| HS Code | Official Doc | Tariff Rate | Origin | Destination | Effective Date |

|---|---|---|---|---|---|

| 9403993080 | Doc | 55.0% | CN | US | 2025-05-12 |

| 9403993080 | Doc | 55.0% | CN | US | 2025-05-12 |

| 3917390010 | Doc | 33.1% | CN | US | 2025-05-12 |

| 3921904010 | Doc | 34.2% | CN | US | 2025-05-12 |

| 3917390010 | Doc | 33.1% | CN | US | 2025-05-12 |

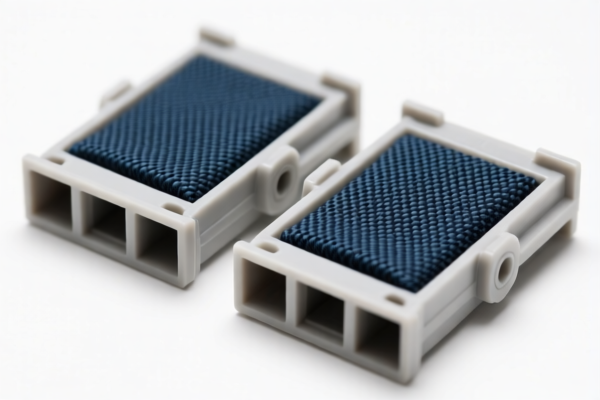

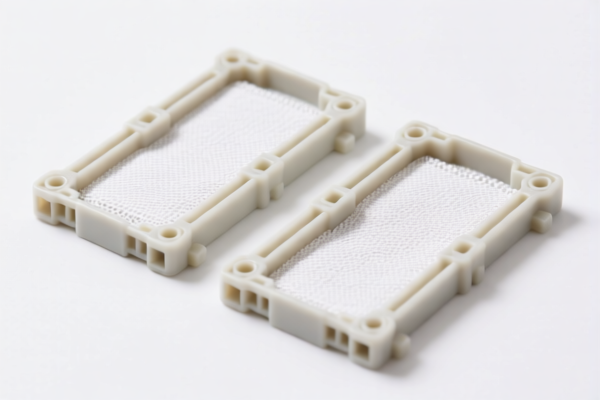

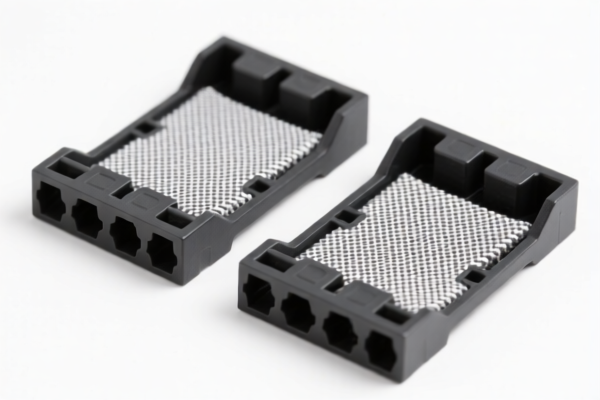

Product Name: Textile Reinforced Plastic Connector Panels

Classification: Based on the provided HS codes and descriptions, the product falls under Chapter 39 (Plastics and articles thereof), specifically Heading 3921 (Plastics and articles thereof: Other articles of plastics, not elsewhere specified or included).

✅ HS CODE: 3921902510

Description: Textile reinforced plastic panels, textile reinforced plastic boards, textile reinforced composite boards, etc.

Total Tax Rate: 61.5%

Breakdown of Tax Rates:

- Base Tariff Rate: 6.5%

- Additional Tariff (General): 25.0%

- Special Tariff (After April 2, 2025): 30.0%

- Anti-dumping duties on iron and aluminum: Not applicable (this product is plastic-based, not metal).

⚠️ Important Notes:

- April 11 Special Tariff: Not applicable for this product. The special tariff mentioned in the data is effective from April 2, 2025, not April 11.

- Anti-dumping duties: Not applicable for this product as it is made of plastic, not iron or aluminum.

- Additional Tariff: Applies to all imports under this HS code, regardless of origin.

📌 Proactive Advice:

- Verify Material Composition: Ensure the product is indeed textile-reinforced plastic and not a different composite (e.g., fiber-reinforced or metal-reinforced), as this could affect the HS code.

- Check Unit Price and Certification: Confirm the unit price and whether any certifications (e.g., RoHS, REACH, or specific import permits) are required for the product.

- Monitor Tariff Changes: Be aware that the 30.0% additional tariff will apply after April 2, 2025, which could significantly increase the total import cost.

- Consult Customs Broker: For accurate classification and compliance, especially if the product has multiple components or is part of a larger assembly.

📊 Summary Table:

| HS Code | Description | Base Tariff | Additional Tariff | Special Tariff (After 2025.4.2) | Total Tax Rate |

|---|---|---|---|---|---|

| 3921902510 | Textile reinforced plastic panels | 6.5% | 25.0% | 30.0% | 61.5% |

| 3921902900 | Fiber-reinforced plastic boards | 4.4% | 25.0% | 30.0% | 59.4% |

Let me know if you need help with customs documentation or tariff calculation tools.

Product Name: Textile Reinforced Plastic Connector Panels

Classification: Based on the provided HS codes and descriptions, the product falls under Chapter 39 (Plastics and articles thereof), specifically Heading 3921 (Plastics and articles thereof: Other articles of plastics, not elsewhere specified or included).

✅ HS CODE: 3921902510

Description: Textile reinforced plastic panels, textile reinforced plastic boards, textile reinforced composite boards, etc.

Total Tax Rate: 61.5%

Breakdown of Tax Rates:

- Base Tariff Rate: 6.5%

- Additional Tariff (General): 25.0%

- Special Tariff (After April 2, 2025): 30.0%

- Anti-dumping duties on iron and aluminum: Not applicable (this product is plastic-based, not metal).

⚠️ Important Notes:

- April 11 Special Tariff: Not applicable for this product. The special tariff mentioned in the data is effective from April 2, 2025, not April 11.

- Anti-dumping duties: Not applicable for this product as it is made of plastic, not iron or aluminum.

- Additional Tariff: Applies to all imports under this HS code, regardless of origin.

📌 Proactive Advice:

- Verify Material Composition: Ensure the product is indeed textile-reinforced plastic and not a different composite (e.g., fiber-reinforced or metal-reinforced), as this could affect the HS code.

- Check Unit Price and Certification: Confirm the unit price and whether any certifications (e.g., RoHS, REACH, or specific import permits) are required for the product.

- Monitor Tariff Changes: Be aware that the 30.0% additional tariff will apply after April 2, 2025, which could significantly increase the total import cost.

- Consult Customs Broker: For accurate classification and compliance, especially if the product has multiple components or is part of a larger assembly.

📊 Summary Table:

| HS Code | Description | Base Tariff | Additional Tariff | Special Tariff (After 2025.4.2) | Total Tax Rate |

|---|---|---|---|---|---|

| 3921902510 | Textile reinforced plastic panels | 6.5% | 25.0% | 30.0% | 61.5% |

| 3921902900 | Fiber-reinforced plastic boards | 4.4% | 25.0% | 30.0% | 59.4% |

Let me know if you need help with customs documentation or tariff calculation tools.

Customer Reviews

No reviews yet.