| HS Code | Official Doc | Tariff Rate | Origin | Destination | Effective Date |

|---|---|---|---|---|---|

| 3921131910 | Doc | 60.3% | CN | US | 2025-05-12 |

| 3921131500 | Doc | 61.5% | CN | US | 2025-05-12 |

| 3921131950 | Doc | 60.3% | CN | US | 2025-05-12 |

| 3921131100 | Doc | 59.2% | CN | US | 2025-05-12 |

| 3920991000 | Doc | 61.0% | CN | US | 2025-05-12 |

Here is the detailed classification and tariff information for Textile Core Polyurethane Sheets based on the provided HS codes and tax details:

🔍 HS CODE: 3921131910

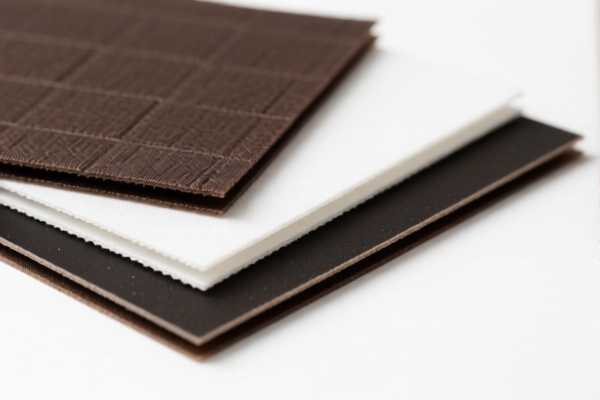

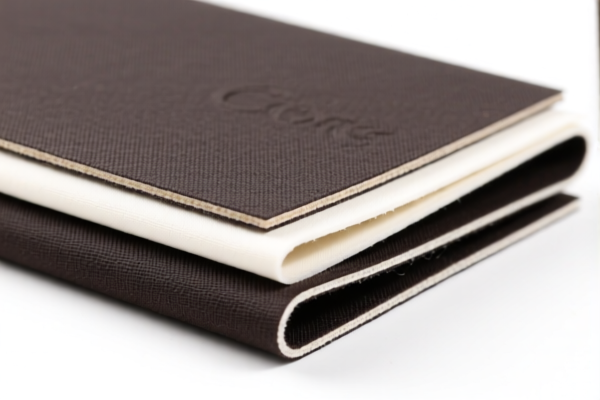

Product Description: Textile Surface Polyurethane Sheets

Total Tax Rate: 60.3%

- Base Tariff Rate: 5.3%

- Additional Tariff: 25.0%

- Special Tariff after April 11, 2025: 30.0%

- Note: This code is for sheets with a textile surface layer.

🔍 HS CODE: 3921131500

Product Description: Polyurethane Textile Composite Sandwich Panels

Total Tax Rate: 61.5%

- Base Tariff Rate: 6.5%

- Additional Tariff: 25.0%

- Special Tariff after April 11, 2025: 30.0%

- Note: This code is for composite sandwich panels with textile components.

🔍 HS CODE: 3921131950

Product Description: Polyurethane Textile Composite Sheets

Total Tax Rate: 60.3%

- Base Tariff Rate: 5.3%

- Additional Tariff: 25.0%

- Special Tariff after April 11, 2025: 30.0%

- Note: This code is for composite sheets with textile integration.

🔍 HS CODE: 3921131100

Product Description: Polyurethane Textile Composite Sheets

Total Tax Rate: 59.2%

- Base Tariff Rate: 4.2%

- Additional Tariff: 25.0%

- Special Tariff after April 11, 2025: 30.0%

- Note: This code is for composite sheets with textile components, likely with a lower base rate due to specific material or structure.

🔍 HS CODE: 3920991000

Product Description: Polyurethane Plastic Sheets

Total Tax Rate: 61.0%

- Base Tariff Rate: 6.0%

- Additional Tariff: 25.0%

- Special Tariff after April 11, 2025: 30.0%

- Note: This code is for general polyurethane plastic sheets without textile components.

⚠️ Important Notes:

- April 11, 2025 Special Tariff: All the above products are subject to an additional 30.0% tariff after April 11, 2025. This is a time-sensitive policy and must be considered in your customs planning.

- Anti-dumping duties: Not explicitly mentioned for these products, but always verify if any anti-dumping or countervailing duties apply based on the origin of the goods.

- Material and Certification: Confirm the exact composition and structure of the product (e.g., textile layer, core material, thickness, etc.) to ensure correct HS code classification.

- Unit Price and Documentation: Ensure that the product description, technical specifications, and commercial invoice match the declared HS code to avoid customs delays or penalties.

✅ Proactive Advice:

- Verify the product structure (e.g., whether it is a composite, sandwich panel, or single-layer sheet).

- Check the origin of the product to determine if any preferential tariffs or additional duties apply.

- Consult with customs brokers or classification experts if the product is borderline between multiple HS codes.

- Keep updated documentation (e.g., material certificates, technical data sheets) to support your classification and tariff claims.

Let me know if you need help determining the most appropriate HS code for your specific product. Here is the detailed classification and tariff information for Textile Core Polyurethane Sheets based on the provided HS codes and tax details:

🔍 HS CODE: 3921131910

Product Description: Textile Surface Polyurethane Sheets

Total Tax Rate: 60.3%

- Base Tariff Rate: 5.3%

- Additional Tariff: 25.0%

- Special Tariff after April 11, 2025: 30.0%

- Note: This code is for sheets with a textile surface layer.

🔍 HS CODE: 3921131500

Product Description: Polyurethane Textile Composite Sandwich Panels

Total Tax Rate: 61.5%

- Base Tariff Rate: 6.5%

- Additional Tariff: 25.0%

- Special Tariff after April 11, 2025: 30.0%

- Note: This code is for composite sandwich panels with textile components.

🔍 HS CODE: 3921131950

Product Description: Polyurethane Textile Composite Sheets

Total Tax Rate: 60.3%

- Base Tariff Rate: 5.3%

- Additional Tariff: 25.0%

- Special Tariff after April 11, 2025: 30.0%

- Note: This code is for composite sheets with textile integration.

🔍 HS CODE: 3921131100

Product Description: Polyurethane Textile Composite Sheets

Total Tax Rate: 59.2%

- Base Tariff Rate: 4.2%

- Additional Tariff: 25.0%

- Special Tariff after April 11, 2025: 30.0%

- Note: This code is for composite sheets with textile components, likely with a lower base rate due to specific material or structure.

🔍 HS CODE: 3920991000

Product Description: Polyurethane Plastic Sheets

Total Tax Rate: 61.0%

- Base Tariff Rate: 6.0%

- Additional Tariff: 25.0%

- Special Tariff after April 11, 2025: 30.0%

- Note: This code is for general polyurethane plastic sheets without textile components.

⚠️ Important Notes:

- April 11, 2025 Special Tariff: All the above products are subject to an additional 30.0% tariff after April 11, 2025. This is a time-sensitive policy and must be considered in your customs planning.

- Anti-dumping duties: Not explicitly mentioned for these products, but always verify if any anti-dumping or countervailing duties apply based on the origin of the goods.

- Material and Certification: Confirm the exact composition and structure of the product (e.g., textile layer, core material, thickness, etc.) to ensure correct HS code classification.

- Unit Price and Documentation: Ensure that the product description, technical specifications, and commercial invoice match the declared HS code to avoid customs delays or penalties.

✅ Proactive Advice:

- Verify the product structure (e.g., whether it is a composite, sandwich panel, or single-layer sheet).

- Check the origin of the product to determine if any preferential tariffs or additional duties apply.

- Consult with customs brokers or classification experts if the product is borderline between multiple HS codes.

- Keep updated documentation (e.g., material certificates, technical data sheets) to support your classification and tariff claims.

Let me know if you need help determining the most appropriate HS code for your specific product.

Customer Reviews

No reviews yet.