| HS Code | Official Doc | Tariff Rate | Origin | Destination | Effective Date |

|---|---|---|---|---|---|

| 3921905050 | Doc | 34.8% | CN | US | 2025-05-12 |

| 3920995000 | Doc | 60.8% | CN | US | 2025-05-12 |

| 3917390010 | Doc | 33.1% | CN | US | 2025-05-12 |

| 7019905150 | Doc | 59.3% | CN | US | 2025-05-12 |

| 3921902900 | Doc | 59.4% | CN | US | 2025-05-12 |

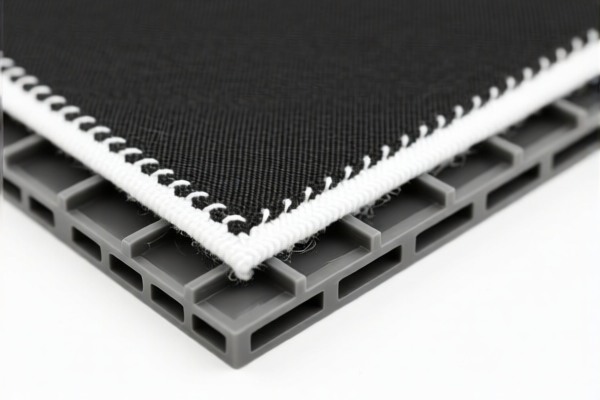

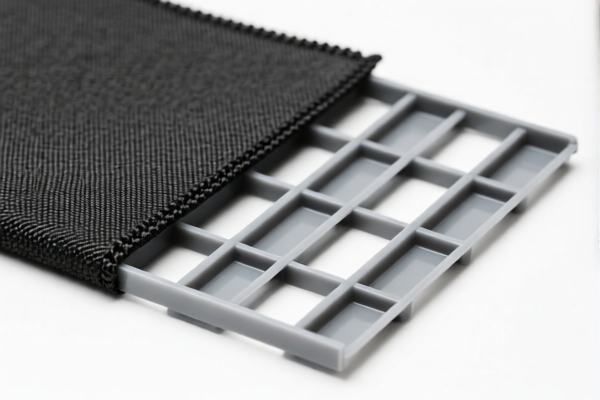

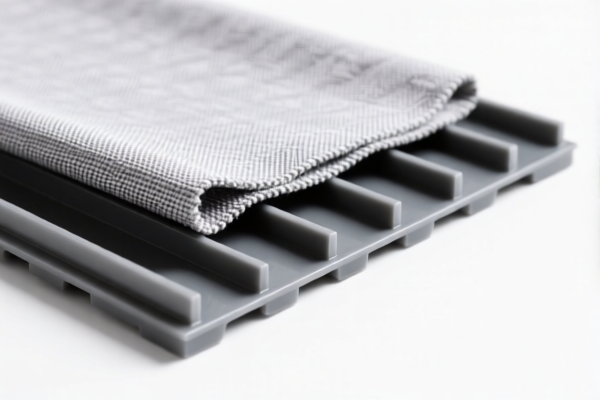

Based on the product name "Textile reinforced Plastic Anti Static Panels", the following HS codes and tariff information are relevant for customs classification and compliance. Here's a structured breakdown:

✅ HS CODE: 3921905050

Description: Other plastic sheets, plates, films, foils and strips

Total Tax Rate: 34.8%

Tax Details:

- Base Tariff: 4.8%

- Additional Tariff: 0.0%

- April 11 Special Tariff (after April 11, 2025): 30.0%

Notes:

- This code applies to plastic sheets that are not composite with other materials.

- Not suitable for textile-reinforced panels (composite material).

✅ HS CODE: 3920995000

Description: Other plastics

Total Tax Rate: 60.8%

Tax Details:

- Base Tariff: 5.8%

- Additional Tariff: 25.0%

- April 11 Special Tariff (after April 11, 2025): 30.0%

Notes:

- This code is for general plastics, not specific to panels or composites.

- Not suitable for textile-reinforced panels.

✅ HS CODE: 3917390010

Description: Metal-reinforced plastic tubes, pipe fittings and hoses

Total Tax Rate: 33.1%

Tax Details:

- Base Tariff: 3.1%

- Additional Tariff: 0.0%

- April 11 Special Tariff (after April 11, 2025): 30.0%

Notes:

- This code is for metal-reinforced plastic tubes, not panels.

- Not suitable for textile-reinforced panels.

✅ HS CODE: 7019905150

Description: Other products of glass fiber (including glass wool) and articles thereof (e.g., yarn, fiber bundles, fabrics)

Total Tax Rate: 59.3%

Tax Details:

- Base Tariff: 4.3%

- Additional Tariff: 25.0%

- April 11 Special Tariff (after April 11, 2025): 30.0%

Notes:

- This code is for glass fiber products, not textile-reinforced plastic panels.

- Not suitable for textile-reinforced panels.

✅ HS CODE: 3921902900

Description: Plastic sheets, plates, films, foils and strips, composite with other materials, with a weight exceeding 1.492 kg/m²

Total Tax Rate: 59.4%

Tax Details:

- Base Tariff: 4.4%

- Additional Tariff: 25.0%

- April 11 Special Tariff (after April 11, 2025): 30.0%

Notes:

- This code is for composite plastic sheets with a weight over 1.492 kg/m².

- Possibly suitable for textile-reinforced plastic panels, if the composite weight meets the threshold.

📌 Proactive Advice:

- Verify the material composition of the panels (e.g., type of textile reinforcement, plastic base, and composite weight).

- Check the unit weight to determine if it meets the 1.492 kg/m² threshold for HS CODE 3921902900.

- Confirm if the product is classified as a composite (textile + plastic) or a standalone plastic sheet.

- Check if any certifications (e.g., anti-static, fire resistance) are required for import.

- Monitor the April 11, 2025 deadline for additional tariffs — this could significantly increase costs.

📌 Recommended Action:

If the textile-reinforced plastic panels are composite and exceed 1.492 kg/m², HS CODE 3921902900 is likely the most accurate classification. Otherwise, further clarification may be needed. Based on the product name "Textile reinforced Plastic Anti Static Panels", the following HS codes and tariff information are relevant for customs classification and compliance. Here's a structured breakdown:

✅ HS CODE: 3921905050

Description: Other plastic sheets, plates, films, foils and strips

Total Tax Rate: 34.8%

Tax Details:

- Base Tariff: 4.8%

- Additional Tariff: 0.0%

- April 11 Special Tariff (after April 11, 2025): 30.0%

Notes:

- This code applies to plastic sheets that are not composite with other materials.

- Not suitable for textile-reinforced panels (composite material).

✅ HS CODE: 3920995000

Description: Other plastics

Total Tax Rate: 60.8%

Tax Details:

- Base Tariff: 5.8%

- Additional Tariff: 25.0%

- April 11 Special Tariff (after April 11, 2025): 30.0%

Notes:

- This code is for general plastics, not specific to panels or composites.

- Not suitable for textile-reinforced panels.

✅ HS CODE: 3917390010

Description: Metal-reinforced plastic tubes, pipe fittings and hoses

Total Tax Rate: 33.1%

Tax Details:

- Base Tariff: 3.1%

- Additional Tariff: 0.0%

- April 11 Special Tariff (after April 11, 2025): 30.0%

Notes:

- This code is for metal-reinforced plastic tubes, not panels.

- Not suitable for textile-reinforced panels.

✅ HS CODE: 7019905150

Description: Other products of glass fiber (including glass wool) and articles thereof (e.g., yarn, fiber bundles, fabrics)

Total Tax Rate: 59.3%

Tax Details:

- Base Tariff: 4.3%

- Additional Tariff: 25.0%

- April 11 Special Tariff (after April 11, 2025): 30.0%

Notes:

- This code is for glass fiber products, not textile-reinforced plastic panels.

- Not suitable for textile-reinforced panels.

✅ HS CODE: 3921902900

Description: Plastic sheets, plates, films, foils and strips, composite with other materials, with a weight exceeding 1.492 kg/m²

Total Tax Rate: 59.4%

Tax Details:

- Base Tariff: 4.4%

- Additional Tariff: 25.0%

- April 11 Special Tariff (after April 11, 2025): 30.0%

Notes:

- This code is for composite plastic sheets with a weight over 1.492 kg/m².

- Possibly suitable for textile-reinforced plastic panels, if the composite weight meets the threshold.

📌 Proactive Advice:

- Verify the material composition of the panels (e.g., type of textile reinforcement, plastic base, and composite weight).

- Check the unit weight to determine if it meets the 1.492 kg/m² threshold for HS CODE 3921902900.

- Confirm if the product is classified as a composite (textile + plastic) or a standalone plastic sheet.

- Check if any certifications (e.g., anti-static, fire resistance) are required for import.

- Monitor the April 11, 2025 deadline for additional tariffs — this could significantly increase costs.

📌 Recommended Action:

If the textile-reinforced plastic panels are composite and exceed 1.492 kg/m², HS CODE 3921902900 is likely the most accurate classification. Otherwise, further clarification may be needed.

Customer Reviews

No reviews yet.