Found 5 matching results

(CN → US)

| HS Code | Official Doc | Tariff Rate | Origin | Destination | Effective Date |

|---|---|---|---|---|---|

| 3921131100 | Doc | 59.2% | CN | US | 2025-05-12 |

| 3921131500 | Doc | 61.5% | CN | US | 2025-05-12 |

| 3921131950 | Doc | 60.3% | CN | US | 2025-05-12 |

| 3921131910 | Doc | 60.3% | CN | US | 2025-05-12 |

| 3921131100 | Doc | 59.2% | CN | US | 2025-05-12 |

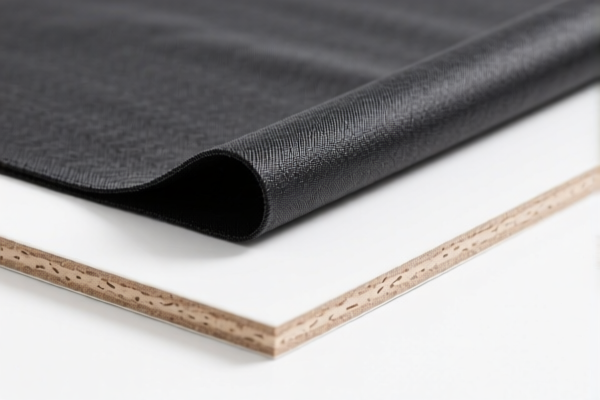

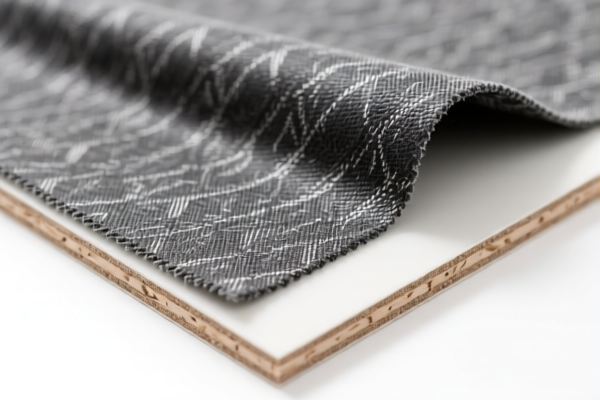

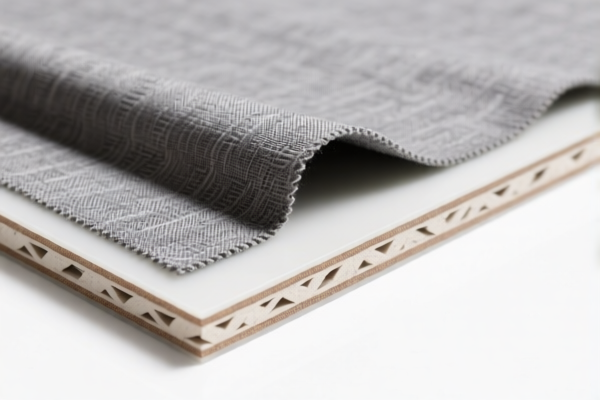

Product Name: Textile Fabric Polyurethane Composite Board

Classification HS Code Options and Tax Details:

✅ HS CODE: 3921131100

- Description: Polyurethane composite boards combined with textile materials, where synthetic fibers make up more than any single natural fiber by weight.

- Total Tax Rate: 59.2%

- Base Tariff: 4.2%

- Additional Tariff: 25.0%

- Special Tariff after April 11, 2025: 30.0%

- Notes:

- This code emphasizes that synthetic fibers (e.g., polyester, nylon) must exceed the weight of any single natural fiber (e.g., cotton, wool).

- Plastic weight must be over 70% in the composite board.

✅ HS CODE: 3921131500

- Description: Polyurethane plastic composite boards combined with textile materials.

- Total Tax Rate: 61.5%

- Base Tariff: 6.5%

- Additional Tariff: 25.0%

- Special Tariff after April 11, 2025: 30.0%

- Notes:

- This code is more general and applies to polyurethane plastic combined with textile materials.

- No specific requirement on fiber composition (e.g., synthetic vs. natural).

⚠️ HS CODE: 3921131950

- Description: Polyurethane textile composite boards.

- Total Tax Rate: 60.3%

- Base Tariff: 5.3%

- Additional Tariff: 25.0%

- Special Tariff after April 11, 2025: 30.0%

- Notes:

- Requires further confirmation of the weight percentage of plant fibers to determine the exact HS code.

- Not suitable for final classification without detailed material composition.

✅ HS CODE: 3921131910

- Description: Polyurethane textile composite boards where textile components by weight exceed any single textile fiber.

- Total Tax Rate: 60.3%

- Base Tariff: 5.3%

- Additional Tariff: 25.0%

- Special Tariff after April 11, 2025: 30.0%

- Notes:

- This code is similar to 3921131100, but does not require plastic to be over 70%.

- Focus is on textile fiber composition rather than plastic content.

📌 Proactive Advice:

- Verify the exact composition of the product, especially the weight percentages of synthetic vs. natural fibers and plastic content.

- Check the unit price to determine if additional tariffs apply (e.g., high-value goods may be subject to different rules).

- Confirm required certifications (e.g., textile origin, environmental compliance, etc.) for customs clearance.

- Review the April 11, 2025, special tariff and ensure your product is not affected by the new policy.

📅 Important Date Reminder:

- April 11, 2025: Additional tariffs of 30.0% will be imposed on this product category. Ensure your import strategy accounts for this change.

Product Name: Textile Fabric Polyurethane Composite Board

Classification HS Code Options and Tax Details:

✅ HS CODE: 3921131100

- Description: Polyurethane composite boards combined with textile materials, where synthetic fibers make up more than any single natural fiber by weight.

- Total Tax Rate: 59.2%

- Base Tariff: 4.2%

- Additional Tariff: 25.0%

- Special Tariff after April 11, 2025: 30.0%

- Notes:

- This code emphasizes that synthetic fibers (e.g., polyester, nylon) must exceed the weight of any single natural fiber (e.g., cotton, wool).

- Plastic weight must be over 70% in the composite board.

✅ HS CODE: 3921131500

- Description: Polyurethane plastic composite boards combined with textile materials.

- Total Tax Rate: 61.5%

- Base Tariff: 6.5%

- Additional Tariff: 25.0%

- Special Tariff after April 11, 2025: 30.0%

- Notes:

- This code is more general and applies to polyurethane plastic combined with textile materials.

- No specific requirement on fiber composition (e.g., synthetic vs. natural).

⚠️ HS CODE: 3921131950

- Description: Polyurethane textile composite boards.

- Total Tax Rate: 60.3%

- Base Tariff: 5.3%

- Additional Tariff: 25.0%

- Special Tariff after April 11, 2025: 30.0%

- Notes:

- Requires further confirmation of the weight percentage of plant fibers to determine the exact HS code.

- Not suitable for final classification without detailed material composition.

✅ HS CODE: 3921131910

- Description: Polyurethane textile composite boards where textile components by weight exceed any single textile fiber.

- Total Tax Rate: 60.3%

- Base Tariff: 5.3%

- Additional Tariff: 25.0%

- Special Tariff after April 11, 2025: 30.0%

- Notes:

- This code is similar to 3921131100, but does not require plastic to be over 70%.

- Focus is on textile fiber composition rather than plastic content.

📌 Proactive Advice:

- Verify the exact composition of the product, especially the weight percentages of synthetic vs. natural fibers and plastic content.

- Check the unit price to determine if additional tariffs apply (e.g., high-value goods may be subject to different rules).

- Confirm required certifications (e.g., textile origin, environmental compliance, etc.) for customs clearance.

- Review the April 11, 2025, special tariff and ensure your product is not affected by the new policy.

📅 Important Date Reminder:

- April 11, 2025: Additional tariffs of 30.0% will be imposed on this product category. Ensure your import strategy accounts for this change.

Customer Reviews

No reviews yet.