Found 5 matching results

(CN → US)

| HS Code | Official Doc | Tariff Rate | Origin | Destination | Effective Date |

|---|---|---|---|---|---|

| 3921902550 | Doc | 61.5% | CN | US | 2025-05-12 |

| 3921901950 | Doc | 60.3% | CN | US | 2025-05-12 |

| 3921904010 | Doc | 34.2% | CN | US | 2025-05-12 |

| 3921121950 | Doc | 60.3% | CN | US | 2025-05-12 |

| 3921902100 | Doc | 61.5% | CN | US | 2025-05-12 |

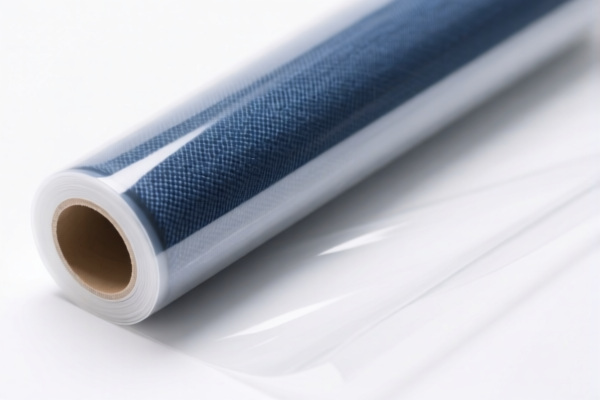

Product Classification: Textile Reinforced Plastic Film

Based on the provided HS codes and descriptions, the product "Textile Reinforced Plastic Film" falls under several HS codes depending on specific attributes such as material composition, use (e.g., packaging or display), and textile content. Below is a structured breakdown of the classification and associated tariffs:

1. HS CODE: 3921902550

- Description: Textile reinforced plastic film, where plastic accounts for more than 70% of the weight.

- Total Tax Rate: 61.5%

- Tariff Breakdown:

- Base Tariff: 6.5%

- Additional Tariff: 25.0%

- Special Tariff after April 11, 2025: 30.0%

- Key Notes:

- This code applies to films where the plastic content is dominant (over 70%).

- The high total tax rate is due to the combination of base, additional, and special tariffs.

2. HS CODE: 3921901950

- Description: Textile reinforced plastic packaging or display film.

- Total Tax Rate: 60.3%

- Tariff Breakdown:

- Base Tariff: 5.3%

- Additional Tariff: 25.0%

- Special Tariff after April 11, 2025: 30.0%

- Key Notes:

- This code is for films used in packaging or display purposes.

- Similar to 3921902550, the total tax rate is high due to the combination of tariffs.

3. HS CODE: 3921904010

- Description: Reinforced plastic film, classified under "plastic films."

- Total Tax Rate: 34.2%

- Tariff Breakdown:

- Base Tariff: 4.2%

- Additional Tariff: 0.0%

- Special Tariff after April 11, 2025: 30.0%

- Key Notes:

- This code applies to general plastic films, not necessarily textile-reinforced.

- The lower base tariff makes this a potentially more cost-effective option if the product does not require textile reinforcement.

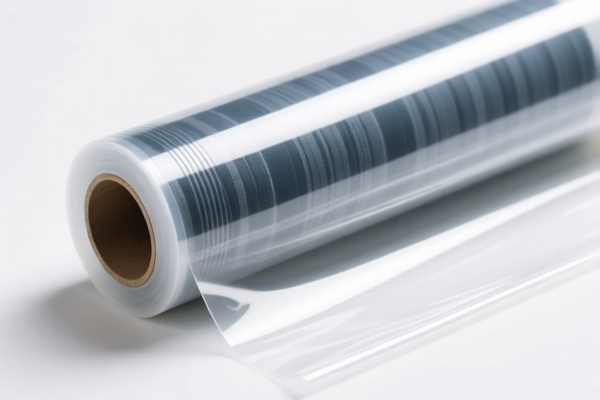

4. HS CODE: 3921121950

- Description: Textile reinforced PVC foam plastic film.

- Total Tax Rate: 60.3%

- Tariff Breakdown:

- Base Tariff: 5.3%

- Additional Tariff: 25.0%

- Special Tariff after April 11, 2025: 30.0%

- Key Notes:

- This code is specific to PVC foam films with textile reinforcement.

- The tax rate is similar to other textile-reinforced plastic films.

5. HS CODE: 3921902100

- Description: Cotton-reinforced plastic film, classified under plastic sheets, films, foils, and strips combined with other textile materials.

- Total Tax Rate: 61.5%

- Tariff Breakdown:

- Base Tariff: 6.5%

- Additional Tariff: 25.0%

- Special Tariff after April 11, 2025: 30.0%

- Key Notes:

- This code is for cotton-reinforced films, which may be subject to higher tariffs due to the textile component.

Important Reminders for Customs Compliance:

- Verify Material Composition: Ensure the plastic content is clearly defined (e.g., over 70% for 3921902550).

- Check Usage: Packaging or display films may fall under different HS codes (e.g., 3921901950).

- Confirm Textile Content: If the product contains cotton or other textiles, the correct code (e.g., 3921902100) must be used.

- Unit Price and Certification: Confirm the unit price and whether any certifications (e.g., textile or plastic content verification) are required for customs clearance.

- April 11, 2025 Tariff Alert: All listed codes will be subject to an additional 30.0% tariff after this date. This is a time-sensitive policy—plan accordingly.

Proactive Advice:

- Double-check the product’s composition and intended use to ensure the correct HS code is applied.

- Consult with a customs broker or classification expert if the product contains multiple materials or is used in specialized applications.

- Keep documentation ready (e.g., material certificates, product specifications) to support the classification and avoid delays in customs clearance.

Product Classification: Textile Reinforced Plastic Film

Based on the provided HS codes and descriptions, the product "Textile Reinforced Plastic Film" falls under several HS codes depending on specific attributes such as material composition, use (e.g., packaging or display), and textile content. Below is a structured breakdown of the classification and associated tariffs:

1. HS CODE: 3921902550

- Description: Textile reinforced plastic film, where plastic accounts for more than 70% of the weight.

- Total Tax Rate: 61.5%

- Tariff Breakdown:

- Base Tariff: 6.5%

- Additional Tariff: 25.0%

- Special Tariff after April 11, 2025: 30.0%

- Key Notes:

- This code applies to films where the plastic content is dominant (over 70%).

- The high total tax rate is due to the combination of base, additional, and special tariffs.

2. HS CODE: 3921901950

- Description: Textile reinforced plastic packaging or display film.

- Total Tax Rate: 60.3%

- Tariff Breakdown:

- Base Tariff: 5.3%

- Additional Tariff: 25.0%

- Special Tariff after April 11, 2025: 30.0%

- Key Notes:

- This code is for films used in packaging or display purposes.

- Similar to 3921902550, the total tax rate is high due to the combination of tariffs.

3. HS CODE: 3921904010

- Description: Reinforced plastic film, classified under "plastic films."

- Total Tax Rate: 34.2%

- Tariff Breakdown:

- Base Tariff: 4.2%

- Additional Tariff: 0.0%

- Special Tariff after April 11, 2025: 30.0%

- Key Notes:

- This code applies to general plastic films, not necessarily textile-reinforced.

- The lower base tariff makes this a potentially more cost-effective option if the product does not require textile reinforcement.

4. HS CODE: 3921121950

- Description: Textile reinforced PVC foam plastic film.

- Total Tax Rate: 60.3%

- Tariff Breakdown:

- Base Tariff: 5.3%

- Additional Tariff: 25.0%

- Special Tariff after April 11, 2025: 30.0%

- Key Notes:

- This code is specific to PVC foam films with textile reinforcement.

- The tax rate is similar to other textile-reinforced plastic films.

5. HS CODE: 3921902100

- Description: Cotton-reinforced plastic film, classified under plastic sheets, films, foils, and strips combined with other textile materials.

- Total Tax Rate: 61.5%

- Tariff Breakdown:

- Base Tariff: 6.5%

- Additional Tariff: 25.0%

- Special Tariff after April 11, 2025: 30.0%

- Key Notes:

- This code is for cotton-reinforced films, which may be subject to higher tariffs due to the textile component.

Important Reminders for Customs Compliance:

- Verify Material Composition: Ensure the plastic content is clearly defined (e.g., over 70% for 3921902550).

- Check Usage: Packaging or display films may fall under different HS codes (e.g., 3921901950).

- Confirm Textile Content: If the product contains cotton or other textiles, the correct code (e.g., 3921902100) must be used.

- Unit Price and Certification: Confirm the unit price and whether any certifications (e.g., textile or plastic content verification) are required for customs clearance.

- April 11, 2025 Tariff Alert: All listed codes will be subject to an additional 30.0% tariff after this date. This is a time-sensitive policy—plan accordingly.

Proactive Advice:

- Double-check the product’s composition and intended use to ensure the correct HS code is applied.

- Consult with a customs broker or classification expert if the product contains multiple materials or is used in specialized applications.

- Keep documentation ready (e.g., material certificates, product specifications) to support the classification and avoid delays in customs clearance.

Customer Reviews

No reviews yet.