | Doc | 59.2% | CN | US | 2025-05-12 |

| 3920992000 | Doc | 59.2% | CN | US | 2025-05-12 |

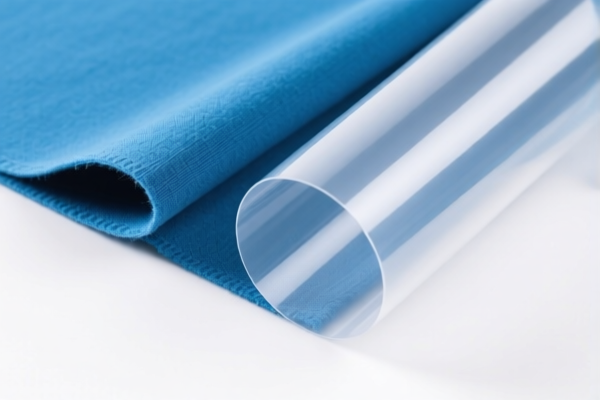

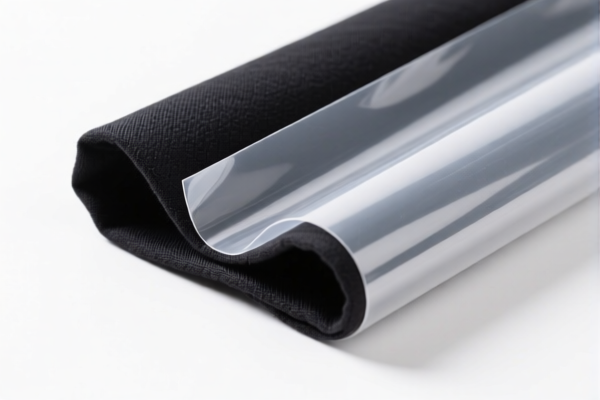

Here is the structured classification and tax information for Textile Composite Plastic Translucent Films, based on the provided HS codes and tariff details:

🔍 HS CODE: 3921901500

Product Description: Light-weight plastic textile composite film

Total Tax Rate: 61.5%

- Base Tariff: 6.5%

- Additional Tariff: 25.0%

- Special Tariff after April 11, 2025: 30.0%

- Note: This is the highest tax rate among the listed options.

🔍 HS CODE: 3921902900

Product Description: Plastic textile composite film

Total Tax Rate: 59.4%

- Base Tariff: 4.4%

- Additional Tariff: 25.0%

- Special Tariff after April 11, 2025: 30.0%

- Note: Slightly lower base tariff than 3921901500.

🔍 HS CODE: 3921901950

Product Description: Textile composite plastic packaging film

Total Tax Rate: 60.3%

- Base Tariff: 5.3%

- Additional Tariff: 25.0%

- Special Tariff after April 11, 2025: 30.0%

- Note: Higher base tariff than 3921902900 but lower than 3921901500.

🔍 HS CODE: 3921901100

Product Description: Textile composite plastic packaging film

Total Tax Rate: 59.2%

- Base Tariff: 4.2%

- Additional Tariff: 25.0%

- Special Tariff after April 11, 2025: 30.0%

- Note: One of the lower tax rates for textile composite films.

🔍 HS CODE: 3920992000

Product Description: Composite plastic film

Total Tax Rate: 59.2%

- Base Tariff: 4.2%

- Additional Tariff: 25.0%

- Special Tariff after April 11, 2025: 30.0%

- Note: This is a broader category and may include non-textile composites.

📌 Key Observations:

- April 11, 2025 Special Tariff: All listed HS codes are subject to an additional 30.0% tariff after this date.

- Base Tariff Differences: The base tariff varies from 4.2% to 6.5%, depending on the specific product description.

- Material and Description Matters: The exact product description (e.g., "light-weight," "packaging," "composite") significantly affects the HS code and tax rate.

✅ Proactive Advice:

- Verify Material Composition: Ensure the product is accurately described (e.g., whether it is "light-weight," "packaging," or "composite").

- Check Unit Price and Certification: Confirm if any certifications (e.g., RoHS, REACH) are required for import.

- Monitor Tariff Updates: Be aware of the April 11, 2025 deadline for the special tariff increase.

- Consult Customs Broker: For complex classifications, seek professional customs advice to avoid delays or penalties.

Let me know if you need help selecting the most appropriate HS code for your specific product. Here is the structured classification and tax information for Textile Composite Plastic Translucent Films, based on the provided HS codes and tariff details:

🔍 HS CODE: 3921901500

Product Description: Light-weight plastic textile composite film

Total Tax Rate: 61.5%

- Base Tariff: 6.5%

- Additional Tariff: 25.0%

- Special Tariff after April 11, 2025: 30.0%

- Note: This is the highest tax rate among the listed options.

🔍 HS CODE: 3921902900

Product Description: Plastic textile composite film

Total Tax Rate: 59.4%

- Base Tariff: 4.4%

- Additional Tariff: 25.0%

- Special Tariff after April 11, 2025: 30.0%

- Note: Slightly lower base tariff than 3921901500.

🔍 HS CODE: 3921901950

Product Description: Textile composite plastic packaging film

Total Tax Rate: 60.3%

- Base Tariff: 5.3%

- Additional Tariff: 25.0%

- Special Tariff after April 11, 2025: 30.0%

- Note: Higher base tariff than 3921902900 but lower than 3921901500.

🔍 HS CODE: 3921901100

Product Description: Textile composite plastic packaging film

Total Tax Rate: 59.2%

- Base Tariff: 4.2%

- Additional Tariff: 25.0%

- Special Tariff after April 11, 2025: 30.0%

- Note: One of the lower tax rates for textile composite films.

🔍 HS CODE: 3920992000

Product Description: Composite plastic film

Total Tax Rate: 59.2%

- Base Tariff: 4.2%

- Additional Tariff: 25.0%

- Special Tariff after April 11, 2025: 30.0%

- Note: This is a broader category and may include non-textile composites.

📌 Key Observations:

- April 11, 2025 Special Tariff: All listed HS codes are subject to an additional 30.0% tariff after this date.

- Base Tariff Differences: The base tariff varies from 4.2% to 6.5%, depending on the specific product description.

- Material and Description Matters: The exact product description (e.g., "light-weight," "packaging," "composite") significantly affects the HS code and tax rate.

✅ Proactive Advice:

- Verify Material Composition: Ensure the product is accurately described (e.g., whether it is "light-weight," "packaging," or "composite").

- Check Unit Price and Certification: Confirm if any certifications (e.g., RoHS, REACH) are required for import.

- Monitor Tariff Updates: Be aware of the April 11, 2025 deadline for the special tariff increase.

- Consult Customs Broker: For complex classifications, seek professional customs advice to avoid delays or penalties.

Let me know if you need help selecting the most appropriate HS code for your specific product.

Customer Reviews

No reviews yet.