| HS Code | Official Doc | Tariff Rate | Origin | Destination | Effective Date |

|---|---|---|---|---|---|

| 3921902510 | Doc | 61.5% | CN | US | 2025-05-12 |

| 3921131100 | Doc | 59.2% | CN | US | 2025-05-12 |

| 3921902900 | Doc | 59.4% | CN | US | 2025-05-12 |

| 3921902550 | Doc | 61.5% | CN | US | 2025-05-12 |

| 3921902510 | Doc | 61.5% | CN | US | 2025-05-12 |

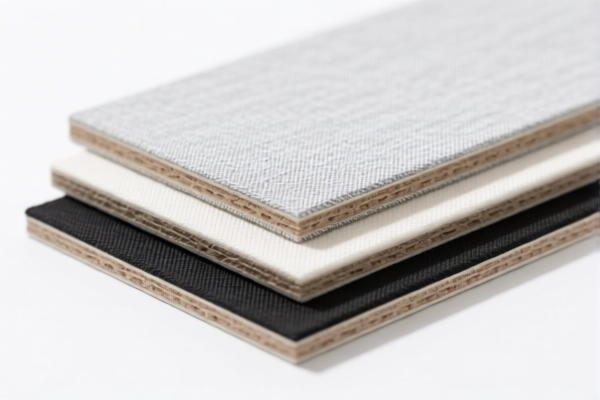

Product Classification: Textile Fabric Composite Boards

HS CODEs and Tax Details (as of current regulations):

✅ HS CODE: 3921902510

Description:

Other plastic sheets, plates, films, foils, and strips combined with textile materials, with a weight exceeding 1.492 kg/m², where the textile component is the main by weight, and the weight of any single textile fiber is less than that of synthetic fibers, and the plastic component accounts for more than 70% of the total weight.

Tariff Summary:

- Base Tariff Rate: 6.5%

- Additional Tariff: 25.0%

- Special Tariff after April 2, 2025: 30.0%

- Total Tax Rate: 61.5%

Key Notes:

- This code applies to products where synthetic fibers (e.g., polyester, nylon) are the dominant textile component by weight.

- Plastic must be >70% of the total weight.

- Weight threshold: >1.492 kg/m².

✅ HS CODE: 3921131100

Description:

Polyurethane plastic sheets combined with textile materials, where synthetic fibers account for more than any other single textile fiber.

Tariff Summary:

- Base Tariff Rate: 4.2%

- Additional Tariff: 25.0%

- Special Tariff after April 2, 2025: 30.0%

- Total Tax Rate: 59.2%

Key Notes:

- Specifically for polyurethane plastic.

- Synthetic fibers must be the dominant textile component.

- Weight threshold: >1.492 kg/m².

✅ HS CODE: 3921902900

Description:

Plastic sheets, plates, films, foils, and strips combined with other materials, with a weight exceeding 1.492 kg/m², where the textile composite is considered part of the "other materials" category.

Tariff Summary:

- Base Tariff Rate: 4.4%

- Additional Tariff: 25.0%

- Special Tariff after April 2, 2025: 30.0%

- Total Tax Rate: 59.4%

Key Notes:

- This code is for non-specific textile composites, where the textile is not the dominant component.

- Weight threshold: >1.492 kg/m².

- Plastic content may be less than 70% (unlike 3921902510).

✅ HS CODE: 3921902550

Description:

Other plastic sheets, plates, films, foils, and strips combined with textile materials, with a weight exceeding 1.492 kg/m², where synthetic fibers are the main textile component by weight, and the plastic component accounts for more than 70% of the total weight.

Tariff Summary:

- Base Tariff Rate: 6.5%

- Additional Tariff: 25.0%

- Special Tariff after April 2, 2025: 30.0%

- Total Tax Rate: 61.5%

Key Notes:

- Similar to 3921902510, but with a slightly different wording.

- Synthetic fibers must be the dominant textile component.

- Plastic must be >70% of the total weight.

- Weight threshold: >1.492 kg/m².

📌 Important Reminders:

-

April 2, 2025 Special Tariff:

A 30.0% additional tariff will be applied to all the above HS codes after April 2, 2025. Ensure your import timeline is aligned with this date. -

Material Verification:

Confirm the exact composition of the product (e.g., plastic percentage, type of textile fibers) to ensure correct classification. -

Certifications:

Check if any certifications (e.g., textile content verification, weight testing) are required for customs clearance. -

Unit Price:

Be aware that tariff rates are applied to the total value, so unit price and product description are critical for accurate duty calculation.

Let me know if you need help with certification requirements or customs documentation for these products.

Product Classification: Textile Fabric Composite Boards

HS CODEs and Tax Details (as of current regulations):

✅ HS CODE: 3921902510

Description:

Other plastic sheets, plates, films, foils, and strips combined with textile materials, with a weight exceeding 1.492 kg/m², where the textile component is the main by weight, and the weight of any single textile fiber is less than that of synthetic fibers, and the plastic component accounts for more than 70% of the total weight.

Tariff Summary:

- Base Tariff Rate: 6.5%

- Additional Tariff: 25.0%

- Special Tariff after April 2, 2025: 30.0%

- Total Tax Rate: 61.5%

Key Notes:

- This code applies to products where synthetic fibers (e.g., polyester, nylon) are the dominant textile component by weight.

- Plastic must be >70% of the total weight.

- Weight threshold: >1.492 kg/m².

✅ HS CODE: 3921131100

Description:

Polyurethane plastic sheets combined with textile materials, where synthetic fibers account for more than any other single textile fiber.

Tariff Summary:

- Base Tariff Rate: 4.2%

- Additional Tariff: 25.0%

- Special Tariff after April 2, 2025: 30.0%

- Total Tax Rate: 59.2%

Key Notes:

- Specifically for polyurethane plastic.

- Synthetic fibers must be the dominant textile component.

- Weight threshold: >1.492 kg/m².

✅ HS CODE: 3921902900

Description:

Plastic sheets, plates, films, foils, and strips combined with other materials, with a weight exceeding 1.492 kg/m², where the textile composite is considered part of the "other materials" category.

Tariff Summary:

- Base Tariff Rate: 4.4%

- Additional Tariff: 25.0%

- Special Tariff after April 2, 2025: 30.0%

- Total Tax Rate: 59.4%

Key Notes:

- This code is for non-specific textile composites, where the textile is not the dominant component.

- Weight threshold: >1.492 kg/m².

- Plastic content may be less than 70% (unlike 3921902510).

✅ HS CODE: 3921902550

Description:

Other plastic sheets, plates, films, foils, and strips combined with textile materials, with a weight exceeding 1.492 kg/m², where synthetic fibers are the main textile component by weight, and the plastic component accounts for more than 70% of the total weight.

Tariff Summary:

- Base Tariff Rate: 6.5%

- Additional Tariff: 25.0%

- Special Tariff after April 2, 2025: 30.0%

- Total Tax Rate: 61.5%

Key Notes:

- Similar to 3921902510, but with a slightly different wording.

- Synthetic fibers must be the dominant textile component.

- Plastic must be >70% of the total weight.

- Weight threshold: >1.492 kg/m².

📌 Important Reminders:

-

April 2, 2025 Special Tariff:

A 30.0% additional tariff will be applied to all the above HS codes after April 2, 2025. Ensure your import timeline is aligned with this date. -

Material Verification:

Confirm the exact composition of the product (e.g., plastic percentage, type of textile fibers) to ensure correct classification. -

Certifications:

Check if any certifications (e.g., textile content verification, weight testing) are required for customs clearance. -

Unit Price:

Be aware that tariff rates are applied to the total value, so unit price and product description are critical for accurate duty calculation.

Let me know if you need help with certification requirements or customs documentation for these products.

Customer Reviews

No reviews yet.