Found 5 matching results

(CN → US)

| HS Code | Official Doc | Tariff Rate | Origin | Destination | Effective Date |

|---|---|---|---|---|---|

| 3921902900 | Doc | 59.4% | CN | US | 2025-05-12 |

| 3921131100 | Doc | 59.2% | CN | US | 2025-05-12 |

| 3921131950 | Doc | 60.3% | CN | US | 2025-05-12 |

| 3921902550 | Doc | 61.5% | CN | US | 2025-05-12 |

| 3921902510 | Doc | 61.5% | CN | US | 2025-05-12 |

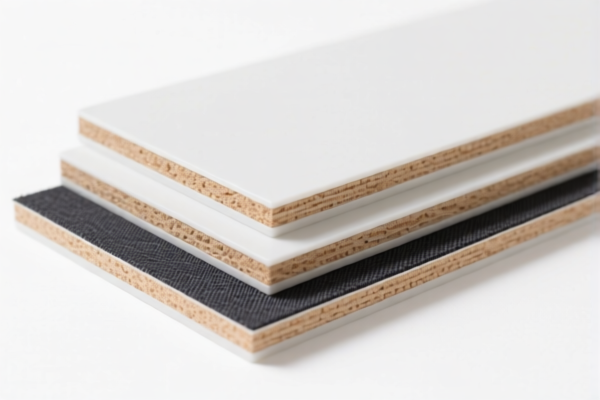

Product Classification: Textile Composite Plastic Wear Resistant Boards

HS CODEs and Tax Details (as of current regulations):

✅ HS CODE: 3921902900

- Description: Plastic sheets, plates, films, foils, and strips combined with other materials, including textile composites.

- Total Tax Rate: 59.4%

- Base Tariff: 4.4%

- Additional Tariff: 25.0%

- Special Tariff after April 11, 2025: 30.0%

- Applicable for: General textile composite plastic boards, not specifically defined by fiber type or weight.

✅ HS CODE: 3921131100

- Description: Polyurethane honeycomb plastic combined with textile materials, where synthetic fiber weight exceeds that of any single natural fiber, and plastic content exceeds 70%.

- Total Tax Rate: 59.2%

- Base Tariff: 4.2%

- Additional Tariff: 25.0%

- Special Tariff after April 11, 2025: 30.0%

- Applicable for: Specific composite materials with defined fiber composition and high plastic content.

✅ HS CODE: 3921131950

- Description: Polyurethane plastic sheets combined with textile materials, where the weight of plant fibers is not clearly specified to exceed that of any single textile fiber.

- Total Tax Rate: 60.3%

- Base Tariff: 5.3%

- Additional Tariff: 25.0%

- Special Tariff after April 11, 2025: 30.0%

- Applicable for: Polyurethane composite boards with textile materials, but without clear fiber weight specifications.

✅ HS CODE: 3921902550

- Description: Plastic sheets combined with textile materials, with a weight exceeding 1.492 kg/m² and plastic content over 70%.

- Total Tax Rate: 61.5%

- Base Tariff: 6.5%

- Additional Tariff: 25.0%

- Special Tariff after April 11, 2025: 30.0%

- Applicable for: Heavier composite boards with high plastic content.

✅ HS CODE: 3921902510

- Description: Composite boards combining plastic and textile materials, with plastic content over 70%.

- Total Tax Rate: 61.5%

- Base Tariff: 6.5%

- Additional Tariff: 25.0%

- Special Tariff after April 11, 2025: 30.0%

- Applicable for: General composite boards with high plastic content, not restricted by weight or fiber type.

⚠️ Important Notes:

- April 11, 2025 Special Tariff: All the above HS codes are subject to an additional 30.0% tariff after April 11, 2025. This is a time-sensitive policy and must be considered in cost planning.

- Anti-dumping duties: Not explicitly mentioned in the data, but always verify if applicable based on the country of origin and product composition.

- Certifications: Ensure compliance with any required certifications (e.g., REACH, RoHS, or textile-related standards) depending on the end market.

- Material and Unit Price: Verify the exact composition (e.g., fiber type, weight ratio, plastic content) and unit price to ensure correct classification and avoid misdeclaration penalties.

📌 Proactive Advice:

- Confirm the exact composition of the composite board (e.g., fiber type, weight, and plastic percentage).

- Check the weight per square meter if applicable (e.g., for HS CODE 3921902550).

- Review certifications required for export and import.

- Be aware of the April 11, 2025 tariff change and plan accordingly for cost and compliance.

Product Classification: Textile Composite Plastic Wear Resistant Boards

HS CODEs and Tax Details (as of current regulations):

✅ HS CODE: 3921902900

- Description: Plastic sheets, plates, films, foils, and strips combined with other materials, including textile composites.

- Total Tax Rate: 59.4%

- Base Tariff: 4.4%

- Additional Tariff: 25.0%

- Special Tariff after April 11, 2025: 30.0%

- Applicable for: General textile composite plastic boards, not specifically defined by fiber type or weight.

✅ HS CODE: 3921131100

- Description: Polyurethane honeycomb plastic combined with textile materials, where synthetic fiber weight exceeds that of any single natural fiber, and plastic content exceeds 70%.

- Total Tax Rate: 59.2%

- Base Tariff: 4.2%

- Additional Tariff: 25.0%

- Special Tariff after April 11, 2025: 30.0%

- Applicable for: Specific composite materials with defined fiber composition and high plastic content.

✅ HS CODE: 3921131950

- Description: Polyurethane plastic sheets combined with textile materials, where the weight of plant fibers is not clearly specified to exceed that of any single textile fiber.

- Total Tax Rate: 60.3%

- Base Tariff: 5.3%

- Additional Tariff: 25.0%

- Special Tariff after April 11, 2025: 30.0%

- Applicable for: Polyurethane composite boards with textile materials, but without clear fiber weight specifications.

✅ HS CODE: 3921902550

- Description: Plastic sheets combined with textile materials, with a weight exceeding 1.492 kg/m² and plastic content over 70%.

- Total Tax Rate: 61.5%

- Base Tariff: 6.5%

- Additional Tariff: 25.0%

- Special Tariff after April 11, 2025: 30.0%

- Applicable for: Heavier composite boards with high plastic content.

✅ HS CODE: 3921902510

- Description: Composite boards combining plastic and textile materials, with plastic content over 70%.

- Total Tax Rate: 61.5%

- Base Tariff: 6.5%

- Additional Tariff: 25.0%

- Special Tariff after April 11, 2025: 30.0%

- Applicable for: General composite boards with high plastic content, not restricted by weight or fiber type.

⚠️ Important Notes:

- April 11, 2025 Special Tariff: All the above HS codes are subject to an additional 30.0% tariff after April 11, 2025. This is a time-sensitive policy and must be considered in cost planning.

- Anti-dumping duties: Not explicitly mentioned in the data, but always verify if applicable based on the country of origin and product composition.

- Certifications: Ensure compliance with any required certifications (e.g., REACH, RoHS, or textile-related standards) depending on the end market.

- Material and Unit Price: Verify the exact composition (e.g., fiber type, weight ratio, plastic content) and unit price to ensure correct classification and avoid misdeclaration penalties.

📌 Proactive Advice:

- Confirm the exact composition of the composite board (e.g., fiber type, weight, and plastic percentage).

- Check the weight per square meter if applicable (e.g., for HS CODE 3921902550).

- Review certifications required for export and import.

- Be aware of the April 11, 2025 tariff change and plan accordingly for cost and compliance.

Customer Reviews

No reviews yet.