| HS Code | Official Doc | Tariff Rate | Origin | Destination | Effective Date |

|---|---|---|---|---|---|

| 3921901100 | Doc | 59.2% | CN | US | 2025-05-12 |

| 3921902900 | Doc | 59.4% | CN | US | 2025-05-12 |

| 3921901500 | Doc | 61.5% | CN | US | 2025-05-12 |

| 3921901910 | Doc | 60.3% | CN | US | 2025-05-12 |

| 3921902550 | Doc | 61.5% | CN | US | 2025-05-12 |

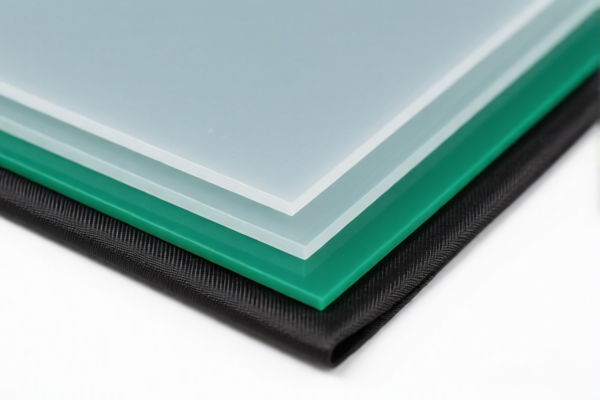

Product Classification: Textile Reinforced Plastic Soundproof Sheets

HS CODEs and Tax Details (as of current regulations):

- HS CODE: 3921901100

- Description: Textile reinforced plastic soundproof sheets

- Total Tax Rate: 59.2%

- Breakdown:

- Base Tariff: 4.2%

- Additional Tariff: 25.0%

- Special Tariff after April 11, 2025: 30.0%

-

Note: This code is suitable for standard textile-reinforced plastic soundproof sheets.

-

HS CODE: 3921902900

- Description: Textile-plastic composite soundproof sheets

- Total Tax Rate: 59.4%

- Breakdown:

- Base Tariff: 4.4%

- Additional Tariff: 25.0%

- Special Tariff after April 11, 2025: 30.0%

-

Note: This code applies to composite materials with textile and plastic layers.

-

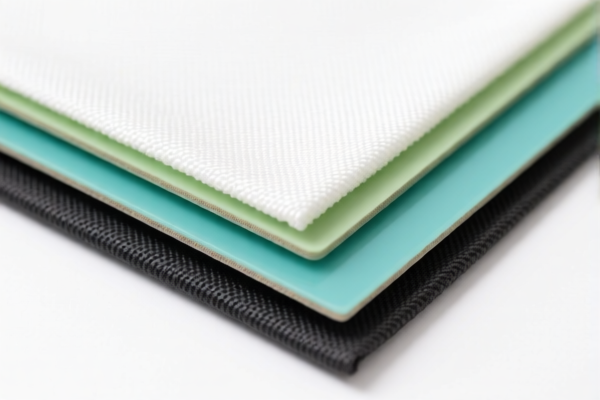

HS CODE: 3921901500

- Description: Textile laminated plastic soundproof sheets

- Total Tax Rate: 61.5%

- Breakdown:

- Base Tariff: 6.5%

- Additional Tariff: 25.0%

- Special Tariff after April 11, 2025: 30.0%

-

Note: Higher base tariff due to laminated construction.

-

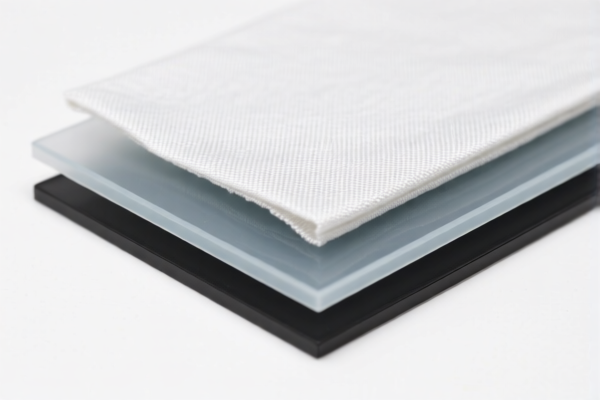

HS CODE: 3921901910

- Description: Lightweight textile plastic soundproof sheets

- Total Tax Rate: 60.3%

- Breakdown:

- Base Tariff: 5.3%

- Additional Tariff: 25.0%

- Special Tariff after April 11, 2025: 30.0%

-

Note: Designed for lighter applications, with a moderate tax rate.

-

HS CODE: 3921902550

- Description: Sound-absorbing textile plastic sheets

- Total Tax Rate: 61.5%

- Breakdown:

- Base Tariff: 6.5%

- Additional Tariff: 25.0%

- Special Tariff after April 11, 2025: 30.0%

- Note: Higher base tariff due to specialized acoustic properties.

📌 Important Notes and Recommendations:

-

April 11, 2025 Special Tariff:

A 30.0% additional tariff will be applied to all the above HS codes after April 11, 2025. This is a time-sensitive policy—plan your import schedule accordingly. -

Anti-Dumping Duties:

If the product contains iron or aluminum components, check for any anti-dumping duties that may apply. These are not included in the base or additional tariffs listed above. -

Certifications Required:

Ensure your product meets customs and safety standards (e.g., fire resistance, acoustic performance). Some countries may require certifications for soundproofing materials. -

Material and Unit Price Verification:

Confirm the exact composition of the product (e.g., type of textile, plastic, and any additives) to ensure correct HS code classification. Also, verify unit price for accurate duty calculation. -

Consult a Customs Broker:

For complex or high-value shipments, consider working with a customs broker to ensure compliance and avoid delays or penalties.

Let me know if you need help selecting the most appropriate HS code based on your product specifications.

Product Classification: Textile Reinforced Plastic Soundproof Sheets

HS CODEs and Tax Details (as of current regulations):

- HS CODE: 3921901100

- Description: Textile reinforced plastic soundproof sheets

- Total Tax Rate: 59.2%

- Breakdown:

- Base Tariff: 4.2%

- Additional Tariff: 25.0%

- Special Tariff after April 11, 2025: 30.0%

-

Note: This code is suitable for standard textile-reinforced plastic soundproof sheets.

-

HS CODE: 3921902900

- Description: Textile-plastic composite soundproof sheets

- Total Tax Rate: 59.4%

- Breakdown:

- Base Tariff: 4.4%

- Additional Tariff: 25.0%

- Special Tariff after April 11, 2025: 30.0%

-

Note: This code applies to composite materials with textile and plastic layers.

-

HS CODE: 3921901500

- Description: Textile laminated plastic soundproof sheets

- Total Tax Rate: 61.5%

- Breakdown:

- Base Tariff: 6.5%

- Additional Tariff: 25.0%

- Special Tariff after April 11, 2025: 30.0%

-

Note: Higher base tariff due to laminated construction.

-

HS CODE: 3921901910

- Description: Lightweight textile plastic soundproof sheets

- Total Tax Rate: 60.3%

- Breakdown:

- Base Tariff: 5.3%

- Additional Tariff: 25.0%

- Special Tariff after April 11, 2025: 30.0%

-

Note: Designed for lighter applications, with a moderate tax rate.

-

HS CODE: 3921902550

- Description: Sound-absorbing textile plastic sheets

- Total Tax Rate: 61.5%

- Breakdown:

- Base Tariff: 6.5%

- Additional Tariff: 25.0%

- Special Tariff after April 11, 2025: 30.0%

- Note: Higher base tariff due to specialized acoustic properties.

📌 Important Notes and Recommendations:

-

April 11, 2025 Special Tariff:

A 30.0% additional tariff will be applied to all the above HS codes after April 11, 2025. This is a time-sensitive policy—plan your import schedule accordingly. -

Anti-Dumping Duties:

If the product contains iron or aluminum components, check for any anti-dumping duties that may apply. These are not included in the base or additional tariffs listed above. -

Certifications Required:

Ensure your product meets customs and safety standards (e.g., fire resistance, acoustic performance). Some countries may require certifications for soundproofing materials. -

Material and Unit Price Verification:

Confirm the exact composition of the product (e.g., type of textile, plastic, and any additives) to ensure correct HS code classification. Also, verify unit price for accurate duty calculation. -

Consult a Customs Broker:

For complex or high-value shipments, consider working with a customs broker to ensure compliance and avoid delays or penalties.

Let me know if you need help selecting the most appropriate HS code based on your product specifications.

Customer Reviews

No reviews yet.