| HS Code | Official Doc | Tariff Rate | Origin | Destination | Effective Date |

|---|---|---|---|---|---|

| 3921902900 | Doc | 59.4% | CN | US | 2025-05-12 |

| 7019629060 | Doc | 44.5% | CN | US | 2025-05-12 |

| 7019905150 | Doc | 59.3% | CN | US | 2025-05-12 |

| 7019140000 | Doc | 59.3% | CN | US | 2025-05-12 |

| 7019739090 | Doc | 61.0% | CN | US | 2025-05-12 |

Here is the structured classification and tariff information for Textile Reinforced Plastic Building Sheets, based on the provided HS codes and tax details:

🔍 Product Classification Overview

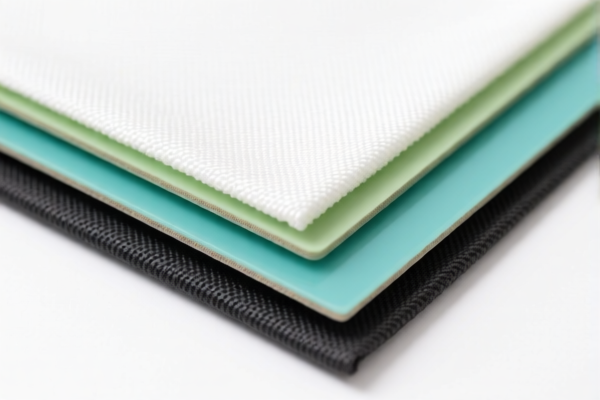

Product Name: Textile Reinforced Plastic Building Sheets

Classification Basis: Based on material composition (e.g., fiber-reinforced plastics, glass fiber-reinforced plastics, etc.)

📦 HS Code Classification & Tax Details

1. HS Code: 3921902900

Description: Fiber Reinforced Textile Plastic Sheets

- Base Tariff Rate: 4.4%

- Additional Tariff: 25.0%

- Special Tariff after April 11, 2025: 30.0%

- Total Tax Rate: 59.4%

- Notes: This code is for textile-reinforced plastic sheets, not glass fiber-reinforced.

2. HS Code: 7019629060

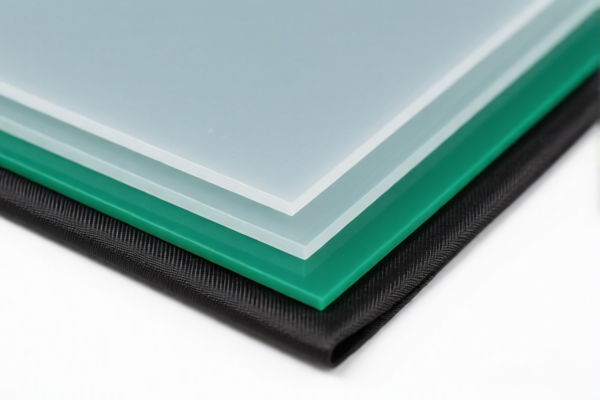

Description: Glass Fiber Reinforced Plastic Building Sheets

- Base Tariff Rate: 7.0%

- Additional Tariff: 7.5%

- Special Tariff after April 11, 2025: 30.0%

- Total Tax Rate: 44.5%

- Notes: This is a specific code for building-grade glass fiber-reinforced plastic sheets.

3. HS Code: 7019905150

Description: Glass Fiber Reinforced Plastic Building Grade Sheets

- Base Tariff Rate: 4.3%

- Additional Tariff: 25.0%

- Special Tariff after April 11, 2025: 30.0%

- Total Tax Rate: 59.3%

- Notes: This code is for building-grade glass fiber-reinforced plastic sheets with specific technical specifications.

4. HS Code: 7019140000

Description: Glass Fiber Reinforced Plastic Sheets

- Base Tariff Rate: 4.3%

- Additional Tariff: 25.0%

- Special Tariff after April 11, 2025: 30.0%

- Total Tax Rate: 59.3%

- Notes: General category for glass fiber-reinforced plastic sheets, not limited to building use.

5. HS Code: 7019739090

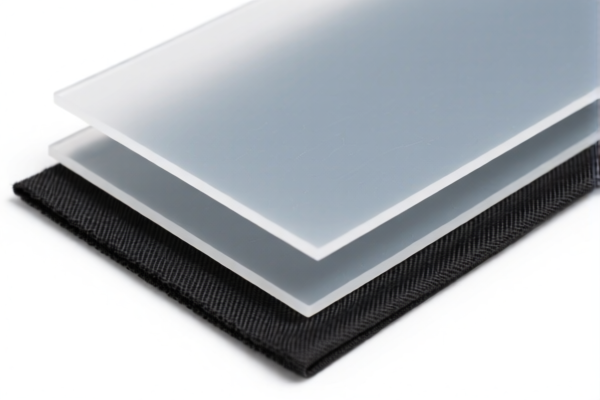

Description: Glass Fiber Reinforced Plastic Boards

- Base Tariff Rate: 6.0%

- Additional Tariff: 25.0%

- Special Tariff after April 11, 2025: 30.0%

- Total Tax Rate: 61.0%

- Notes: This code is for glass fiber-reinforced plastic boards, possibly with different thickness or use.

⚠️ Important Notes & Alerts

- April 11, 2025 Special Tariff: A 30.0% additional tariff is imposed on all the above HS codes after April 11, 2025. This is a time-sensitive policy and must be accounted for in cost estimation and customs planning.

- Anti-dumping duties: Not explicitly mentioned for this product category, but always verify if applicable based on the country of origin.

- Material Verification: Confirm the exact composition (e.g., textile vs. glass fiber) and technical specifications to ensure correct HS code classification.

- Certifications: Check if any certifications (e.g., fire resistance, building standards) are required for import into the destination country.

✅ Proactive Advice for Importers

- Verify Material Composition: Ensure the product is correctly classified based on whether it is textile-reinforced or glass fiber-reinforced.

- Check Unit Price & Tax Impact: The total tax rate can significantly affect the final cost. Use the total tax rate (e.g., 59.4%, 61.0%) to calculate import costs.

- Consult Customs Broker: For complex classifications or high-value shipments, seek professional customs advice to avoid delays or penalties.

- Monitor Policy Updates: Stay informed about any changes in tariff policies, especially the April 11, 2025 deadline.

Let me know if you need help with HS code selection based on product specifications or documentation requirements. Here is the structured classification and tariff information for Textile Reinforced Plastic Building Sheets, based on the provided HS codes and tax details:

🔍 Product Classification Overview

Product Name: Textile Reinforced Plastic Building Sheets

Classification Basis: Based on material composition (e.g., fiber-reinforced plastics, glass fiber-reinforced plastics, etc.)

📦 HS Code Classification & Tax Details

1. HS Code: 3921902900

Description: Fiber Reinforced Textile Plastic Sheets

- Base Tariff Rate: 4.4%

- Additional Tariff: 25.0%

- Special Tariff after April 11, 2025: 30.0%

- Total Tax Rate: 59.4%

- Notes: This code is for textile-reinforced plastic sheets, not glass fiber-reinforced.

2. HS Code: 7019629060

Description: Glass Fiber Reinforced Plastic Building Sheets

- Base Tariff Rate: 7.0%

- Additional Tariff: 7.5%

- Special Tariff after April 11, 2025: 30.0%

- Total Tax Rate: 44.5%

- Notes: This is a specific code for building-grade glass fiber-reinforced plastic sheets.

3. HS Code: 7019905150

Description: Glass Fiber Reinforced Plastic Building Grade Sheets

- Base Tariff Rate: 4.3%

- Additional Tariff: 25.0%

- Special Tariff after April 11, 2025: 30.0%

- Total Tax Rate: 59.3%

- Notes: This code is for building-grade glass fiber-reinforced plastic sheets with specific technical specifications.

4. HS Code: 7019140000

Description: Glass Fiber Reinforced Plastic Sheets

- Base Tariff Rate: 4.3%

- Additional Tariff: 25.0%

- Special Tariff after April 11, 2025: 30.0%

- Total Tax Rate: 59.3%

- Notes: General category for glass fiber-reinforced plastic sheets, not limited to building use.

5. HS Code: 7019739090

Description: Glass Fiber Reinforced Plastic Boards

- Base Tariff Rate: 6.0%

- Additional Tariff: 25.0%

- Special Tariff after April 11, 2025: 30.0%

- Total Tax Rate: 61.0%

- Notes: This code is for glass fiber-reinforced plastic boards, possibly with different thickness or use.

⚠️ Important Notes & Alerts

- April 11, 2025 Special Tariff: A 30.0% additional tariff is imposed on all the above HS codes after April 11, 2025. This is a time-sensitive policy and must be accounted for in cost estimation and customs planning.

- Anti-dumping duties: Not explicitly mentioned for this product category, but always verify if applicable based on the country of origin.

- Material Verification: Confirm the exact composition (e.g., textile vs. glass fiber) and technical specifications to ensure correct HS code classification.

- Certifications: Check if any certifications (e.g., fire resistance, building standards) are required for import into the destination country.

✅ Proactive Advice for Importers

- Verify Material Composition: Ensure the product is correctly classified based on whether it is textile-reinforced or glass fiber-reinforced.

- Check Unit Price & Tax Impact: The total tax rate can significantly affect the final cost. Use the total tax rate (e.g., 59.4%, 61.0%) to calculate import costs.

- Consult Customs Broker: For complex classifications or high-value shipments, seek professional customs advice to avoid delays or penalties.

- Monitor Policy Updates: Stay informed about any changes in tariff policies, especially the April 11, 2025 deadline.

Let me know if you need help with HS code selection based on product specifications or documentation requirements.

Customer Reviews

No reviews yet.