Found 5 matching results

(CN → US)

| HS Code | Official Doc | Tariff Rate | Origin | Destination | Effective Date |

|---|---|---|---|---|---|

| 3921902510 | Doc | 61.5% | CN | US | 2025-05-12 |

| 3921904010 | Doc | 34.2% | CN | US | 2025-05-12 |

| 7019905150 | Doc | 59.3% | CN | US | 2025-05-12 |

| 3921902100 | Doc | 61.5% | CN | US | 2025-05-12 |

| 3921902550 | Doc | 61.5% | CN | US | 2025-05-12 |

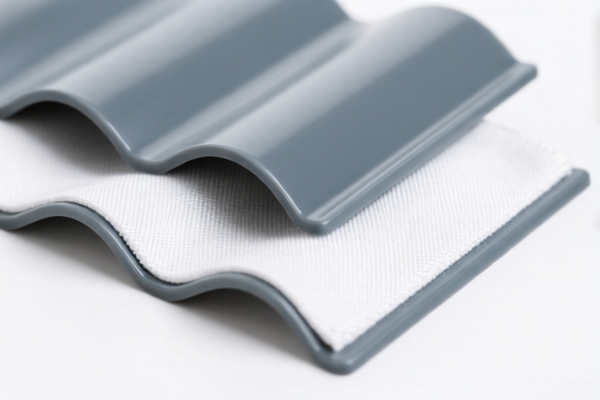

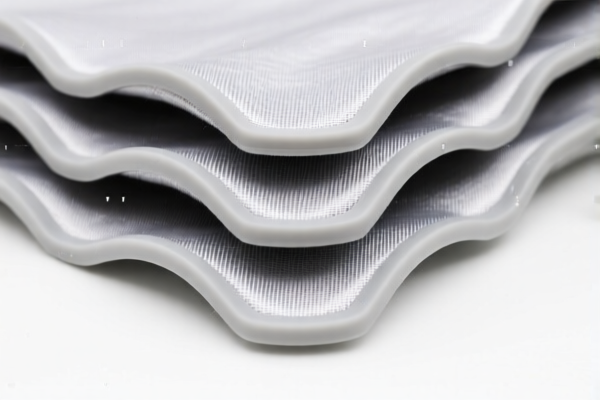

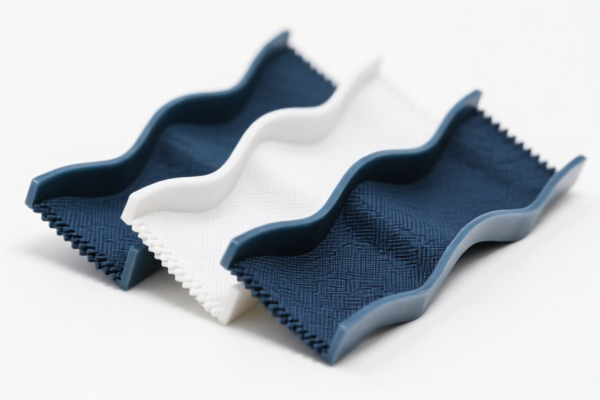

Here is the structured classification and tariff information for Textile Reinforced Plastic Special Shaped Panels, based on the provided HS codes and tax details:

✅ Product Classification Overview: Textile Reinforced Plastic Special Shaped Panels

🔢 HS CODE: 3921902510

- Description: Textile reinforced plastic panels

- Total Tax Rate: 61.5%

- Breakdown:

- Base Tariff: 6.5%

- Additional Tariff: 25.0%

- Tariff after April 11, 2025: 30.0%

- Note: This code is specifically for textile-reinforced plastic panels, which aligns well with your product description.

🔢 HS CODE: 3921904010

- Description: Plastic sheets, plates, films, foils, and strips

- Total Tax Rate: 34.2%

- Breakdown:

- Base Tariff: 4.2%

- Additional Tariff: 0.0%

- Tariff after April 11, 2025: 30.0%

- Note: This code is more general and may not be the best fit for textile-reinforced products.

🔢 HS CODE: 7019905150

- Description: Other products of glass fiber (including glass wool)

- Total Tax Rate: 59.3%

- Breakdown:

- Base Tariff: 4.3%

- Additional Tariff: 25.0%

- Tariff after April 11, 2025: 30.0%

- Note: This is for glass fiber products, not suitable for textile-reinforced plastic panels.

🔢 HS CODE: 3921902100

- Description: Boards combined with other textile materials

- Total Tax Rate: 61.5%

- Breakdown:

- Base Tariff: 6.5%

- Additional Tariff: 25.0%

- Tariff after April 11, 2025: 30.0%

- Note: This code is also suitable for textile-reinforced plastic panels, especially if the product is described as "combined with other textile materials."

🔢 HS CODE: 3921902550

- Description: Plastic combined with other textile materials in the form of sheets, plates, etc.

- Total Tax Rate: 61.5%

- Breakdown:

- Base Tariff: 6.5%

- Additional Tariff: 25.0%

- Tariff after April 11, 2025: 30.0%

- Note: This is a strong candidate for your product, especially if it is in the form of sheets or panels.

📌 Key Tariff Notes (April 11, 2025 onwards):

- All listed codes will have an additional 30.0% tariff applied after April 11, 2025.

- No anti-dumping duties are mentioned for this product category.

🛠️ Proactive Advice for Importers:

- Verify the exact composition of your product (e.g., type of textile reinforcement, plastic base material).

- Check the unit price and material specifications to ensure correct classification.

- Confirm if any certifications (e.g., RoHS, REACH, or specific import permits) are required for your product.

- Consider the impact of the April 11, 2025 tariff increase on your cost structure and pricing strategy.

✅ Recommended HS Code:

- 3921902510 or 3921902550 are the most accurate for Textile Reinforced Plastic Special Shaped Panels.

Let me know if you need help with customs documentation or further classification clarification. Here is the structured classification and tariff information for Textile Reinforced Plastic Special Shaped Panels, based on the provided HS codes and tax details:

✅ Product Classification Overview: Textile Reinforced Plastic Special Shaped Panels

🔢 HS CODE: 3921902510

- Description: Textile reinforced plastic panels

- Total Tax Rate: 61.5%

- Breakdown:

- Base Tariff: 6.5%

- Additional Tariff: 25.0%

- Tariff after April 11, 2025: 30.0%

- Note: This code is specifically for textile-reinforced plastic panels, which aligns well with your product description.

🔢 HS CODE: 3921904010

- Description: Plastic sheets, plates, films, foils, and strips

- Total Tax Rate: 34.2%

- Breakdown:

- Base Tariff: 4.2%

- Additional Tariff: 0.0%

- Tariff after April 11, 2025: 30.0%

- Note: This code is more general and may not be the best fit for textile-reinforced products.

🔢 HS CODE: 7019905150

- Description: Other products of glass fiber (including glass wool)

- Total Tax Rate: 59.3%

- Breakdown:

- Base Tariff: 4.3%

- Additional Tariff: 25.0%

- Tariff after April 11, 2025: 30.0%

- Note: This is for glass fiber products, not suitable for textile-reinforced plastic panels.

🔢 HS CODE: 3921902100

- Description: Boards combined with other textile materials

- Total Tax Rate: 61.5%

- Breakdown:

- Base Tariff: 6.5%

- Additional Tariff: 25.0%

- Tariff after April 11, 2025: 30.0%

- Note: This code is also suitable for textile-reinforced plastic panels, especially if the product is described as "combined with other textile materials."

🔢 HS CODE: 3921902550

- Description: Plastic combined with other textile materials in the form of sheets, plates, etc.

- Total Tax Rate: 61.5%

- Breakdown:

- Base Tariff: 6.5%

- Additional Tariff: 25.0%

- Tariff after April 11, 2025: 30.0%

- Note: This is a strong candidate for your product, especially if it is in the form of sheets or panels.

📌 Key Tariff Notes (April 11, 2025 onwards):

- All listed codes will have an additional 30.0% tariff applied after April 11, 2025.

- No anti-dumping duties are mentioned for this product category.

🛠️ Proactive Advice for Importers:

- Verify the exact composition of your product (e.g., type of textile reinforcement, plastic base material).

- Check the unit price and material specifications to ensure correct classification.

- Confirm if any certifications (e.g., RoHS, REACH, or specific import permits) are required for your product.

- Consider the impact of the April 11, 2025 tariff increase on your cost structure and pricing strategy.

✅ Recommended HS Code:

- 3921902510 or 3921902550 are the most accurate for Textile Reinforced Plastic Special Shaped Panels.

Let me know if you need help with customs documentation or further classification clarification.

Customer Reviews

No reviews yet.