| HS Code | Official Doc | Tariff Rate | Origin | Destination | Effective Date |

|---|---|---|---|---|---|

| 3921901100 | Doc | 59.2% | CN | US | 2025-05-12 |

| 3921902550 | Doc | 61.5% | CN | US | 2025-05-12 |

| 3921901950 | Doc | 60.3% | CN | US | 2025-05-12 |

| 3921902510 | Doc | 61.5% | CN | US | 2025-05-12 |

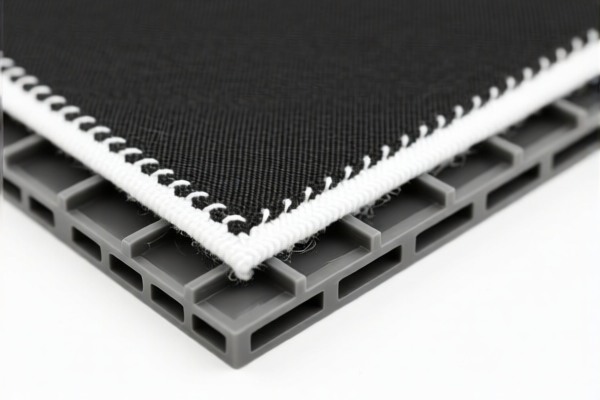

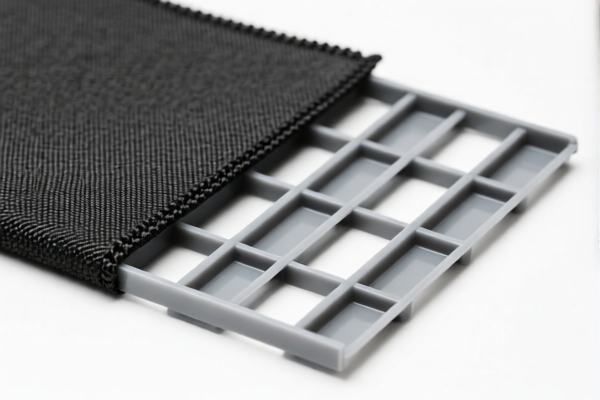

Here is the structured classification and tariff information for the Textile Reinforced Plastic Electronic Product Housing Panels based on the provided HS codes and details:

✅ HS CODE: 3921901100

Product Description:

- Textile reinforced plastic panels

- Weight per square meter < 1.492 kg

- Synthetic fibers make up the majority of the textile component

- Plastic content > 70% by weight

Tariff Summary:

- Base Tariff Rate: 4.2%

- Additional Tariff (General): 25.0%

- Special Tariff after April 11, 2025: 30.0%

- Total Tax Rate: 59.2%

Key Notes:

- This code applies to panels with specific textile and plastic composition requirements.

- Ensure the product meets the weight and fiber composition criteria to qualify for this classification.

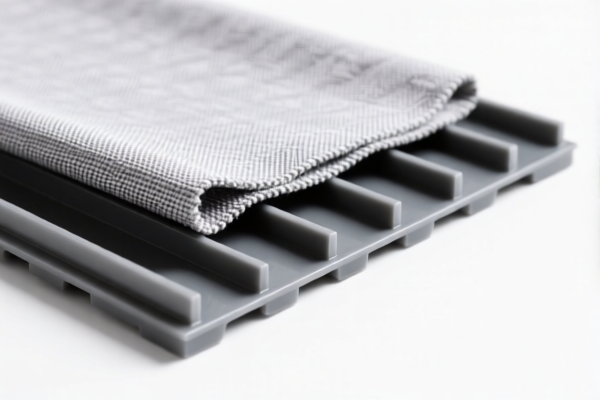

✅ HS CODE: 3921902550

Product Description:

- Textile reinforced plastic film

- Plastic content > 70% by weight

Tariff Summary:

- Base Tariff Rate: 6.5%

- Additional Tariff (General): 25.0%

- Special Tariff after April 11, 2025: 30.0%

- Total Tax Rate: 61.5%

Key Notes:

- This code is for thin, film-like products with high plastic content.

- Confirm the product is not classified under a more specific category (e.g., 3921901950).

✅ HS CODE: 3921901950

Product Description:

- Textile reinforced plastic display film

- Plastic content > 70% by weight

- May be ≤ 1.492 kg/m²

- Classified under "Other" category

Tariff Summary:

- Base Tariff Rate: 5.3%

- Additional Tariff (General): 25.0%

- Special Tariff after April 11, 2025: 30.0%

- Total Tax Rate: 60.3%

Key Notes:

- This is a catch-all category for textile-reinforced plastic panels or films that do not meet the specific criteria of other codes.

- Verify the product's exact composition and structure to ensure correct classification.

✅ HS CODE: 3921902510

Product Description:

- Textile composite plastic panels

- Textile component is the main weight

- No single textile fiber exceeds synthetic fiber weight

- Plastic content > 70% by weight

Tariff Summary:

- Base Tariff Rate: 6.5%

- Additional Tariff (General): 25.0%

- Special Tariff after April 11, 2025: 30.0%

- Total Tax Rate: 61.5%

Key Notes:

- This code applies to composite panels where synthetic fibers dominate the textile component.

- Ensure the product is not misclassified as a different type of composite or panel.

📌 Proactive Advice for Importers:

- Verify Material Composition: Confirm the exact weight percentages of plastic and textile components to ensure correct HS code selection.

- Check Unit Price and Certification: Some products may require specific certifications (e.g., RoHS, REACH) for compliance.

- Monitor Tariff Changes: The April 11, 2025 special tariff applies to all four codes, so plan accordingly for increased costs.

- Consult Customs Broker: For complex classifications, seek professional advice to avoid delays or penalties.

Let me know if you need help with a specific product or further clarification on any of these codes. Here is the structured classification and tariff information for the Textile Reinforced Plastic Electronic Product Housing Panels based on the provided HS codes and details:

✅ HS CODE: 3921901100

Product Description:

- Textile reinforced plastic panels

- Weight per square meter < 1.492 kg

- Synthetic fibers make up the majority of the textile component

- Plastic content > 70% by weight

Tariff Summary:

- Base Tariff Rate: 4.2%

- Additional Tariff (General): 25.0%

- Special Tariff after April 11, 2025: 30.0%

- Total Tax Rate: 59.2%

Key Notes:

- This code applies to panels with specific textile and plastic composition requirements.

- Ensure the product meets the weight and fiber composition criteria to qualify for this classification.

✅ HS CODE: 3921902550

Product Description:

- Textile reinforced plastic film

- Plastic content > 70% by weight

Tariff Summary:

- Base Tariff Rate: 6.5%

- Additional Tariff (General): 25.0%

- Special Tariff after April 11, 2025: 30.0%

- Total Tax Rate: 61.5%

Key Notes:

- This code is for thin, film-like products with high plastic content.

- Confirm the product is not classified under a more specific category (e.g., 3921901950).

✅ HS CODE: 3921901950

Product Description:

- Textile reinforced plastic display film

- Plastic content > 70% by weight

- May be ≤ 1.492 kg/m²

- Classified under "Other" category

Tariff Summary:

- Base Tariff Rate: 5.3%

- Additional Tariff (General): 25.0%

- Special Tariff after April 11, 2025: 30.0%

- Total Tax Rate: 60.3%

Key Notes:

- This is a catch-all category for textile-reinforced plastic panels or films that do not meet the specific criteria of other codes.

- Verify the product's exact composition and structure to ensure correct classification.

✅ HS CODE: 3921902510

Product Description:

- Textile composite plastic panels

- Textile component is the main weight

- No single textile fiber exceeds synthetic fiber weight

- Plastic content > 70% by weight

Tariff Summary:

- Base Tariff Rate: 6.5%

- Additional Tariff (General): 25.0%

- Special Tariff after April 11, 2025: 30.0%

- Total Tax Rate: 61.5%

Key Notes:

- This code applies to composite panels where synthetic fibers dominate the textile component.

- Ensure the product is not misclassified as a different type of composite or panel.

📌 Proactive Advice for Importers:

- Verify Material Composition: Confirm the exact weight percentages of plastic and textile components to ensure correct HS code selection.

- Check Unit Price and Certification: Some products may require specific certifications (e.g., RoHS, REACH) for compliance.

- Monitor Tariff Changes: The April 11, 2025 special tariff applies to all four codes, so plan accordingly for increased costs.

- Consult Customs Broker: For complex classifications, seek professional advice to avoid delays or penalties.

Let me know if you need help with a specific product or further clarification on any of these codes.

Customer Reviews

No reviews yet.