| HS Code | Official Doc | Tariff Rate | Origin | Destination | Effective Date |

|---|---|---|---|---|---|

| 3920995000 | Doc | 60.8% | CN | US | 2025-05-12 |

| 3921902100 | Doc | 61.5% | CN | US | 2025-05-12 |

| 3921902550 | Doc | 61.5% | CN | US | 2025-05-12 |

| 3921902900 | Doc | 59.4% | CN | US | 2025-05-12 |

| 3921904010 | Doc | 34.2% | CN | US | 2025-05-12 |

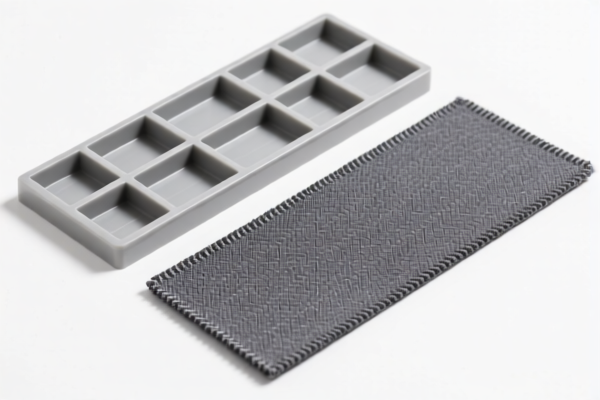

Product Classification: Textile Reinforced Plastic Model Panels

HS CODEs and Tax Details (as of current regulations):

- HS CODE: 3920995000

- Product Description: Plastic model panels

- Total Tax Rate: 60.8%

- Breakdown:

- Base Tariff: 5.8%

- Additional Tariff: 25.0%

- Special Tariff after April 11, 2025: 30.0%

-

Notes: This code is for general plastic model panels, not specifically textile-reinforced.

-

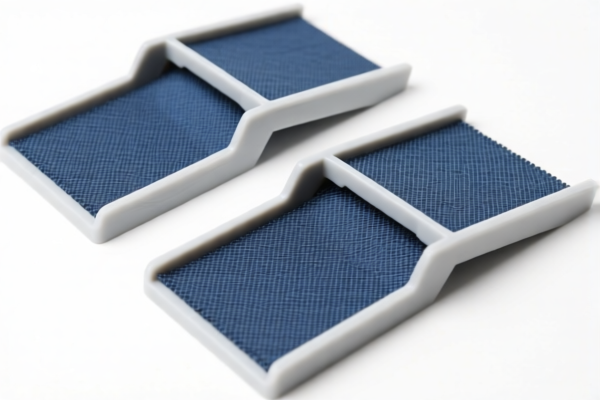

HS CODE: 3921902100

- Product Description: Cotton-reinforced plastic panels

- Total Tax Rate: 61.5%

- Breakdown:

- Base Tariff: 6.5%

- Additional Tariff: 25.0%

- Special Tariff after April 11, 2025: 30.0%

-

Notes: This is a textile-reinforced plastic panel using cotton as the reinforcement material.

-

HS CODE: 3921902550

- Product Description: Polyester fiber-reinforced plastic composite panels

- Total Tax Rate: 61.5%

- Breakdown:

- Base Tariff: 6.5%

- Additional Tariff: 25.0%

- Special Tariff after April 11, 2025: 30.0%

-

Notes: This is a composite panel with polyester fiber reinforcement.

-

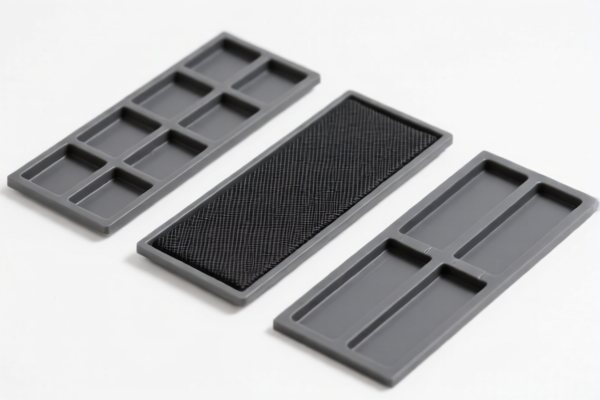

HS CODE: 3921902900

- Product Description: Fiber-reinforced textile plastic panels

- Total Tax Rate: 59.4%

- Breakdown:

- Base Tariff: 4.4%

- Additional Tariff: 25.0%

- Special Tariff after April 11, 2025: 30.0%

-

Notes: This is a general category for fiber-reinforced textile plastic panels.

-

HS CODE: 3921904010

- Product Description: Paper-reinforced plastic panels

- Total Tax Rate: 34.2%

- Breakdown:

- Base Tariff: 4.2%

- Additional Tariff: 0.0%

- Special Tariff after April 11, 2025: 30.0%

- Notes: This is a lower-taxed category, likely due to the use of paper as reinforcement.

Key Tax Rate Changes (April 11, 2025):

- All listed HS codes will see an additional 30.0% tariff applied after April 11, 2025.

- This is a time-sensitive policy, so it is crucial to plan import timelines accordingly.

Proactive Advice:

- Verify Material Composition: Ensure the product is correctly classified based on the type of textile reinforcement (e.g., cotton, polyester, or other fibers).

- Check Unit Price and Certification: Confirm if any certifications (e.g., safety, environmental compliance) are required for import.

- Review Tariff Impact: If importing after April 11, 2025, be prepared for a 30% additional tariff on all listed HS codes.

- Consult Customs Broker: For complex classifications or large shipments, seek professional customs advice to avoid delays or penalties.

Let me know if you need help determining the most accurate HS code for your specific product.

Product Classification: Textile Reinforced Plastic Model Panels

HS CODEs and Tax Details (as of current regulations):

- HS CODE: 3920995000

- Product Description: Plastic model panels

- Total Tax Rate: 60.8%

- Breakdown:

- Base Tariff: 5.8%

- Additional Tariff: 25.0%

- Special Tariff after April 11, 2025: 30.0%

-

Notes: This code is for general plastic model panels, not specifically textile-reinforced.

-

HS CODE: 3921902100

- Product Description: Cotton-reinforced plastic panels

- Total Tax Rate: 61.5%

- Breakdown:

- Base Tariff: 6.5%

- Additional Tariff: 25.0%

- Special Tariff after April 11, 2025: 30.0%

-

Notes: This is a textile-reinforced plastic panel using cotton as the reinforcement material.

-

HS CODE: 3921902550

- Product Description: Polyester fiber-reinforced plastic composite panels

- Total Tax Rate: 61.5%

- Breakdown:

- Base Tariff: 6.5%

- Additional Tariff: 25.0%

- Special Tariff after April 11, 2025: 30.0%

-

Notes: This is a composite panel with polyester fiber reinforcement.

-

HS CODE: 3921902900

- Product Description: Fiber-reinforced textile plastic panels

- Total Tax Rate: 59.4%

- Breakdown:

- Base Tariff: 4.4%

- Additional Tariff: 25.0%

- Special Tariff after April 11, 2025: 30.0%

-

Notes: This is a general category for fiber-reinforced textile plastic panels.

-

HS CODE: 3921904010

- Product Description: Paper-reinforced plastic panels

- Total Tax Rate: 34.2%

- Breakdown:

- Base Tariff: 4.2%

- Additional Tariff: 0.0%

- Special Tariff after April 11, 2025: 30.0%

- Notes: This is a lower-taxed category, likely due to the use of paper as reinforcement.

Key Tax Rate Changes (April 11, 2025):

- All listed HS codes will see an additional 30.0% tariff applied after April 11, 2025.

- This is a time-sensitive policy, so it is crucial to plan import timelines accordingly.

Proactive Advice:

- Verify Material Composition: Ensure the product is correctly classified based on the type of textile reinforcement (e.g., cotton, polyester, or other fibers).

- Check Unit Price and Certification: Confirm if any certifications (e.g., safety, environmental compliance) are required for import.

- Review Tariff Impact: If importing after April 11, 2025, be prepared for a 30% additional tariff on all listed HS codes.

- Consult Customs Broker: For complex classifications or large shipments, seek professional customs advice to avoid delays or penalties.

Let me know if you need help determining the most accurate HS code for your specific product.

Customer Reviews

No reviews yet.