| HS Code | Official Doc | Tariff Rate | Origin | Destination | Effective Date |

|---|---|---|---|---|---|

| 3921904010 | Doc | 34.2% | CN | US | 2025-05-12 |

| 3919905020 | Doc | 60.8% | CN | US | 2025-05-12 |

| 3916100000 | Doc | 60.8% | CN | US | 2025-05-12 |

| 7019905150 | Doc | 59.3% | CN | US | 2025-05-12 |

| 9403993080 | Doc | 55.0% | CN | US | 2025-05-12 |

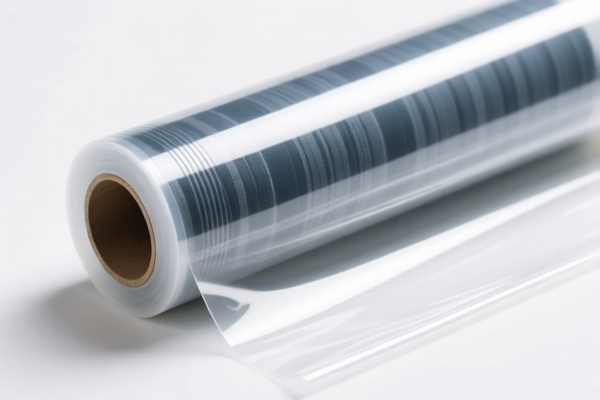

Here is the structured classification and tariff analysis for the Textile Reinforced Plastic Strip based on the provided HS codes and tax details:

✅ HS CODE: 3921904010

Product Description: Plastic-made other sheets, plates, films, foils, and strips

Total Tax Rate: 34.2%

- Base Tariff: 4.2%

- Additional Tariff: 0.0%

- April 11, 2025 Special Tariff: 30.0% (applies after April 11, 2025)

- Anti-dumping duties: Not applicable for this category

- Note: This code is for general plastic strips, not reinforced with textile fibers.

- Action Required: Confirm if the product is purely plastic or contains textile reinforcement.

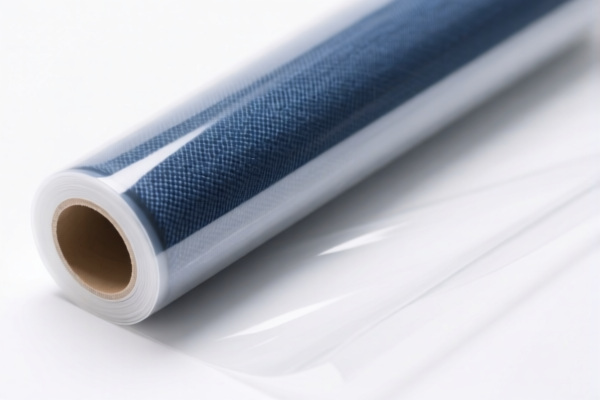

✅ HS CODE: 3919905020

Product Description: Reinforced tape (e.g., with fibers or textiles)

Total Tax Rate: 60.8%

- Base Tariff: 5.8%

- Additional Tariff: 25.0%

- April 11, 2025 Special Tariff: 30.0% (applies after April 11, 2025)

- Anti-dumping duties: Not applicable

- Note: This code is suitable for reinforced plastic tapes, possibly including textile reinforcement.

- Action Required: Verify if the product is classified as "reinforced tape" and confirm the reinforcement material.

✅ HS CODE: 3916100000

Product Description: Polyethylene plastic strips

Total Tax Rate: 60.8%

- Base Tariff: 5.8%

- Additional Tariff: 25.0%

- April 11, 2025 Special Tariff: 30.0% (applies after April 11, 2025)

- Anti-dumping duties: Not applicable

- Note: This code is for polyethylene strips, not reinforced with textiles.

- Action Required: Ensure the product is not reinforced with textile fibers, as this would change the classification.

✅ HS CODE: 7019905150

Product Description: Other products of glass fiber and articles thereof

Total Tax Rate: 59.3%

- Base Tariff: 4.3%

- Additional Tariff: 25.0%

- April 11, 2025 Special Tariff: 30.0% (applies after April 11, 2025)

- Anti-dumping duties: Not applicable

- Note: This code is for glass fiber products, which may be used in reinforced plastic strips.

- Action Required: Confirm if the product is a finished reinforced strip or just a glass fiber component.

✅ HS CODE: 9403993080

Product Description: Other parts of rubber or plastic, or of reinforced or laminated plastics

Total Tax Rate: 55.0%

- Base Tariff: 0.0%

- Additional Tariff: 25.0%

- April 11, 2025 Special Tariff: 30.0% (applies after April 11, 2025)

- Anti-dumping duties: Not applicable

- Note: This code is for parts of reinforced or laminated plastics, which may include textile-reinforced strips.

- Action Required: Confirm if the product is a component or a finished strip, and whether it is reinforced with textiles.

📌 Proactive Advice:

- Verify Material Composition: Ensure the product is correctly classified based on its primary material and reinforcement (e.g., textile, glass fiber, or polyethylene).

- Check Unit Price and Certification: Some HS codes may require specific certifications or documentation (e.g., for reinforced materials).

- Monitor April 11, 2025 Policy: Be aware that additional tariffs of 30.0% will apply after this date for all listed codes.

- Consult Customs Authority: For final confirmation, especially if the product is a composite or hybrid material.

Let me know if you need help with customs documentation or further classification details. Here is the structured classification and tariff analysis for the Textile Reinforced Plastic Strip based on the provided HS codes and tax details:

✅ HS CODE: 3921904010

Product Description: Plastic-made other sheets, plates, films, foils, and strips

Total Tax Rate: 34.2%

- Base Tariff: 4.2%

- Additional Tariff: 0.0%

- April 11, 2025 Special Tariff: 30.0% (applies after April 11, 2025)

- Anti-dumping duties: Not applicable for this category

- Note: This code is for general plastic strips, not reinforced with textile fibers.

- Action Required: Confirm if the product is purely plastic or contains textile reinforcement.

✅ HS CODE: 3919905020

Product Description: Reinforced tape (e.g., with fibers or textiles)

Total Tax Rate: 60.8%

- Base Tariff: 5.8%

- Additional Tariff: 25.0%

- April 11, 2025 Special Tariff: 30.0% (applies after April 11, 2025)

- Anti-dumping duties: Not applicable

- Note: This code is suitable for reinforced plastic tapes, possibly including textile reinforcement.

- Action Required: Verify if the product is classified as "reinforced tape" and confirm the reinforcement material.

✅ HS CODE: 3916100000

Product Description: Polyethylene plastic strips

Total Tax Rate: 60.8%

- Base Tariff: 5.8%

- Additional Tariff: 25.0%

- April 11, 2025 Special Tariff: 30.0% (applies after April 11, 2025)

- Anti-dumping duties: Not applicable

- Note: This code is for polyethylene strips, not reinforced with textiles.

- Action Required: Ensure the product is not reinforced with textile fibers, as this would change the classification.

✅ HS CODE: 7019905150

Product Description: Other products of glass fiber and articles thereof

Total Tax Rate: 59.3%

- Base Tariff: 4.3%

- Additional Tariff: 25.0%

- April 11, 2025 Special Tariff: 30.0% (applies after April 11, 2025)

- Anti-dumping duties: Not applicable

- Note: This code is for glass fiber products, which may be used in reinforced plastic strips.

- Action Required: Confirm if the product is a finished reinforced strip or just a glass fiber component.

✅ HS CODE: 9403993080

Product Description: Other parts of rubber or plastic, or of reinforced or laminated plastics

Total Tax Rate: 55.0%

- Base Tariff: 0.0%

- Additional Tariff: 25.0%

- April 11, 2025 Special Tariff: 30.0% (applies after April 11, 2025)

- Anti-dumping duties: Not applicable

- Note: This code is for parts of reinforced or laminated plastics, which may include textile-reinforced strips.

- Action Required: Confirm if the product is a component or a finished strip, and whether it is reinforced with textiles.

📌 Proactive Advice:

- Verify Material Composition: Ensure the product is correctly classified based on its primary material and reinforcement (e.g., textile, glass fiber, or polyethylene).

- Check Unit Price and Certification: Some HS codes may require specific certifications or documentation (e.g., for reinforced materials).

- Monitor April 11, 2025 Policy: Be aware that additional tariffs of 30.0% will apply after this date for all listed codes.

- Consult Customs Authority: For final confirmation, especially if the product is a composite or hybrid material.

Let me know if you need help with customs documentation or further classification details.

Customer Reviews

No reviews yet.