| HS Code | Official Doc | Tariff Rate | Origin | Destination | Effective Date |

|---|---|---|---|---|---|

| 3921901100 | Doc | 59.2% | CN | US | 2025-05-12 |

| 3921902510 | Doc | 61.5% | CN | US | 2025-05-12 |

| 3921901950 | Doc | 60.3% | CN | US | 2025-05-12 |

| 3921902550 | Doc | 61.5% | CN | US | 2025-05-12 |

Here is the structured classification and tariff information for Textile Reinforced Plastic Laboratory Panels, based on the provided HS codes and details:

🔍 Product Classification Overview

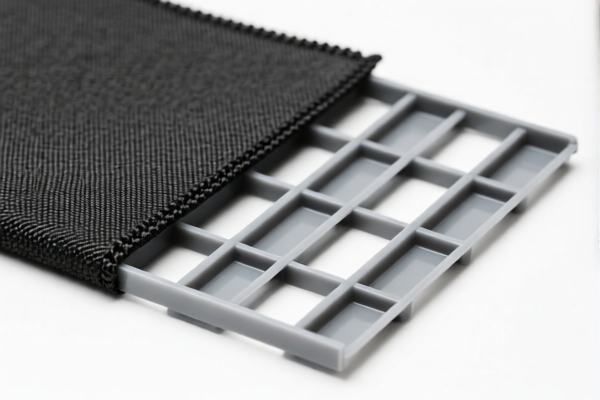

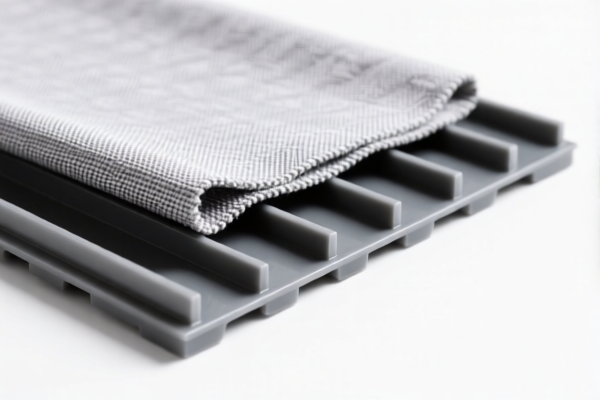

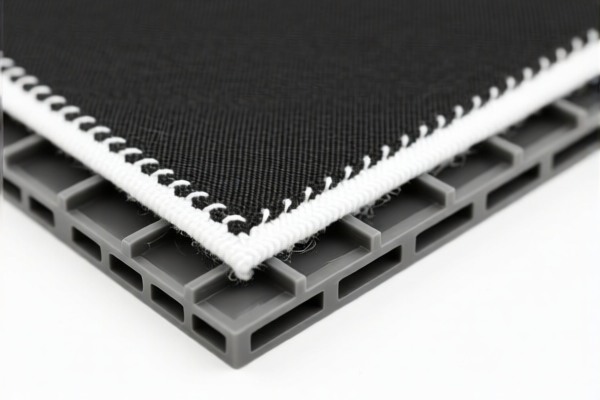

Product Name: Textile Reinforced Plastic Laboratory Panels

Material Composition: Combines textile fibers (primarily synthetic) with plastic (over 70% by weight)

📦 HS Code Classification & Tax Details

1. HS CODE: 3921901100

- Description: Textile reinforced plastic panels with weight < 1.492 kg/m², where synthetic fibers make up the majority of the textile component, and plastic > 70% by weight.

- Total Tax Rate: 59.2%

- Base Tariff: 4.2%

- Additional Tariff: 25.0%

- April 11, 2025 Special Tariff: 30.0% (applies after April 11, 2025)

- Note: This code applies to lighter panels (under 1.492 kg/m²) with synthetic fiber dominance.

2. HS CODE: 3921902510

- Description: Textile composite plastic panels with weight > 1.492 kg/m², where synthetic fibers are the main textile component, and plastic > 70% by weight.

- Total Tax Rate: 61.5%

- Base Tariff: 6.5%

- Additional Tariff: 25.0%

- April 11, 2025 Special Tariff: 30.0%

- Note: This code applies to heavier panels (over 1.492 kg/m²) with synthetic fiber dominance.

3. HS CODE: 3921901950

- Description: Textile reinforced plastic display films, where the plastic component (sheet, film, foil, strip) is combined with textile materials. Classification depends on the weight percentage of plant fibers.

- Total Tax Rate: 60.3%

- Base Tariff: 5.3%

- Additional Tariff: 25.0%

- April 11, 2025 Special Tariff: 30.0%

- Note: This code is for thinner, film-like products. Ensure the textile composition is clearly defined for accurate classification.

4. HS CODE: 3921902550

- Description: Textile reinforced plastic films with weight > 1.492 kg/m², where synthetic fibers make up the majority of the textile component, and plastic > 70% by weight.

- Total Tax Rate: 61.5%

- Base Tariff: 6.5%

- Additional Tariff: 25.0%

- April 11, 2025 Special Tariff: 30.0%

- Note: This code applies to heavier, film-like products with synthetic fiber dominance.

⚠️ Important Notes & Proactive Advice

- April 11, 2025 Special Tariff: A 30% additional tariff will be applied to all the above HS codes after April 11, 2025. Ensure your import timeline is planned accordingly.

- Anti-dumping duties: Not specified in the data, but be aware that anti-dumping duties may apply depending on the country of origin and product type.

- Material Verification: Confirm the exact composition (weight of plastic vs. textile fibers) and unit price to ensure correct HS code selection.

- Certifications: Check if any certifications (e.g., RoHS, REACH, or specific import permits) are required for the product in the destination country.

- Documentation: Maintain detailed product specifications and material declarations for customs compliance and potential audits.

✅ Summary of Tax Rates (after April 11, 2025)

| HS Code | Total Tax Rate | Base Tariff | Additional Tariff | April 11 Special Tariff |

|---|---|---|---|---|

| 3921901100 | 59.2% | 4.2% | 25.0% | 30.0% |

| 3921902510 | 61.5% | 6.5% | 25.0% | 30.0% |

| 3921901950 | 60.3% | 5.3% | 25.0% | 30.0% |

| 3921902550 | 61.5% | 6.5% | 25.0% | 30.0% |

If you need help determining the correct HS code based on your specific product details, feel free to provide more information. Here is the structured classification and tariff information for Textile Reinforced Plastic Laboratory Panels, based on the provided HS codes and details:

🔍 Product Classification Overview

Product Name: Textile Reinforced Plastic Laboratory Panels

Material Composition: Combines textile fibers (primarily synthetic) with plastic (over 70% by weight)

📦 HS Code Classification & Tax Details

1. HS CODE: 3921901100

- Description: Textile reinforced plastic panels with weight < 1.492 kg/m², where synthetic fibers make up the majority of the textile component, and plastic > 70% by weight.

- Total Tax Rate: 59.2%

- Base Tariff: 4.2%

- Additional Tariff: 25.0%

- April 11, 2025 Special Tariff: 30.0% (applies after April 11, 2025)

- Note: This code applies to lighter panels (under 1.492 kg/m²) with synthetic fiber dominance.

2. HS CODE: 3921902510

- Description: Textile composite plastic panels with weight > 1.492 kg/m², where synthetic fibers are the main textile component, and plastic > 70% by weight.

- Total Tax Rate: 61.5%

- Base Tariff: 6.5%

- Additional Tariff: 25.0%

- April 11, 2025 Special Tariff: 30.0%

- Note: This code applies to heavier panels (over 1.492 kg/m²) with synthetic fiber dominance.

3. HS CODE: 3921901950

- Description: Textile reinforced plastic display films, where the plastic component (sheet, film, foil, strip) is combined with textile materials. Classification depends on the weight percentage of plant fibers.

- Total Tax Rate: 60.3%

- Base Tariff: 5.3%

- Additional Tariff: 25.0%

- April 11, 2025 Special Tariff: 30.0%

- Note: This code is for thinner, film-like products. Ensure the textile composition is clearly defined for accurate classification.

4. HS CODE: 3921902550

- Description: Textile reinforced plastic films with weight > 1.492 kg/m², where synthetic fibers make up the majority of the textile component, and plastic > 70% by weight.

- Total Tax Rate: 61.5%

- Base Tariff: 6.5%

- Additional Tariff: 25.0%

- April 11, 2025 Special Tariff: 30.0%

- Note: This code applies to heavier, film-like products with synthetic fiber dominance.

⚠️ Important Notes & Proactive Advice

- April 11, 2025 Special Tariff: A 30% additional tariff will be applied to all the above HS codes after April 11, 2025. Ensure your import timeline is planned accordingly.

- Anti-dumping duties: Not specified in the data, but be aware that anti-dumping duties may apply depending on the country of origin and product type.

- Material Verification: Confirm the exact composition (weight of plastic vs. textile fibers) and unit price to ensure correct HS code selection.

- Certifications: Check if any certifications (e.g., RoHS, REACH, or specific import permits) are required for the product in the destination country.

- Documentation: Maintain detailed product specifications and material declarations for customs compliance and potential audits.

✅ Summary of Tax Rates (after April 11, 2025)

| HS Code | Total Tax Rate | Base Tariff | Additional Tariff | April 11 Special Tariff |

|---|---|---|---|---|

| 3921901100 | 59.2% | 4.2% | 25.0% | 30.0% |

| 3921902510 | 61.5% | 6.5% | 25.0% | 30.0% |

| 3921901950 | 60.3% | 5.3% | 25.0% | 30.0% |

| 3921902550 | 61.5% | 6.5% | 25.0% | 30.0% |

If you need help determining the correct HS code based on your specific product details, feel free to provide more information.

Customer Reviews

No reviews yet.