| HS Code | Official Doc | Tariff Rate | Origin | Destination | Effective Date |

|---|---|---|---|---|---|

| 3921902550 | Doc | 61.5% | CN | US | 2025-05-12 |

| 3921901950 | Doc | 60.3% | CN | US | 2025-05-12 |

| 3921904010 | Doc | 34.2% | CN | US | 2025-05-12 |

| 3921902100 | Doc | 61.5% | CN | US | 2025-05-12 |

| 3921121950 | Doc | 60.3% | CN | US | 2025-05-12 |

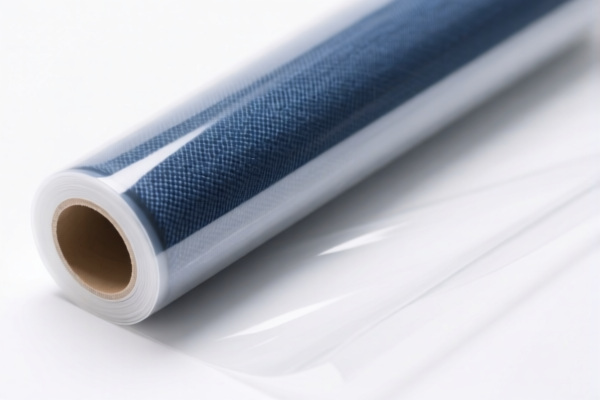

Product Classification: Textile Reinforced Plastic Films

HS CODEs and Tax Details (April 2025 Update):

✅ HS CODE: 3921902550

Description: Textile reinforced plastic films, where plastic accounts for more than 70% of the weight.

- Total Tax Rate: 61.5%

- Breakdown:

- Base Tariff: 6.5%

- Additional Tariff: 25.0%

- Special Tariff after April 11, 2025: 30.0%

- Note: High tax rate due to both standard and additional tariffs.

✅ HS CODE: 3921901950

Description: Textile reinforced plastic packaging or display films.

- Total Tax Rate: 60.3%

- Breakdown:

- Base Tariff: 5.3%

- Additional Tariff: 25.0%

- Special Tariff after April 11, 2025: 30.0%

- Note: Slightly lower base rate but still subject to high additional tariffs.

✅ HS CODE: 3921904010

Description: Reinforced plastic films made of plastic.

- Total Tax Rate: 34.2%

- Breakdown:

- Base Tariff: 4.2%

- Additional Tariff: 0.0%

- Special Tariff after April 11, 2025: 30.0%

- Note: Lower base and additional tariffs, but still subject to the April 11 special tariff.

✅ HS CODE: 3921902100

Description: Cotton-reinforced plastic films, combined with other textile materials.

- Total Tax Rate: 61.5%

- Breakdown:

- Base Tariff: 6.5%

- Additional Tariff: 25.0%

- Special Tariff after April 11, 2025: 30.0%

- Note: Similar to 3921902550, with high overall tax burden.

✅ HS CODE: 3921121950

Description: Textile-reinforced PVC foam plastic films.

- Total Tax Rate: 60.3%

- Breakdown:

- Base Tariff: 5.3%

- Additional Tariff: 25.0%

- Special Tariff after April 11, 2025: 30.0%

- Note: PVC foam is a specific type of plastic, but still subject to the same tariff structure.

📌 Important Notes and Recommendations:

- April 11, 2025 Special Tariff: All listed HS codes are subject to an additional 30% tariff after April 11, 2025. This is a time-sensitive policy—ensure your import timeline aligns with this date.

- Material Composition: Confirm the plastic weight percentage and reinforcing material (e.g., cotton, other textiles) to ensure correct HS code classification.

- Certifications: Check if any customs certifications or origin documentation are required for preferential tariff treatment.

- Unit Price: Verify the unit price and product specifications to avoid misclassification and potential penalties.

- Anti-Dumping Duties: While not explicitly mentioned here, be aware that anti-dumping duties may apply to certain plastic products, especially if imported from countries under such measures.

Pro Tip: For accurate classification and tax calculation, always consult with a customs broker or use the latest China Customs HS Code database.

Product Classification: Textile Reinforced Plastic Films

HS CODEs and Tax Details (April 2025 Update):

✅ HS CODE: 3921902550

Description: Textile reinforced plastic films, where plastic accounts for more than 70% of the weight.

- Total Tax Rate: 61.5%

- Breakdown:

- Base Tariff: 6.5%

- Additional Tariff: 25.0%

- Special Tariff after April 11, 2025: 30.0%

- Note: High tax rate due to both standard and additional tariffs.

✅ HS CODE: 3921901950

Description: Textile reinforced plastic packaging or display films.

- Total Tax Rate: 60.3%

- Breakdown:

- Base Tariff: 5.3%

- Additional Tariff: 25.0%

- Special Tariff after April 11, 2025: 30.0%

- Note: Slightly lower base rate but still subject to high additional tariffs.

✅ HS CODE: 3921904010

Description: Reinforced plastic films made of plastic.

- Total Tax Rate: 34.2%

- Breakdown:

- Base Tariff: 4.2%

- Additional Tariff: 0.0%

- Special Tariff after April 11, 2025: 30.0%

- Note: Lower base and additional tariffs, but still subject to the April 11 special tariff.

✅ HS CODE: 3921902100

Description: Cotton-reinforced plastic films, combined with other textile materials.

- Total Tax Rate: 61.5%

- Breakdown:

- Base Tariff: 6.5%

- Additional Tariff: 25.0%

- Special Tariff after April 11, 2025: 30.0%

- Note: Similar to 3921902550, with high overall tax burden.

✅ HS CODE: 3921121950

Description: Textile-reinforced PVC foam plastic films.

- Total Tax Rate: 60.3%

- Breakdown:

- Base Tariff: 5.3%

- Additional Tariff: 25.0%

- Special Tariff after April 11, 2025: 30.0%

- Note: PVC foam is a specific type of plastic, but still subject to the same tariff structure.

📌 Important Notes and Recommendations:

- April 11, 2025 Special Tariff: All listed HS codes are subject to an additional 30% tariff after April 11, 2025. This is a time-sensitive policy—ensure your import timeline aligns with this date.

- Material Composition: Confirm the plastic weight percentage and reinforcing material (e.g., cotton, other textiles) to ensure correct HS code classification.

- Certifications: Check if any customs certifications or origin documentation are required for preferential tariff treatment.

- Unit Price: Verify the unit price and product specifications to avoid misclassification and potential penalties.

- Anti-Dumping Duties: While not explicitly mentioned here, be aware that anti-dumping duties may apply to certain plastic products, especially if imported from countries under such measures.

Pro Tip: For accurate classification and tax calculation, always consult with a customs broker or use the latest China Customs HS Code database.

Customer Reviews

No reviews yet.