| HS Code | Official Doc | Tariff Rate | Origin | Destination | Effective Date |

|---|---|---|---|---|---|

| 3921902900 | Doc | 59.4% | CN | US | 2025-05-12 |

| 3921902900 | Doc | 59.4% | CN | US | 2025-05-12 |

| 3921902550 | Doc | 61.5% | CN | US | 2025-05-12 |

| 3921902510 | Doc | 61.5% | CN | US | 2025-05-12 |

| 3918902000 | Doc | 61.5% | CN | US | 2025-05-12 |

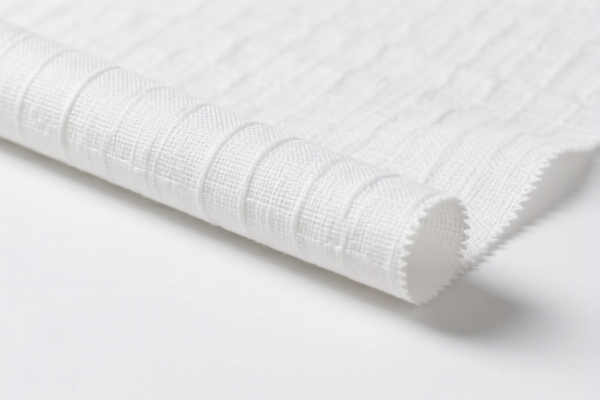

Product Classification: Textile Laminated Plastic Wall Material

HS CODE: 3921902900, 3921902550, 3921902510, 3918902000

🔍 Classification Overview

The product "Textile Laminated Plastic Wall Material" falls under several HS codes depending on specific composition and use (e.g., wall panel vs. decorative panel). Below is a structured breakdown of the applicable HS codes and their associated tariffs:

📌 HS Code: 3921902900

Product Description: Textile Plastic Composite Wall Panel

Total Tax Rate: 59.4%

Tariff Breakdown:

- Base Tariff: 4.4%

- Additional Tariff: 25.0%

- Special Tariff after April 11, 2025: 30.0%

- Anti-dumping duties: Not applicable for this code.

📌 HS Code: 3921902550

Product Description: Decorative Wall Panel – Textile Plastic Board

Total Tax Rate: 61.5%

Tariff Breakdown:

- Base Tariff: 6.5%

- Additional Tariff: 25.0%

- Special Tariff after April 11, 2025: 30.0%

- Anti-dumping duties: Not applicable for this code.

📌 HS Code: 3921902510

Product Description: Textile Laminated Plastic Board (with layered structure)

Total Tax Rate: 61.5%

Tariff Breakdown:

- Base Tariff: 6.5%

- Additional Tariff: 25.0%

- Special Tariff after April 11, 2025: 30.0%

- Anti-dumping duties: Not applicable for this code.

📌 HS Code: 3918902000

Product Description: Textile Fiber Composite Plastic Wall Decorative Panel

Total Tax Rate: 61.5%

Tariff Breakdown:

- Base Tariff: 6.5%

- Additional Tariff: 25.0%

- Special Tariff after April 11, 2025: 30.0%

- Anti-dumping duties: Not applicable for this code.

⚠️ Important Notes and Alerts

- April 11, 2025 Special Tariff: A 30.0% additional tariff will be imposed on all the above HS codes after April 11, 2025. This is a time-sensitive policy and must be accounted for in cost planning.

- No Anti-dumping duties: None of the listed HS codes are subject to anti-dumping duties on iron or aluminum.

- Material Verification: Confirm the exact composition and structure of the product (e.g., textile layering, plastic type, and thickness) to ensure correct HS code classification.

- Certifications Required: Check if any certifications (e.g., fire resistance, environmental compliance) are required for import into the destination country.

✅ Proactive Advice

- Verify Material and Unit Price: Ensure the product description matches the HS code and that the unit price is consistent with the declared classification.

- Consult Customs Broker: For complex or high-value shipments, consult a customs broker to confirm classification and tax implications.

- Monitor Policy Updates: Stay informed about any changes in tariff policies, especially around the April 11, 2025 deadline.

Let me know if you need help with a specific product description or customs documentation.

Product Classification: Textile Laminated Plastic Wall Material

HS CODE: 3921902900, 3921902550, 3921902510, 3918902000

🔍 Classification Overview

The product "Textile Laminated Plastic Wall Material" falls under several HS codes depending on specific composition and use (e.g., wall panel vs. decorative panel). Below is a structured breakdown of the applicable HS codes and their associated tariffs:

📌 HS Code: 3921902900

Product Description: Textile Plastic Composite Wall Panel

Total Tax Rate: 59.4%

Tariff Breakdown:

- Base Tariff: 4.4%

- Additional Tariff: 25.0%

- Special Tariff after April 11, 2025: 30.0%

- Anti-dumping duties: Not applicable for this code.

📌 HS Code: 3921902550

Product Description: Decorative Wall Panel – Textile Plastic Board

Total Tax Rate: 61.5%

Tariff Breakdown:

- Base Tariff: 6.5%

- Additional Tariff: 25.0%

- Special Tariff after April 11, 2025: 30.0%

- Anti-dumping duties: Not applicable for this code.

📌 HS Code: 3921902510

Product Description: Textile Laminated Plastic Board (with layered structure)

Total Tax Rate: 61.5%

Tariff Breakdown:

- Base Tariff: 6.5%

- Additional Tariff: 25.0%

- Special Tariff after April 11, 2025: 30.0%

- Anti-dumping duties: Not applicable for this code.

📌 HS Code: 3918902000

Product Description: Textile Fiber Composite Plastic Wall Decorative Panel

Total Tax Rate: 61.5%

Tariff Breakdown:

- Base Tariff: 6.5%

- Additional Tariff: 25.0%

- Special Tariff after April 11, 2025: 30.0%

- Anti-dumping duties: Not applicable for this code.

⚠️ Important Notes and Alerts

- April 11, 2025 Special Tariff: A 30.0% additional tariff will be imposed on all the above HS codes after April 11, 2025. This is a time-sensitive policy and must be accounted for in cost planning.

- No Anti-dumping duties: None of the listed HS codes are subject to anti-dumping duties on iron or aluminum.

- Material Verification: Confirm the exact composition and structure of the product (e.g., textile layering, plastic type, and thickness) to ensure correct HS code classification.

- Certifications Required: Check if any certifications (e.g., fire resistance, environmental compliance) are required for import into the destination country.

✅ Proactive Advice

- Verify Material and Unit Price: Ensure the product description matches the HS code and that the unit price is consistent with the declared classification.

- Consult Customs Broker: For complex or high-value shipments, consult a customs broker to confirm classification and tax implications.

- Monitor Policy Updates: Stay informed about any changes in tariff policies, especially around the April 11, 2025 deadline.

Let me know if you need help with a specific product description or customs documentation.

Customer Reviews

No reviews yet.