| HS Code | Official Doc | Tariff Rate | Origin | Destination | Effective Date |

|---|---|---|---|---|---|

| 3921901100 | Doc | 59.2% | CN | US | 2025-05-12 |

| 3921901950 | Doc | 60.3% | CN | US | 2025-05-12 |

| 3921902510 | Doc | 61.5% | CN | US | 2025-05-12 |

| 3921902510 | Doc | 61.5% | CN | US | 2025-05-12 |

| 3921902510 | Doc | 61.5% | CN | US | 2025-05-12 |

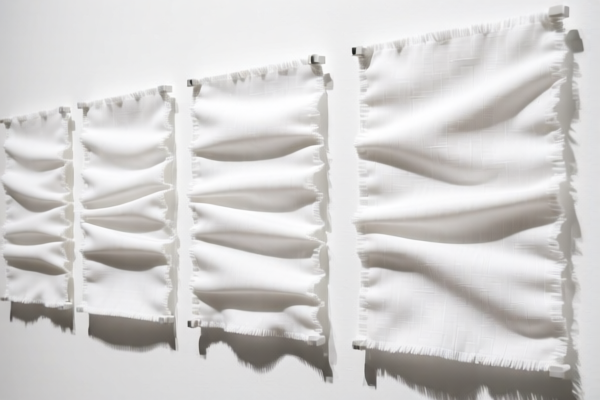

Product Classification: Textile Reinforced Plastic Artwork Panels

Based on the provided HS codes and descriptions, the product falls under Chapter 3921 of the Harmonized System (HS), which covers Plastics and articles thereof. Below is a structured breakdown of the classification and associated tariff details.

HS CODE: 3921901100

Description:

- Textile reinforced plastic panels

- Weight per square meter < 1.492 kg

- Textile composition: synthetic fibers > any other single textile fiber

- Plastic content > 70% by weight

Tariff Summary:

- Base Tariff Rate: 4.2%

- Additional Tariff (General): 25.0%

- Special Tariff (After April 11, 2025): 30.0%

- Total Tax Rate: 59.2%

HS CODE: 3921901950

Description:

- Textile reinforced plastic display film

- Plastic sheets, plates, films, foils, strips combined with textile materials

- Classification depends on the weight percentage of plant fibers

Tariff Summary:

- Base Tariff Rate: 5.3%

- Additional Tariff (General): 25.0%

- Special Tariff (After April 11, 2025): 30.0%

- Total Tax Rate: 60.3%

HS CODE: 3921902510

Description (Multiple Variants):

- Textile composite plastic panels

- Weight per square meter > 1.492 kg

- Textile component is the major weight component

- No single textile fiber exceeds synthetic fiber weight

- Plastic content > 70% by weight

Tariff Summary (Same for all variants):

- Base Tariff Rate: 6.5%

- Additional Tariff (General): 25.0%

- Special Tariff (After April 11, 2025): 30.0%

- Total Tax Rate: 61.5%

Key Notes and Proactive Advice:

-

April 11, 2025 Special Tariff:

A 30.0% additional tariff will be applied after April 11, 2025. Ensure your import timeline is aligned with this date to avoid unexpected costs. -

Material Composition Verification:

Confirm the exact weight percentages of plastic and textile components, as this determines the correct HS code. For example, if the textile component is not the major weight, the classification may change. -

Certifications and Documentation:

Check if certifications (e.g., origin, material composition, compliance with environmental standards) are required for customs clearance. This can vary by country and product type. -

Unit Price and Classification:

The unit price may influence the classification, especially if the product is considered a "finished article" rather than a raw material. Clarify with customs or a classification expert if uncertain. -

Anti-Dumping Duties:

While not explicitly mentioned in the data, be aware that anti-dumping duties may apply to iron and aluminum products. However, this is not applicable to plastic-based products like textile-reinforced panels.

Conclusion:

The textile-reinforced plastic artwork panels fall under HS CODE 3921901100 or 3921902510, depending on the weight per square meter and material composition. The total tax rate ranges from 59.2% to 61.5%, with a 30.0% additional tariff applicable after April 11, 2025. Ensure accurate classification and documentation to avoid delays and additional costs.

Product Classification: Textile Reinforced Plastic Artwork Panels

Based on the provided HS codes and descriptions, the product falls under Chapter 3921 of the Harmonized System (HS), which covers Plastics and articles thereof. Below is a structured breakdown of the classification and associated tariff details.

HS CODE: 3921901100

Description:

- Textile reinforced plastic panels

- Weight per square meter < 1.492 kg

- Textile composition: synthetic fibers > any other single textile fiber

- Plastic content > 70% by weight

Tariff Summary:

- Base Tariff Rate: 4.2%

- Additional Tariff (General): 25.0%

- Special Tariff (After April 11, 2025): 30.0%

- Total Tax Rate: 59.2%

HS CODE: 3921901950

Description:

- Textile reinforced plastic display film

- Plastic sheets, plates, films, foils, strips combined with textile materials

- Classification depends on the weight percentage of plant fibers

Tariff Summary:

- Base Tariff Rate: 5.3%

- Additional Tariff (General): 25.0%

- Special Tariff (After April 11, 2025): 30.0%

- Total Tax Rate: 60.3%

HS CODE: 3921902510

Description (Multiple Variants):

- Textile composite plastic panels

- Weight per square meter > 1.492 kg

- Textile component is the major weight component

- No single textile fiber exceeds synthetic fiber weight

- Plastic content > 70% by weight

Tariff Summary (Same for all variants):

- Base Tariff Rate: 6.5%

- Additional Tariff (General): 25.0%

- Special Tariff (After April 11, 2025): 30.0%

- Total Tax Rate: 61.5%

Key Notes and Proactive Advice:

-

April 11, 2025 Special Tariff:

A 30.0% additional tariff will be applied after April 11, 2025. Ensure your import timeline is aligned with this date to avoid unexpected costs. -

Material Composition Verification:

Confirm the exact weight percentages of plastic and textile components, as this determines the correct HS code. For example, if the textile component is not the major weight, the classification may change. -

Certifications and Documentation:

Check if certifications (e.g., origin, material composition, compliance with environmental standards) are required for customs clearance. This can vary by country and product type. -

Unit Price and Classification:

The unit price may influence the classification, especially if the product is considered a "finished article" rather than a raw material. Clarify with customs or a classification expert if uncertain. -

Anti-Dumping Duties:

While not explicitly mentioned in the data, be aware that anti-dumping duties may apply to iron and aluminum products. However, this is not applicable to plastic-based products like textile-reinforced panels.

Conclusion:

The textile-reinforced plastic artwork panels fall under HS CODE 3921901100 or 3921902510, depending on the weight per square meter and material composition. The total tax rate ranges from 59.2% to 61.5%, with a 30.0% additional tariff applicable after April 11, 2025. Ensure accurate classification and documentation to avoid delays and additional costs.

Customer Reviews

No reviews yet.