| HS Code | Official Doc | Tariff Rate | Origin | Destination | Effective Date |

|---|---|---|---|---|---|

| 3918903000 | Doc | 60.3% | CN | US | 2025-05-12 |

| 3921901100 | Doc | 59.2% | CN | US | 2025-05-12 |

| 3921901500 | Doc | 61.5% | CN | US | 2025-05-12 |

| 3921901910 | Doc | 60.3% | CN | US | 2025-05-12 |

| 3918902000 | Doc | 61.5% | CN | US | 2025-05-12 |

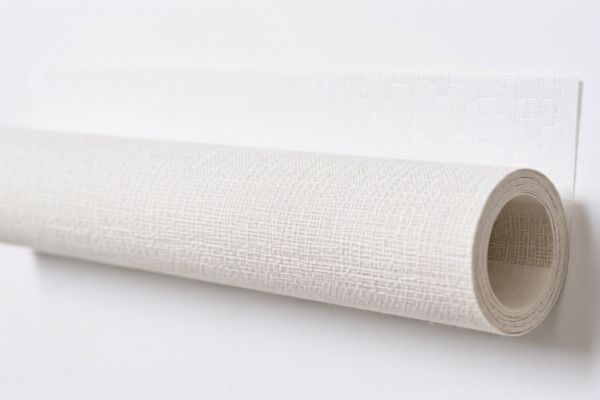

Here is the structured classification and tariff information for Textile-backed plastic wall film for indoor decoration, based on the provided HS codes and tax details:

✅ HS CODE: 3918903000

Product Description: Plastic wall film with textile backing for indoor decoration

Total Tax Rate: 60.3%

Tariff Breakdown:

- Base Tariff: 5.3%

- Additional Tariff: 25.0%

- April 11 Special Tariff (after April 11, 2025): 30.0%

- Anti-dumping duties: Not applicable for this product category

- Special Notes: No specific anti-dumping duties on iron or aluminum apply here.

✅ HS CODE: 3921901100

Product Description: Textile-backed plastic wall paper, weight ≤1.492 kg/m², with synthetic fiber content exceeding any other single fiber, and plastic content >70%

Total Tax Rate: 59.2%

Tariff Breakdown:

- Base Tariff: 4.2%

- Additional Tariff: 25.0%

- April 11 Special Tariff (after April 11, 2025): 30.0%

- Anti-dumping duties: Not applicable

- Special Notes: This code applies to specific compositions (plastic >70%).

✅ HS CODE: 3921901500

Product Description: Textile-backed plastic wall paper, weight ≤1.492 kg/m², with synthetic fiber content exceeding any other single fiber

Total Tax Rate: 61.5%

Tariff Breakdown:

- Base Tariff: 6.5%

- Additional Tariff: 25.0%

- April 11 Special Tariff (after April 11, 2025): 30.0%

- Anti-dumping duties: Not applicable

- Special Notes: This code applies to products with synthetic fiber as the dominant textile component.

✅ HS CODE: 3921901910

Product Description: Textile-backed plastic decorative film, weight ≤1.492 kg/m², with textile content (by weight) exceeding any single fiber

Total Tax Rate: 60.3%

Tariff Breakdown:

- Base Tariff: 5.3%

- Additional Tariff: 25.0%

- April 11 Special Tariff (after April 11, 2025): 30.0%

- Anti-dumping duties: Not applicable

- Special Notes: This code is for decorative films with textile content as the dominant component.

✅ HS CODE: 3918902000

Product Description: Plastic wall covering with textile fiber backing, for walls or ceilings

Total Tax Rate: 61.5%

Tariff Breakdown:

- Base Tariff: 6.5%

- Additional Tariff: 25.0%

- April 11 Special Tariff (after April 11, 2025): 30.0%

- Anti-dumping duties: Not applicable

- Special Notes: This code is for general-purpose wall or ceiling coverings.

📌 Proactive Advice for Importers:

- Verify Material Composition: Ensure the product meets the specific composition criteria for the selected HS code (e.g., plastic content, textile fiber type).

- Check Unit Price: Tariff rates may vary based on the declared value and classification.

- Certifications Required: Confirm if any certifications (e.g., fire resistance, environmental compliance) are needed for import.

- April 11, 2025 Deadline: Be aware of the additional 30% tariff that will apply after this date. Plan accordingly for cost adjustments.

- Consult Customs Broker: For accurate classification and compliance, especially if the product has mixed materials or dual uses.

Let me know if you need help selecting the most appropriate HS code for your specific product. Here is the structured classification and tariff information for Textile-backed plastic wall film for indoor decoration, based on the provided HS codes and tax details:

✅ HS CODE: 3918903000

Product Description: Plastic wall film with textile backing for indoor decoration

Total Tax Rate: 60.3%

Tariff Breakdown:

- Base Tariff: 5.3%

- Additional Tariff: 25.0%

- April 11 Special Tariff (after April 11, 2025): 30.0%

- Anti-dumping duties: Not applicable for this product category

- Special Notes: No specific anti-dumping duties on iron or aluminum apply here.

✅ HS CODE: 3921901100

Product Description: Textile-backed plastic wall paper, weight ≤1.492 kg/m², with synthetic fiber content exceeding any other single fiber, and plastic content >70%

Total Tax Rate: 59.2%

Tariff Breakdown:

- Base Tariff: 4.2%

- Additional Tariff: 25.0%

- April 11 Special Tariff (after April 11, 2025): 30.0%

- Anti-dumping duties: Not applicable

- Special Notes: This code applies to specific compositions (plastic >70%).

✅ HS CODE: 3921901500

Product Description: Textile-backed plastic wall paper, weight ≤1.492 kg/m², with synthetic fiber content exceeding any other single fiber

Total Tax Rate: 61.5%

Tariff Breakdown:

- Base Tariff: 6.5%

- Additional Tariff: 25.0%

- April 11 Special Tariff (after April 11, 2025): 30.0%

- Anti-dumping duties: Not applicable

- Special Notes: This code applies to products with synthetic fiber as the dominant textile component.

✅ HS CODE: 3921901910

Product Description: Textile-backed plastic decorative film, weight ≤1.492 kg/m², with textile content (by weight) exceeding any single fiber

Total Tax Rate: 60.3%

Tariff Breakdown:

- Base Tariff: 5.3%

- Additional Tariff: 25.0%

- April 11 Special Tariff (after April 11, 2025): 30.0%

- Anti-dumping duties: Not applicable

- Special Notes: This code is for decorative films with textile content as the dominant component.

✅ HS CODE: 3918902000

Product Description: Plastic wall covering with textile fiber backing, for walls or ceilings

Total Tax Rate: 61.5%

Tariff Breakdown:

- Base Tariff: 6.5%

- Additional Tariff: 25.0%

- April 11 Special Tariff (after April 11, 2025): 30.0%

- Anti-dumping duties: Not applicable

- Special Notes: This code is for general-purpose wall or ceiling coverings.

📌 Proactive Advice for Importers:

- Verify Material Composition: Ensure the product meets the specific composition criteria for the selected HS code (e.g., plastic content, textile fiber type).

- Check Unit Price: Tariff rates may vary based on the declared value and classification.

- Certifications Required: Confirm if any certifications (e.g., fire resistance, environmental compliance) are needed for import.

- April 11, 2025 Deadline: Be aware of the additional 30% tariff that will apply after this date. Plan accordingly for cost adjustments.

- Consult Customs Broker: For accurate classification and compliance, especially if the product has mixed materials or dual uses.

Let me know if you need help selecting the most appropriate HS code for your specific product.

Customer Reviews

No reviews yet.