| HS Code | Official Doc | Tariff Rate | Origin | Destination | Effective Date |

|---|---|---|---|---|---|

| 3921902900 | Doc | 59.4% | CN | US | 2025-05-12 |

| 7019739090 | Doc | 61.0% | CN | US | 2025-05-12 |

| 7019905150 | Doc | 59.3% | CN | US | 2025-05-12 |

| 7019140000 | Doc | 59.3% | CN | US | 2025-05-12 |

| 3921902550 | Doc | 61.5% | CN | US | 2025-05-12 |

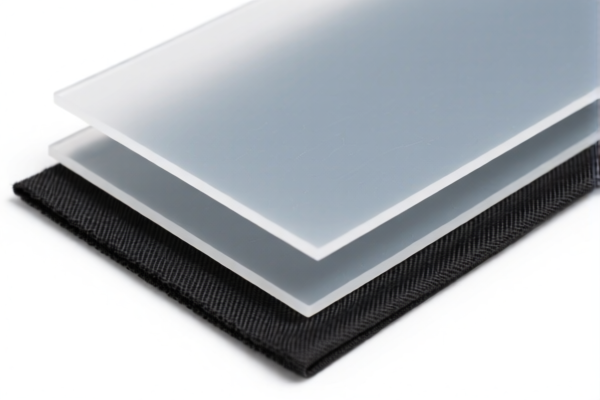

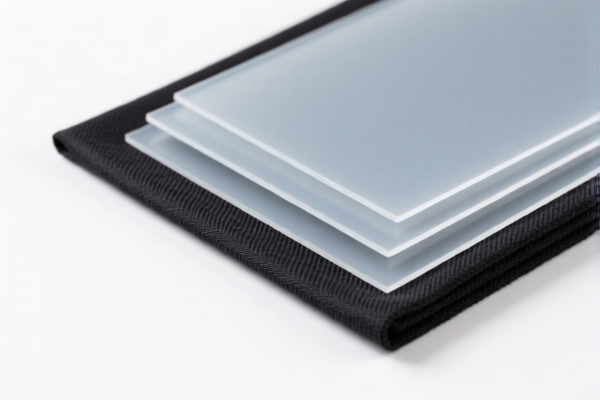

Here is the structured classification and tariff information for Textile Reinforced Plastic Sheets, based on the provided HS codes and tax details:

✅ HS CODE: 3921902900

Product Description: Fiber-reinforced textile plastic sheets

Total Tax Rate: 59.4%

- Base Tariff: 4.4%

- Additional Tariff: 25.0%

- Special Tariff after April 11, 2025: 30.0%

- Note: This code is suitable for textile-reinforced plastic sheets made from synthetic resins.

✅ HS CODE: 7019739090

Product Description: Glass fiber-reinforced plastic sheets

Total Tax Rate: 61.0%

- Base Tariff: 6.0%

- Additional Tariff: 25.0%

- Special Tariff after April 11, 2025: 30.0%

- Note: This code applies to glass fiber-reinforced plastic sheets, typically used in industrial or construction applications.

✅ HS CODE: 7019905150

Product Description: Glass fiber-reinforced plastic sheets (other products)

Total Tax Rate: 59.3%

- Base Tariff: 4.3%

- Additional Tariff: 25.0%

- Special Tariff after April 11, 2025: 30.0%

- Note: This code covers glass fiber-reinforced plastic sheets that do not fall under more specific categories.

✅ HS CODE: 7019140000

Product Description: Glass fiber-reinforced plastic sheets (mechanically bonded sheet products)

Total Tax Rate: 59.3%

- Base Tariff: 4.3%

- Additional Tariff: 25.0%

- Special Tariff after April 11, 2025: 30.0%

- Note: This code is for mechanically bonded glass fiber-reinforced plastic sheets, often used in composite manufacturing.

✅ HS CODE: 3921902550

Product Description: Polyester fiber-reinforced plastic composite sheets

Total Tax Rate: 61.5%

- Base Tariff: 6.5%

- Additional Tariff: 25.0%

- Special Tariff after April 11, 2025: 30.0%

- Note: This code applies to composite sheets made with polyester fiber reinforcement.

📌 Important Notes and Recommendations:

- April 11, 2025 Special Tariff: All the above HS codes are subject to an additional 30.0% tariff after April 11, 2025. Ensure your import timeline is planned accordingly.

- Anti-dumping duties: If the product contains iron or aluminum components, check for any applicable anti-dumping duties based on the country of origin.

- Material Verification: Confirm the exact composition of the plastic sheets (e.g., type of fiber, resin, and bonding method) to ensure correct HS code classification.

- Certifications: Some products may require technical documentation or certifications (e.g., safety, environmental compliance) for customs clearance.

- Unit Price: Be aware that tariff rates may vary based on the unit price or quantity of the goods, especially under preferential trade agreements.

If you provide more details about the material composition, intended use, and country of origin, I can help you further refine the classification and tax implications. Here is the structured classification and tariff information for Textile Reinforced Plastic Sheets, based on the provided HS codes and tax details:

✅ HS CODE: 3921902900

Product Description: Fiber-reinforced textile plastic sheets

Total Tax Rate: 59.4%

- Base Tariff: 4.4%

- Additional Tariff: 25.0%

- Special Tariff after April 11, 2025: 30.0%

- Note: This code is suitable for textile-reinforced plastic sheets made from synthetic resins.

✅ HS CODE: 7019739090

Product Description: Glass fiber-reinforced plastic sheets

Total Tax Rate: 61.0%

- Base Tariff: 6.0%

- Additional Tariff: 25.0%

- Special Tariff after April 11, 2025: 30.0%

- Note: This code applies to glass fiber-reinforced plastic sheets, typically used in industrial or construction applications.

✅ HS CODE: 7019905150

Product Description: Glass fiber-reinforced plastic sheets (other products)

Total Tax Rate: 59.3%

- Base Tariff: 4.3%

- Additional Tariff: 25.0%

- Special Tariff after April 11, 2025: 30.0%

- Note: This code covers glass fiber-reinforced plastic sheets that do not fall under more specific categories.

✅ HS CODE: 7019140000

Product Description: Glass fiber-reinforced plastic sheets (mechanically bonded sheet products)

Total Tax Rate: 59.3%

- Base Tariff: 4.3%

- Additional Tariff: 25.0%

- Special Tariff after April 11, 2025: 30.0%

- Note: This code is for mechanically bonded glass fiber-reinforced plastic sheets, often used in composite manufacturing.

✅ HS CODE: 3921902550

Product Description: Polyester fiber-reinforced plastic composite sheets

Total Tax Rate: 61.5%

- Base Tariff: 6.5%

- Additional Tariff: 25.0%

- Special Tariff after April 11, 2025: 30.0%

- Note: This code applies to composite sheets made with polyester fiber reinforcement.

📌 Important Notes and Recommendations:

- April 11, 2025 Special Tariff: All the above HS codes are subject to an additional 30.0% tariff after April 11, 2025. Ensure your import timeline is planned accordingly.

- Anti-dumping duties: If the product contains iron or aluminum components, check for any applicable anti-dumping duties based on the country of origin.

- Material Verification: Confirm the exact composition of the plastic sheets (e.g., type of fiber, resin, and bonding method) to ensure correct HS code classification.

- Certifications: Some products may require technical documentation or certifications (e.g., safety, environmental compliance) for customs clearance.

- Unit Price: Be aware that tariff rates may vary based on the unit price or quantity of the goods, especially under preferential trade agreements.

If you provide more details about the material composition, intended use, and country of origin, I can help you further refine the classification and tax implications.

Customer Reviews

No reviews yet.