| HS Code | Official Doc | Tariff Rate | Origin | Destination | Effective Date |

|---|---|---|---|---|---|

| 3921902510 | Doc | 61.5% | CN | US | 2025-05-12 |

| 3921902900 | Doc | 59.4% | CN | US | 2025-05-12 |

| 3921902550 | Doc | 61.5% | CN | US | 2025-05-12 |

| 3921902510 | Doc | 61.5% | CN | US | 2025-05-12 |

| 3921902900 | Doc | 59.4% | CN | US | 2025-05-12 |

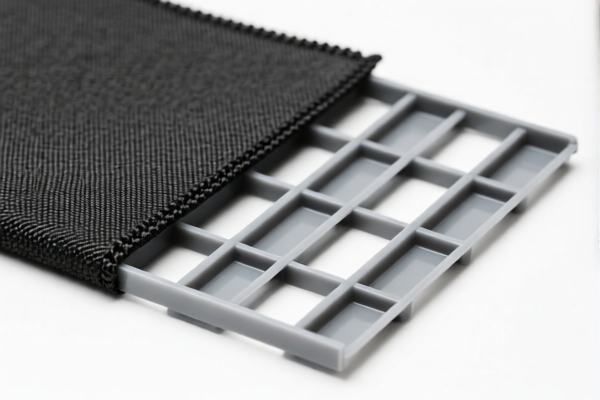

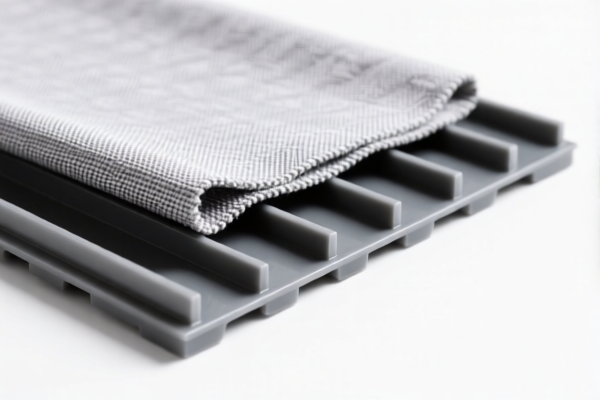

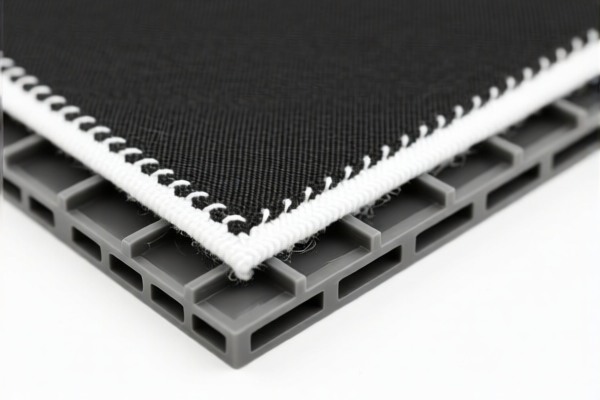

Product Name: Textile Reinforced Plastic Reinforcing Panels

Classification: Based on the provided HS codes and descriptions, the product falls under Chapter 3921 of the Harmonized System, specifically under 3921.90.25 or 3921.90.29, depending on the composition and weight specifications.

🔍 HS Code Classification Summary

- HS CODE: 3921902510

- Description: Products where textile components are the main weight component, and the weight of any single textile fiber is less than that of synthetic fibers, with plastic content exceeding 70%.

- Total Tax Rate: 61.5%

-

Tax Breakdown:

- Base Tariff: 6.5%

- Additional Tariff: 25.0%

- Special Tariff after April 11, 2025: 30.0%

-

HS CODE: 3921902900

- Description: Other plastic sheets, plates, films, foils, and strips, combined with other materials and with a weight exceeding 1.492 kg/m². Also includes fiber-reinforced textile plastic panels.

- Total Tax Rate: 59.4%

-

Tax Breakdown:

- Base Tariff: 4.4%

- Additional Tariff: 25.0%

- Special Tariff after April 11, 2025: 30.0%

-

HS CODE: 3921902550

- Description: Products where synthetic fiber weight exceeds that of any other single textile fiber, with plastic content exceeding 70%.

- Total Tax Rate: 61.5%

- Tax Breakdown:

- Base Tariff: 6.5%

- Additional Tariff: 25.0%

- Special Tariff after April 11, 2025: 30.0%

⚠️ Important Notes and Alerts

-

April 11, 2025 Special Tariff: A 30.0% additional tariff will be imposed on all the above HS codes after April 11, 2025. This is a time-sensitive policy and must be accounted for in cost planning and customs declarations.

-

Anti-Dumping Duties: Not explicitly mentioned in the data, but if the product is imported from countries under anti-dumping investigations, additional duties may apply. Verify with customs or a trade compliance expert.

-

Material Composition: The classification depends heavily on the weight ratio of textile fibers to plastic and the total weight per square meter. Ensure that the product's composition is accurately documented.

📌 Proactive Advice for Importers

-

Verify Material Composition: Confirm the exact weight percentages of textile fibers and plastic in the product. This will determine the correct HS code.

-

Check Unit Price and Certification: Some HS codes may require certifications (e.g., for composite materials or textile content). Ensure all necessary documentation is in place.

-

Monitor Tariff Changes: The April 11, 2025 tariff increase is a key date. Plan accordingly to avoid unexpected costs.

-

Consult Customs Authority: For high-value or complex products, it is advisable to seek a pre-classification ruling from the customs authority to avoid misclassification penalties.

Let me know if you need help determining the correct HS code based on your product's specifications.

Product Name: Textile Reinforced Plastic Reinforcing Panels

Classification: Based on the provided HS codes and descriptions, the product falls under Chapter 3921 of the Harmonized System, specifically under 3921.90.25 or 3921.90.29, depending on the composition and weight specifications.

🔍 HS Code Classification Summary

- HS CODE: 3921902510

- Description: Products where textile components are the main weight component, and the weight of any single textile fiber is less than that of synthetic fibers, with plastic content exceeding 70%.

- Total Tax Rate: 61.5%

-

Tax Breakdown:

- Base Tariff: 6.5%

- Additional Tariff: 25.0%

- Special Tariff after April 11, 2025: 30.0%

-

HS CODE: 3921902900

- Description: Other plastic sheets, plates, films, foils, and strips, combined with other materials and with a weight exceeding 1.492 kg/m². Also includes fiber-reinforced textile plastic panels.

- Total Tax Rate: 59.4%

-

Tax Breakdown:

- Base Tariff: 4.4%

- Additional Tariff: 25.0%

- Special Tariff after April 11, 2025: 30.0%

-

HS CODE: 3921902550

- Description: Products where synthetic fiber weight exceeds that of any other single textile fiber, with plastic content exceeding 70%.

- Total Tax Rate: 61.5%

- Tax Breakdown:

- Base Tariff: 6.5%

- Additional Tariff: 25.0%

- Special Tariff after April 11, 2025: 30.0%

⚠️ Important Notes and Alerts

-

April 11, 2025 Special Tariff: A 30.0% additional tariff will be imposed on all the above HS codes after April 11, 2025. This is a time-sensitive policy and must be accounted for in cost planning and customs declarations.

-

Anti-Dumping Duties: Not explicitly mentioned in the data, but if the product is imported from countries under anti-dumping investigations, additional duties may apply. Verify with customs or a trade compliance expert.

-

Material Composition: The classification depends heavily on the weight ratio of textile fibers to plastic and the total weight per square meter. Ensure that the product's composition is accurately documented.

📌 Proactive Advice for Importers

-

Verify Material Composition: Confirm the exact weight percentages of textile fibers and plastic in the product. This will determine the correct HS code.

-

Check Unit Price and Certification: Some HS codes may require certifications (e.g., for composite materials or textile content). Ensure all necessary documentation is in place.

-

Monitor Tariff Changes: The April 11, 2025 tariff increase is a key date. Plan accordingly to avoid unexpected costs.

-

Consult Customs Authority: For high-value or complex products, it is advisable to seek a pre-classification ruling from the customs authority to avoid misclassification penalties.

Let me know if you need help determining the correct HS code based on your product's specifications.

Customer Reviews

No reviews yet.