| HS Code | Official Doc | Tariff Rate | Origin | Destination | Effective Date |

|---|---|---|---|---|---|

| 3921902550 | Doc | 61.5% | CN | US | 2025-05-12 |

| 3921901950 | Doc | 60.3% | CN | US | 2025-05-12 |

| 3921904010 | Doc | 34.2% | CN | US | 2025-05-12 |

| 3921902100 | Doc | 61.5% | CN | US | 2025-05-12 |

| 3921121950 | Doc | 60.3% | CN | US | 2025-05-12 |

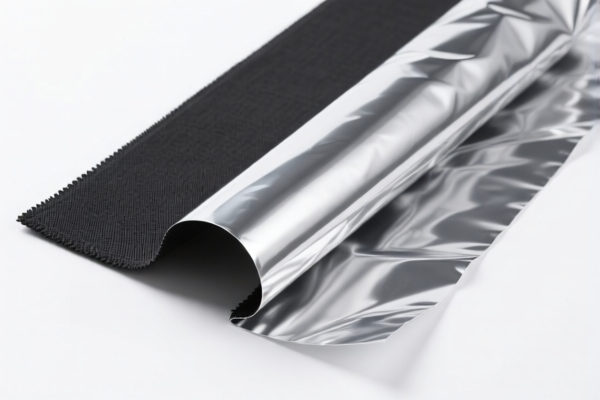

Here is the structured classification and tariff information for Textile Reinforced Plastic Foils, based on the provided HS codes and tax details:

✅ HS CODE: 3921902550

Product Description: Textile reinforced plastic films, where plastic constitutes more than 70% of the weight.

- Base Tariff Rate: 6.5%

- Additional Tariff (General): 25.0%

- Special Tariff after April 11, 2025: 30.0%

- Total Tax Rate: 61.5%

- Notes:

- This code applies to films with a plastic content over 70%.

- Ensure the material composition is clearly documented for customs compliance.

✅ HS CODE: 3921901950

Product Description: Textile reinforced plastic films used for packaging or display purposes.

- Base Tariff Rate: 5.3%

- Additional Tariff (General): 25.0%

- Special Tariff after April 11, 2025: 30.0%

- Total Tax Rate: 60.3%

- Notes:

- This code is for packaging or display films.

- Confirm the intended use of the product to ensure correct classification.

✅ HS CODE: 3921904010

Product Description: Reinforced plastic films, classified under "Plastic sheets, plates, films, foils and strips."

- Base Tariff Rate: 4.2%

- Additional Tariff (General): 0.0%

- Special Tariff after April 11, 2025: 30.0%

- Total Tax Rate: 34.2%

- Notes:

- This code is for general-purpose reinforced plastic films.

- No general additional tariffs apply, but the April 11, 2025 special tariff is still in effect.

✅ HS CODE: 3921902100

Product Description: Cotton-reinforced plastic films, classified under plastic sheets, films, foils, and strips combined with other textile materials.

- Base Tariff Rate: 6.5%

- Additional Tariff (General): 25.0%

- Special Tariff after April 11, 2025: 30.0%

- Total Tax Rate: 61.5%

- Notes:

- This code applies to cotton-reinforced films.

- Verify the material composition and weight ratio of cotton and plastic.

✅ HS CODE: 3921121950

Product Description: Textile-reinforced PVC foam plastic films.

- Base Tariff Rate: 5.3%

- Additional Tariff (General): 25.0%

- Special Tariff after April 11, 2025: 30.0%

- Total Tax Rate: 60.3%

- Notes:

- This code is for PVC foam films with textile reinforcement.

- Confirm the PVC content and reinforcement material for accurate classification.

📌 Proactive Advice for Importers:

- Verify Material Composition: Ensure the plastic-to-textile weight ratio is clearly documented, especially for codes like 3921902550 and 3921902100.

- Check Intended Use: For codes like 3921901950, the intended use (packaging, display) may affect classification.

- April 11, 2025 Special Tariff: All listed codes are subject to an additional 30% tariff after this date.

- Certifications: Confirm if any certifications (e.g., RoHS, REACH) are required for the product type.

- Unit Price and Quantity: Ensure accurate unit pricing and quantity reporting to avoid discrepancies during customs clearance.

Let me know if you need help with certification requirements or customs documentation for any of these HS codes. Here is the structured classification and tariff information for Textile Reinforced Plastic Foils, based on the provided HS codes and tax details:

✅ HS CODE: 3921902550

Product Description: Textile reinforced plastic films, where plastic constitutes more than 70% of the weight.

- Base Tariff Rate: 6.5%

- Additional Tariff (General): 25.0%

- Special Tariff after April 11, 2025: 30.0%

- Total Tax Rate: 61.5%

- Notes:

- This code applies to films with a plastic content over 70%.

- Ensure the material composition is clearly documented for customs compliance.

✅ HS CODE: 3921901950

Product Description: Textile reinforced plastic films used for packaging or display purposes.

- Base Tariff Rate: 5.3%

- Additional Tariff (General): 25.0%

- Special Tariff after April 11, 2025: 30.0%

- Total Tax Rate: 60.3%

- Notes:

- This code is for packaging or display films.

- Confirm the intended use of the product to ensure correct classification.

✅ HS CODE: 3921904010

Product Description: Reinforced plastic films, classified under "Plastic sheets, plates, films, foils and strips."

- Base Tariff Rate: 4.2%

- Additional Tariff (General): 0.0%

- Special Tariff after April 11, 2025: 30.0%

- Total Tax Rate: 34.2%

- Notes:

- This code is for general-purpose reinforced plastic films.

- No general additional tariffs apply, but the April 11, 2025 special tariff is still in effect.

✅ HS CODE: 3921902100

Product Description: Cotton-reinforced plastic films, classified under plastic sheets, films, foils, and strips combined with other textile materials.

- Base Tariff Rate: 6.5%

- Additional Tariff (General): 25.0%

- Special Tariff after April 11, 2025: 30.0%

- Total Tax Rate: 61.5%

- Notes:

- This code applies to cotton-reinforced films.

- Verify the material composition and weight ratio of cotton and plastic.

✅ HS CODE: 3921121950

Product Description: Textile-reinforced PVC foam plastic films.

- Base Tariff Rate: 5.3%

- Additional Tariff (General): 25.0%

- Special Tariff after April 11, 2025: 30.0%

- Total Tax Rate: 60.3%

- Notes:

- This code is for PVC foam films with textile reinforcement.

- Confirm the PVC content and reinforcement material for accurate classification.

📌 Proactive Advice for Importers:

- Verify Material Composition: Ensure the plastic-to-textile weight ratio is clearly documented, especially for codes like 3921902550 and 3921902100.

- Check Intended Use: For codes like 3921901950, the intended use (packaging, display) may affect classification.

- April 11, 2025 Special Tariff: All listed codes are subject to an additional 30% tariff after this date.

- Certifications: Confirm if any certifications (e.g., RoHS, REACH) are required for the product type.

- Unit Price and Quantity: Ensure accurate unit pricing and quantity reporting to avoid discrepancies during customs clearance.

Let me know if you need help with certification requirements or customs documentation for any of these HS codes.

Customer Reviews

No reviews yet.