Found 5 matching results

(CN → US)

| HS Code | Official Doc | Tariff Rate | Origin | Destination | Effective Date |

|---|---|---|---|---|---|

| 3921901500 | Doc | 61.5% | CN | US | 2025-05-12 |

| 3921901500 | Doc | 61.5% | CN | US | 2025-05-12 |

| 3921901950 | Doc | 60.3% | CN | US | 2025-05-12 |

| 3921902510 | Doc | 61.5% | CN | US | 2025-05-12 |

| 3921901100 | Doc | 59.2% | CN | US | 2025-05-12 |

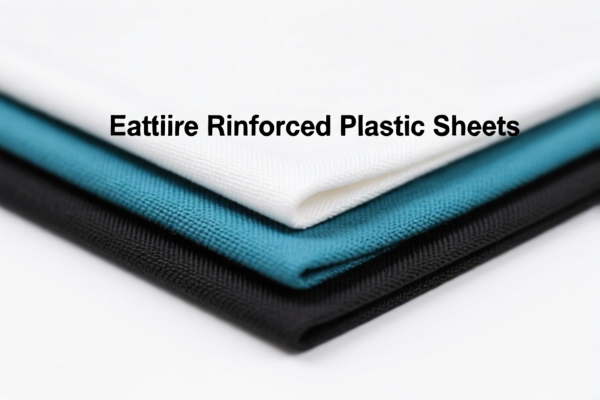

Product Classification: Textile Reinforced Plastic Packaging Sheets

HS CODE: 3921901500, 3921901950, 3921902510, 3921901100 (varies by specific product type)

🔍 Classification Overview

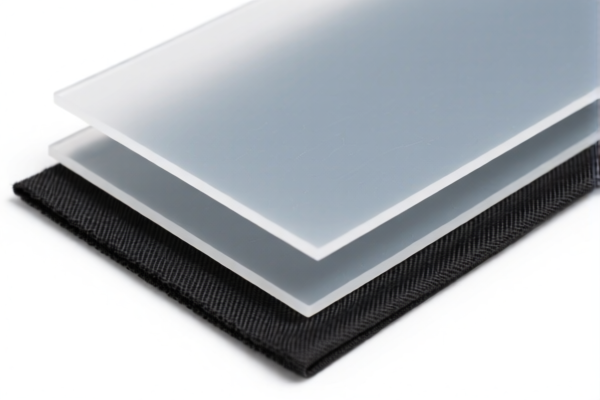

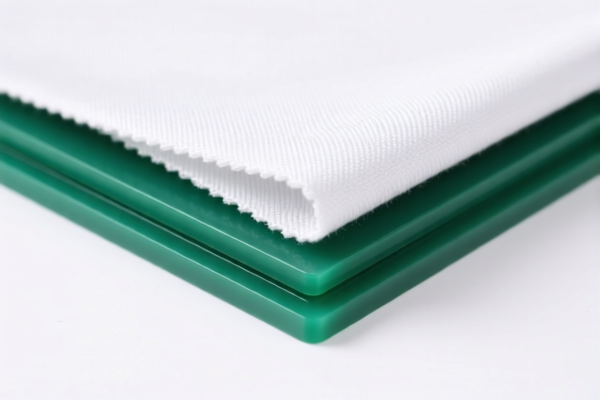

- Product Type: Textile-reinforced plastic packaging materials (e.g., sheets, films, rolls, and boards).

- HS Code Range: 392190xx (Plastic plates, sheets, film, foil, and strip of plastics, not elsewhere specified or included).

- Key Classification Factors:

- Reinforced with textile fibers (e.g., woven or non-woven fabric).

- Used primarily for packaging purposes.

- Not classified under other more specific HS codes (e.g., 3921901500 for "textile-reinforced plastic packaging film").

📊 Tariff Breakdown (as of current regulations)

- Base Tariff Rate: Varies from 4.2% to 6.5%, depending on the specific HS code.

- Additional Tariff (General): 25.0% (applies to all products in this category).

- Special Tariff (April 11, 2025 onwards): 30.0% (additional to the above).

- Anti-dumping duties: Not applicable for this product category (no specific anti-dumping duties on textile-reinforced plastic packaging materials as of now).

⚠️ Time-Sensitive Policy Alert

- April 11, 2025 Special Tariff: A 30.0% additional tariff will be imposed on all products in this category after April 11, 2025. This is a critical date to note for import planning and cost estimation.

📌 Proactive Advice for Importers

- Verify Material Composition: Ensure the product is indeed textile-reinforced plastic and not just plastic with a textile surface print or coating.

- Check Unit Price and Classification: Confirm the HS code based on the exact product form (e.g., film, sheet, roll, board) to avoid misclassification penalties.

- Certifications Required: Some countries may require documentation such as:

- Material safety data sheets (MSDS)

- Certifications of origin

- Import permits (if applicable)

- Monitor Tariff Updates: Stay informed about any changes in tariff rates or policy updates, especially around the April 11, 2025 deadline.

📌 Summary of Tax Rates by HS Code

| HS Code | Product Description | Base Tariff | Additional Tariff | April 11 Special Tariff | Total Tax Rate |

|---|---|---|---|---|---|

| 3921901500 | Textile-reinforced plastic film | 6.5% | 25.0% | 30.0% | 61.5% |

| 3921901950 | Textile-reinforced plastic film | 5.3% | 25.0% | 30.0% | 60.3% |

| 3921902510 | Textile-reinforced plastic sheet | 6.5% | 25.0% | 30.0% | 61.5% |

| 3921901100 | Textile-reinforced plastic roll | 4.2% | 25.0% | 30.0% | 59.2% |

If you need further assistance with customs documentation or HS code verification, feel free to provide more product details.

Product Classification: Textile Reinforced Plastic Packaging Sheets

HS CODE: 3921901500, 3921901950, 3921902510, 3921901100 (varies by specific product type)

🔍 Classification Overview

- Product Type: Textile-reinforced plastic packaging materials (e.g., sheets, films, rolls, and boards).

- HS Code Range: 392190xx (Plastic plates, sheets, film, foil, and strip of plastics, not elsewhere specified or included).

- Key Classification Factors:

- Reinforced with textile fibers (e.g., woven or non-woven fabric).

- Used primarily for packaging purposes.

- Not classified under other more specific HS codes (e.g., 3921901500 for "textile-reinforced plastic packaging film").

📊 Tariff Breakdown (as of current regulations)

- Base Tariff Rate: Varies from 4.2% to 6.5%, depending on the specific HS code.

- Additional Tariff (General): 25.0% (applies to all products in this category).

- Special Tariff (April 11, 2025 onwards): 30.0% (additional to the above).

- Anti-dumping duties: Not applicable for this product category (no specific anti-dumping duties on textile-reinforced plastic packaging materials as of now).

⚠️ Time-Sensitive Policy Alert

- April 11, 2025 Special Tariff: A 30.0% additional tariff will be imposed on all products in this category after April 11, 2025. This is a critical date to note for import planning and cost estimation.

📌 Proactive Advice for Importers

- Verify Material Composition: Ensure the product is indeed textile-reinforced plastic and not just plastic with a textile surface print or coating.

- Check Unit Price and Classification: Confirm the HS code based on the exact product form (e.g., film, sheet, roll, board) to avoid misclassification penalties.

- Certifications Required: Some countries may require documentation such as:

- Material safety data sheets (MSDS)

- Certifications of origin

- Import permits (if applicable)

- Monitor Tariff Updates: Stay informed about any changes in tariff rates or policy updates, especially around the April 11, 2025 deadline.

📌 Summary of Tax Rates by HS Code

| HS Code | Product Description | Base Tariff | Additional Tariff | April 11 Special Tariff | Total Tax Rate |

|---|---|---|---|---|---|

| 3921901500 | Textile-reinforced plastic film | 6.5% | 25.0% | 30.0% | 61.5% |

| 3921901950 | Textile-reinforced plastic film | 5.3% | 25.0% | 30.0% | 60.3% |

| 3921902510 | Textile-reinforced plastic sheet | 6.5% | 25.0% | 30.0% | 61.5% |

| 3921901100 | Textile-reinforced plastic roll | 4.2% | 25.0% | 30.0% | 59.2% |

If you need further assistance with customs documentation or HS code verification, feel free to provide more product details.

Customer Reviews

No reviews yet.