| HS Code | Official Doc | Tariff Rate | Origin | Destination | Effective Date |

|---|---|---|---|---|---|

| 3921902550 | Doc | 61.5% | CN | US | 2025-05-12 |

| 3921905050 | Doc | 34.8% | CN | US | 2025-05-12 |

| 3920995000 | Doc | 60.8% | CN | US | 2025-05-12 |

| 3920690000 | Doc | 59.2% | CN | US | 2025-05-12 |

| 3921902900 | Doc | 59.4% | CN | US | 2025-05-12 |

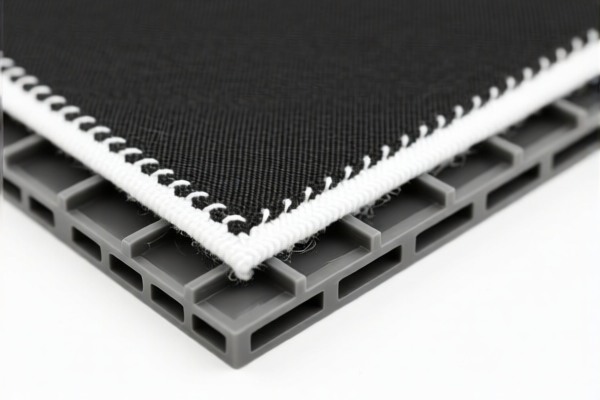

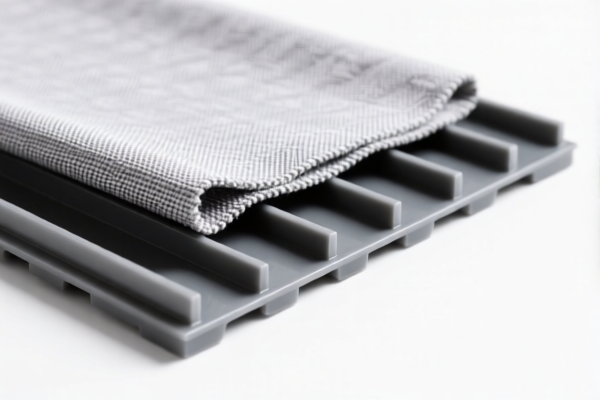

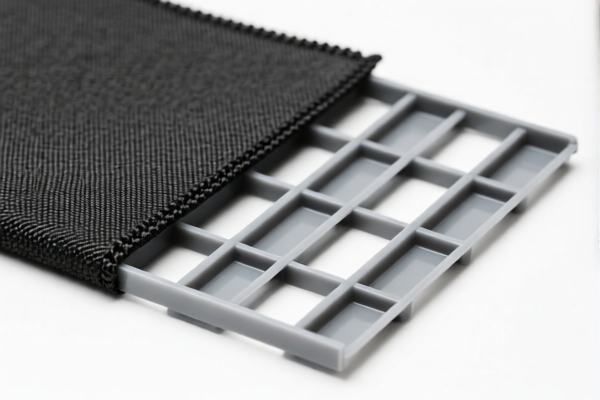

Product Name: Textile Reinforced Plastic Coated Panels

Classification Task: HS Code Interpretation and Tariff Analysis

✅ HS Code Classification Overview

Based on the product description "Textile Reinforced Plastic Coated Panels," the following HS codes may be applicable. Each code corresponds to different classifications of plastic panels combined with textile materials or other substrates. Here's a breakdown:

🔢 HS Code Details and Tax Rates

1. HS CODE: 3921902550

Description: Plastic combined with other textile materials

- Total Tax Rate: 61.5%

- Breakdown:

- Base Tariff: 6.5%

- Additional Tariff: 25.0%

- Tariff after April 11, 2025: 30.0%

- Note: This code is most likely the correct classification for your product, as it explicitly mentions plastic combined with textile materials.

2. HS CODE: 3921905050

Description: Other plastic sheets, plates, films, foils, and strips

- Total Tax Rate: 34.8%

- Breakdown:

- Base Tariff: 4.8%

- Additional Tariff: 0.0%

- Tariff after April 11, 2025: 30.0%

- Note: This code applies to general plastic sheets, not specifically reinforced with textiles.

3. HS CODE: 3920995000

Description: Laminated, supported, or otherwise combined with other materials of non-cellular plastics and non-reinforced plastics sheets

- Total Tax Rate: 60.8%

- Breakdown:

- Base Tariff: 5.8%

- Additional Tariff: 25.0%

- Tariff after April 11, 2025: 30.0%

- Note: This code is for non-cellular and non-reinforced plastic sheets combined with other materials, but not specifically textile-reinforced.

4. HS CODE: 3920690000

Description: Non-cellular and non-reinforced plastic sheets combined with other materials

- Total Tax Rate: 59.2%

- Breakdown:

- Base Tariff: 4.2%

- Additional Tariff: 25.0%

- Tariff after April 11, 2025: 30.0%

- Note: This code is for non-reinforced plastic sheets combined with other materials, but not textile-reinforced.

5. HS CODE: 3921902900

Description: Plastic sheets, plates, films, foils, and strips combined with other materials, with weight over 1.492 kg/m²

- Total Tax Rate: 59.4%

- Breakdown:

- Base Tariff: 4.4%

- Additional Tariff: 25.0%

- Tariff after April 11, 2025: 30.0%

- Note: This code applies to heavier composite plastic sheets, but not specifically textile-reinforced.

⚠️ Important Notes and Alerts

-

April 11, 2025 Special Tariff:

A 30.0% additional tariff will be imposed on all the above codes after April 11, 2025. This is a time-sensitive policy and must be considered in your import planning. -

Anti-Dumping Duties:

If the product contains iron or aluminum components, additional anti-dumping duties may apply. Confirm the composition of the product to avoid unexpected costs.

📌 Proactive Advice for Importers

- Verify Material Composition: Ensure the product is textile-reinforced plastic and not just a general composite. This will help in selecting the correct HS code (likely 3921902550).

- Check Unit Price and Weight: If the product is heavier than 1.492 kg/m², it may fall under 3921902900.

- Certifications Required: Confirm if customs documentation, product certifications, or origin declarations are needed for compliance.

- Plan for Tariff Increases: With the 30.0% additional tariff after April 11, 2025, consider import timing and cost adjustments.

✅ Recommended HS Code for Textile Reinforced Plastic Coated Panels:

3921902550

- Total Tax Rate: 61.5% (with 30.0% additional after April 11, 2025)

- Most Accurate Classification for your product description.

Product Name: Textile Reinforced Plastic Coated Panels

Classification Task: HS Code Interpretation and Tariff Analysis

✅ HS Code Classification Overview

Based on the product description "Textile Reinforced Plastic Coated Panels," the following HS codes may be applicable. Each code corresponds to different classifications of plastic panels combined with textile materials or other substrates. Here's a breakdown:

🔢 HS Code Details and Tax Rates

1. HS CODE: 3921902550

Description: Plastic combined with other textile materials

- Total Tax Rate: 61.5%

- Breakdown:

- Base Tariff: 6.5%

- Additional Tariff: 25.0%

- Tariff after April 11, 2025: 30.0%

- Note: This code is most likely the correct classification for your product, as it explicitly mentions plastic combined with textile materials.

2. HS CODE: 3921905050

Description: Other plastic sheets, plates, films, foils, and strips

- Total Tax Rate: 34.8%

- Breakdown:

- Base Tariff: 4.8%

- Additional Tariff: 0.0%

- Tariff after April 11, 2025: 30.0%

- Note: This code applies to general plastic sheets, not specifically reinforced with textiles.

3. HS CODE: 3920995000

Description: Laminated, supported, or otherwise combined with other materials of non-cellular plastics and non-reinforced plastics sheets

- Total Tax Rate: 60.8%

- Breakdown:

- Base Tariff: 5.8%

- Additional Tariff: 25.0%

- Tariff after April 11, 2025: 30.0%

- Note: This code is for non-cellular and non-reinforced plastic sheets combined with other materials, but not specifically textile-reinforced.

4. HS CODE: 3920690000

Description: Non-cellular and non-reinforced plastic sheets combined with other materials

- Total Tax Rate: 59.2%

- Breakdown:

- Base Tariff: 4.2%

- Additional Tariff: 25.0%

- Tariff after April 11, 2025: 30.0%

- Note: This code is for non-reinforced plastic sheets combined with other materials, but not textile-reinforced.

5. HS CODE: 3921902900

Description: Plastic sheets, plates, films, foils, and strips combined with other materials, with weight over 1.492 kg/m²

- Total Tax Rate: 59.4%

- Breakdown:

- Base Tariff: 4.4%

- Additional Tariff: 25.0%

- Tariff after April 11, 2025: 30.0%

- Note: This code applies to heavier composite plastic sheets, but not specifically textile-reinforced.

⚠️ Important Notes and Alerts

-

April 11, 2025 Special Tariff:

A 30.0% additional tariff will be imposed on all the above codes after April 11, 2025. This is a time-sensitive policy and must be considered in your import planning. -

Anti-Dumping Duties:

If the product contains iron or aluminum components, additional anti-dumping duties may apply. Confirm the composition of the product to avoid unexpected costs.

📌 Proactive Advice for Importers

- Verify Material Composition: Ensure the product is textile-reinforced plastic and not just a general composite. This will help in selecting the correct HS code (likely 3921902550).

- Check Unit Price and Weight: If the product is heavier than 1.492 kg/m², it may fall under 3921902900.

- Certifications Required: Confirm if customs documentation, product certifications, or origin declarations are needed for compliance.

- Plan for Tariff Increases: With the 30.0% additional tariff after April 11, 2025, consider import timing and cost adjustments.

✅ Recommended HS Code for Textile Reinforced Plastic Coated Panels:

3921902550

- Total Tax Rate: 61.5% (with 30.0% additional after April 11, 2025)

- Most Accurate Classification for your product description.

Customer Reviews

No reviews yet.