| HS Code | Official Doc | Tariff Rate | Origin | Destination | Effective Date |

|---|---|---|---|---|---|

| 3921902900 | Doc | 59.4% | CN | US | 2025-05-12 |

| 3921902550 | Doc | 61.5% | CN | US | 2025-05-12 |

| 3921901910 | Doc | 60.3% | CN | US | 2025-05-12 |

| 3921902510 | Doc | 61.5% | CN | US | 2025-05-12 |

| 3921902550 | Doc | 61.5% | CN | US | 2025-05-12 |

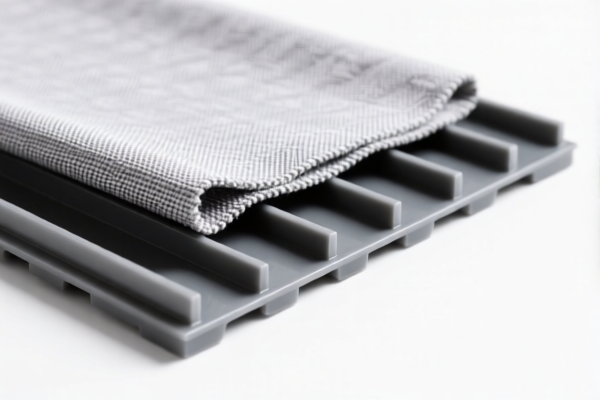

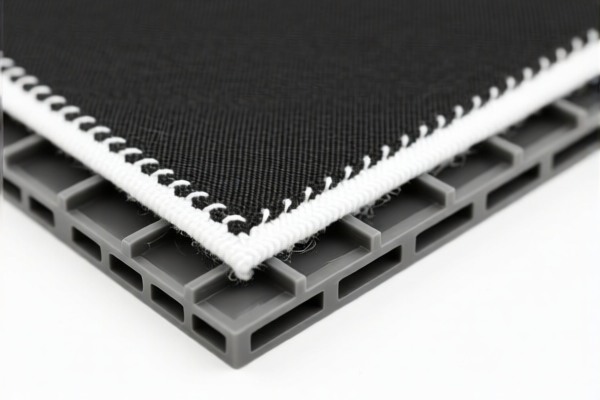

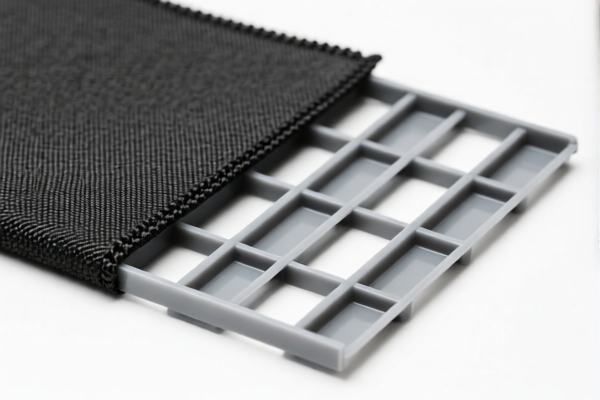

Product Classification: Textile Reinforced Plastic Anti-UV Panels

Based on the provided HS codes and descriptions, the Textile Reinforced Plastic Anti-UV Panels fall under Chapter 3921 of the Harmonized System (HS), specifically 3921.90 for "Other plates, sheets, films, foils and strips of plastics, of other plastics, other." Below is a structured breakdown of the classification and associated tariffs:

HS CODE: 3921902900

Description:

- Applicable to anti-UV textile plastic panels classified as plastic plates, sheets, etc., combined with other materials, with a weight exceeding 1.492 kg/m².

Tariff Summary: - Base Tariff Rate: 4.4% - Additional Tariff (General): 25.0% - Special Tariff (After April 11, 2025): 30.0% - Total Tax Rate: 59.4%

HS CODE: 3921902550

Description:

- Applicable to anti-UV textile plastic panels classified as combined with other textile materials, with a weight exceeding 1.492 kg/m², where synthetic fibers make up the majority by weight, and plastic content exceeds 70%.

Tariff Summary: - Base Tariff Rate: 6.5% - Additional Tariff (General): 25.0% - Special Tariff (After April 11, 2025): 30.0% - Total Tax Rate: 61.5%

HS CODE: 3921901910

Description:

- Applicable to textile-reinforced plastic anti-UV panels classified as textile-composite plastic panels, where textile components make up the majority by weight.

Tariff Summary: - Base Tariff Rate: 5.3% - Additional Tariff (General): 25.0% - Special Tariff (After April 11, 2025): 30.0% - Total Tax Rate: 60.3%

HS CODE: 3921902510

Description:

- Applicable to textile-reinforced plastic panels classified as combined with other textile materials, with a weight exceeding 1.492 kg/m², where textile components make up the majority by weight, and synthetic fibers are the dominant single fiber type, with plastic content exceeding 70%.

Tariff Summary: - Base Tariff Rate: 6.5% - Additional Tariff (General): 25.0% - Special Tariff (After April 11, 2025): 30.0% - Total Tax Rate: 61.5%

Key Notes and Proactive Advice:

-

April 11, 2025 Special Tariff:

A 30% additional tariff will be applied after April 11, 2025, so plan your import schedule accordingly. -

Material Composition Matters:

Ensure the weight of textile components, type of fibers, and plastic content are clearly documented, as these determine the correct HS code and applicable tax rate. -

Certifications Required:

Verify if certifications (e.g., UV resistance, fire safety, or environmental compliance) are required for import into the destination country. -

Unit Price and Material Verification:

Confirm the unit price and material composition to avoid misclassification and potential penalties. -

Anti-Dumping Duties:

If the product contains iron or aluminum components, check for anti-dumping duties that may apply, depending on the country of origin and destination.

Conclusion:

The Textile Reinforced Plastic Anti-UV Panels are subject to tariff rates ranging from 59.4% to 61.5%, depending on the material composition and weight. Ensure accurate classification and compliance with documentation to avoid delays and additional costs.

Product Classification: Textile Reinforced Plastic Anti-UV Panels

Based on the provided HS codes and descriptions, the Textile Reinforced Plastic Anti-UV Panels fall under Chapter 3921 of the Harmonized System (HS), specifically 3921.90 for "Other plates, sheets, films, foils and strips of plastics, of other plastics, other." Below is a structured breakdown of the classification and associated tariffs:

HS CODE: 3921902900

Description:

- Applicable to anti-UV textile plastic panels classified as plastic plates, sheets, etc., combined with other materials, with a weight exceeding 1.492 kg/m².

Tariff Summary: - Base Tariff Rate: 4.4% - Additional Tariff (General): 25.0% - Special Tariff (After April 11, 2025): 30.0% - Total Tax Rate: 59.4%

HS CODE: 3921902550

Description:

- Applicable to anti-UV textile plastic panels classified as combined with other textile materials, with a weight exceeding 1.492 kg/m², where synthetic fibers make up the majority by weight, and plastic content exceeds 70%.

Tariff Summary: - Base Tariff Rate: 6.5% - Additional Tariff (General): 25.0% - Special Tariff (After April 11, 2025): 30.0% - Total Tax Rate: 61.5%

HS CODE: 3921901910

Description:

- Applicable to textile-reinforced plastic anti-UV panels classified as textile-composite plastic panels, where textile components make up the majority by weight.

Tariff Summary: - Base Tariff Rate: 5.3% - Additional Tariff (General): 25.0% - Special Tariff (After April 11, 2025): 30.0% - Total Tax Rate: 60.3%

HS CODE: 3921902510

Description:

- Applicable to textile-reinforced plastic panels classified as combined with other textile materials, with a weight exceeding 1.492 kg/m², where textile components make up the majority by weight, and synthetic fibers are the dominant single fiber type, with plastic content exceeding 70%.

Tariff Summary: - Base Tariff Rate: 6.5% - Additional Tariff (General): 25.0% - Special Tariff (After April 11, 2025): 30.0% - Total Tax Rate: 61.5%

Key Notes and Proactive Advice:

-

April 11, 2025 Special Tariff:

A 30% additional tariff will be applied after April 11, 2025, so plan your import schedule accordingly. -

Material Composition Matters:

Ensure the weight of textile components, type of fibers, and plastic content are clearly documented, as these determine the correct HS code and applicable tax rate. -

Certifications Required:

Verify if certifications (e.g., UV resistance, fire safety, or environmental compliance) are required for import into the destination country. -

Unit Price and Material Verification:

Confirm the unit price and material composition to avoid misclassification and potential penalties. -

Anti-Dumping Duties:

If the product contains iron or aluminum components, check for anti-dumping duties that may apply, depending on the country of origin and destination.

Conclusion:

The Textile Reinforced Plastic Anti-UV Panels are subject to tariff rates ranging from 59.4% to 61.5%, depending on the material composition and weight. Ensure accurate classification and compliance with documentation to avoid delays and additional costs.

Customer Reviews

No reviews yet.