| HS Code | Official Doc | Tariff Rate | Origin | Destination | Effective Date |

|---|---|---|---|---|---|

| 3921902900 | Doc | 59.4% | CN | US | 2025-05-12 |

| 7019629060 | Doc | 44.5% | CN | US | 2025-05-12 |

| 7019739090 | Doc | 61.0% | CN | US | 2025-05-12 |

| 7019905150 | Doc | 59.3% | CN | US | 2025-05-12 |

| 7019140000 | Doc | 59.3% | CN | US | 2025-05-12 |

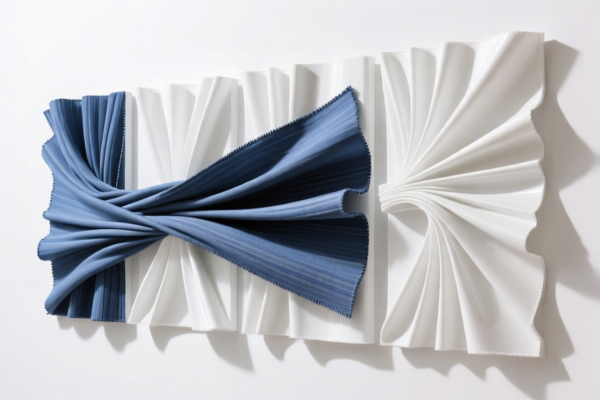

Product Classification: Textile Reinforced Plastic Sculpture Panels

HS CODEs and Tax Details (April 2025 Update):

- HS CODE: 3921902900

- Description: Applicable to fiber-reinforced textile plastic panels, including carbon fiber-reinforced panels, with a weight exceeding 1.492 kg/m².

- Total Tax Rate: 59.4%

- Base Tariff: 4.4%

- Additional Tariff: 25.0%

- Special Tariff after April 11, 2025: 30.0%

-

Notes: This code is suitable for heavier, fiber-reinforced plastic panels, especially those with carbon fiber.

-

HS CODE: 7019629060

- Description: Applicable to colored glass fiber-reinforced plastic sculpture panels, containing glass fiber and described as "colored," matching the "colored" description.

- Total Tax Rate: 44.5%

- Base Tariff: 7.0%

- Additional Tariff: 7.5%

- Special Tariff after April 11, 2025: 30.0%

-

Notes: This code is ideal for decorative or artistic panels with a "colored" finish.

-

HS CODE: 7019739090

- Description: Applicable to glass fiber-reinforced plastic panels.

- Total Tax Rate: 61.0%

- Base Tariff: 6.0%

- Additional Tariff: 25.0%

- Special Tariff after April 11, 2025: 30.0%

-

Notes: This is a general code for standard glass fiber-reinforced plastic panels without specific color or weight details.

-

HS CODE: 7019905150

- Description: Applicable to glass fiber-reinforced plastic panels, covering other products in the category of glass fiber and its products.

- Total Tax Rate: 59.3%

- Base Tariff: 4.3%

- Additional Tariff: 25.0%

- Special Tariff after April 11, 2025: 30.0%

-

Notes: This code is suitable for panels that do not fall under more specific categories.

-

HS CODE: 7019140000

- Description: Applicable to glass fiber-reinforced plastic panels, which are part of glass fiber (including glass wool) and its products, specifically mechanically bonded sheet products.

- Total Tax Rate: 59.3%

- Base Tariff: 4.3%

- Additional Tariff: 25.0%

- Special Tariff after April 11, 2025: 30.0%

- Notes: This code is for mechanically bonded sheet products made from glass fiber.

Proactive Advice:

- Verify Material and Unit Price: Confirm the exact composition (e.g., carbon fiber, glass fiber, or other fibers) and weight of the panels to ensure correct classification.

- Check Required Certifications: Some products may require specific certifications (e.g., safety, environmental compliance) depending on the destination country.

- Monitor Tariff Changes: The special tariff after April 11, 2025, applies to all the above codes. Ensure your import timeline aligns with these regulations.

-

Consider Anti-Dumping Duties: If the product contains iron or aluminum components, check for applicable anti-dumping duties, which may vary by country and product type. Product Classification: Textile Reinforced Plastic Sculpture Panels

HS CODEs and Tax Details (April 2025 Update): -

HS CODE: 3921902900

- Description: Applicable to fiber-reinforced textile plastic panels, including carbon fiber-reinforced panels, with a weight exceeding 1.492 kg/m².

- Total Tax Rate: 59.4%

- Base Tariff: 4.4%

- Additional Tariff: 25.0%

- Special Tariff after April 11, 2025: 30.0%

-

Notes: This code is suitable for heavier, fiber-reinforced plastic panels, especially those with carbon fiber.

-

HS CODE: 7019629060

- Description: Applicable to colored glass fiber-reinforced plastic sculpture panels, containing glass fiber and described as "colored," matching the "colored" description.

- Total Tax Rate: 44.5%

- Base Tariff: 7.0%

- Additional Tariff: 7.5%

- Special Tariff after April 11, 2025: 30.0%

-

Notes: This code is ideal for decorative or artistic panels with a "colored" finish.

-

HS CODE: 7019739090

- Description: Applicable to glass fiber-reinforced plastic panels.

- Total Tax Rate: 61.0%

- Base Tariff: 6.0%

- Additional Tariff: 25.0%

- Special Tariff after April 11, 2025: 30.0%

-

Notes: This is a general code for standard glass fiber-reinforced plastic panels without specific color or weight details.

-

HS CODE: 7019905150

- Description: Applicable to glass fiber-reinforced plastic panels, covering other products in the category of glass fiber and its products.

- Total Tax Rate: 59.3%

- Base Tariff: 4.3%

- Additional Tariff: 25.0%

- Special Tariff after April 11, 2025: 30.0%

-

Notes: This code is suitable for panels that do not fall under more specific categories.

-

HS CODE: 7019140000

- Description: Applicable to glass fiber-reinforced plastic panels, which are part of glass fiber (including glass wool) and its products, specifically mechanically bonded sheet products.

- Total Tax Rate: 59.3%

- Base Tariff: 4.3%

- Additional Tariff: 25.0%

- Special Tariff after April 11, 2025: 30.0%

- Notes: This code is for mechanically bonded sheet products made from glass fiber.

Proactive Advice:

- Verify Material and Unit Price: Confirm the exact composition (e.g., carbon fiber, glass fiber, or other fibers) and weight of the panels to ensure correct classification.

- Check Required Certifications: Some products may require specific certifications (e.g., safety, environmental compliance) depending on the destination country.

- Monitor Tariff Changes: The special tariff after April 11, 2025, applies to all the above codes. Ensure your import timeline aligns with these regulations.

- Consider Anti-Dumping Duties: If the product contains iron or aluminum components, check for applicable anti-dumping duties, which may vary by country and product type.

Customer Reviews

No reviews yet.