| HS Code | Official Doc | Tariff Rate | Origin | Destination | Effective Date |

|---|---|---|---|---|---|

| 3921901100 | Doc | 59.2% | CN | US | 2025-05-12 |

| 3921902510 | Doc | 61.5% | CN | US | 2025-05-12 |

| 3921131910 | Doc | 60.3% | CN | US | 2025-05-12 |

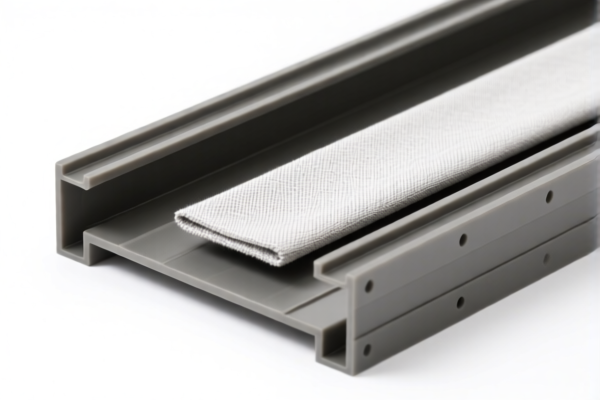

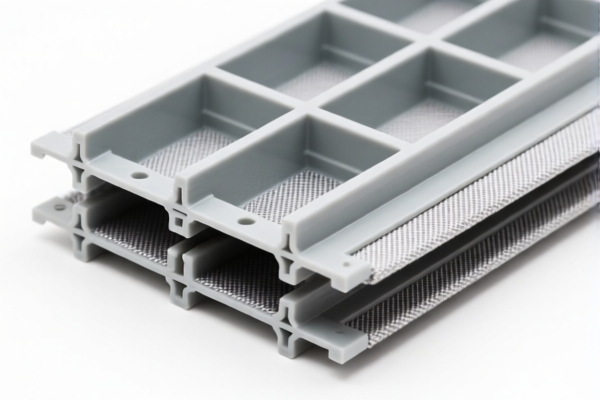

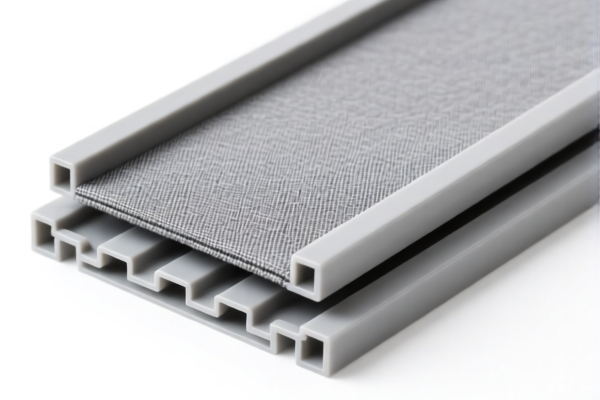

Product Classification: Textile Reinforced Plastic Structural Components Panels

HS CODE:

- 3921901100

- 3921902510

- 3921131910

🔍 Classification Overview

These HS codes classify textile-reinforced plastic structural panels, with specific criteria based on weight per square meter, fiber composition, and plastic content. Below is a breakdown of the key classifications and associated tariffs:

📌 HS Code 3921901100

Description:

- Panels with weight < 1.492 kg/m²

- Textile component contains synthetic fibers in greater weight than any other single textile fiber

- Plastic content > 70% by weight

Tariff Summary:

- Base Tariff: 4.2%

- Additional Tariff: 25.0%

- Special Tariff after April 11, 2025: 30.0%

- Total Tax Rate: 59.2%

📌 HS Code 3921902510

Description:

- Panels with weight > 1.492 kg/m²

- Textile component is dominated by synthetic fibers (i.e., no single textile fiber exceeds synthetic fiber weight)

- Plastic content > 70% by weight

Tariff Summary:

- Base Tariff: 6.5%

- Additional Tariff: 25.0%

- Special Tariff after April 11, 2025: 30.0%

- Total Tax Rate: 61.5%

📌 HS Code 3921131910

Description:

- Polyurethane combined with textile materials

- Textile component by weight exceeds any other single textile fiber

- Plastic content > 70% by weight

Tariff Summary:

- Base Tariff: 5.3%

- Additional Tariff: 25.0%

- Special Tariff after April 11, 2025: 30.0%

- Total Tax Rate: 60.3%

⚠️ Important Notes and Alerts

-

April 11, 2025 Special Tariff:

A 30.0% additional tariff will be applied to all three HS codes after April 11, 2025. Ensure your import timeline is aligned with this policy change. -

Anti-dumping duties:

Not explicitly mentioned in the data, but anti-dumping duties may apply depending on the origin of the product and market conditions. Verify with customs or a trade compliance expert if the product is subject to such duties. -

Material and Certification Requirements:

Confirm the exact composition of the textile and plastic components, as this determines the correct HS code.

Check if certifications (e.g., safety, environmental compliance) are required for import into the destination country.

✅ Proactive Advice for Importers

- Verify the exact weight per square meter of the panels to determine the correct HS code.

- Confirm the fiber composition (e.g., synthetic vs. natural fibers) and plastic content.

- Review the unit price and total tax impact before finalizing the import plan.

- Consult with customs brokers or trade compliance experts to ensure full compliance with local regulations and avoid delays or penalties.

Let me know if you need help determining which HS code applies to your specific product.

Product Classification: Textile Reinforced Plastic Structural Components Panels

HS CODE:

- 3921901100

- 3921902510

- 3921131910

🔍 Classification Overview

These HS codes classify textile-reinforced plastic structural panels, with specific criteria based on weight per square meter, fiber composition, and plastic content. Below is a breakdown of the key classifications and associated tariffs:

📌 HS Code 3921901100

Description:

- Panels with weight < 1.492 kg/m²

- Textile component contains synthetic fibers in greater weight than any other single textile fiber

- Plastic content > 70% by weight

Tariff Summary:

- Base Tariff: 4.2%

- Additional Tariff: 25.0%

- Special Tariff after April 11, 2025: 30.0%

- Total Tax Rate: 59.2%

📌 HS Code 3921902510

Description:

- Panels with weight > 1.492 kg/m²

- Textile component is dominated by synthetic fibers (i.e., no single textile fiber exceeds synthetic fiber weight)

- Plastic content > 70% by weight

Tariff Summary:

- Base Tariff: 6.5%

- Additional Tariff: 25.0%

- Special Tariff after April 11, 2025: 30.0%

- Total Tax Rate: 61.5%

📌 HS Code 3921131910

Description:

- Polyurethane combined with textile materials

- Textile component by weight exceeds any other single textile fiber

- Plastic content > 70% by weight

Tariff Summary:

- Base Tariff: 5.3%

- Additional Tariff: 25.0%

- Special Tariff after April 11, 2025: 30.0%

- Total Tax Rate: 60.3%

⚠️ Important Notes and Alerts

-

April 11, 2025 Special Tariff:

A 30.0% additional tariff will be applied to all three HS codes after April 11, 2025. Ensure your import timeline is aligned with this policy change. -

Anti-dumping duties:

Not explicitly mentioned in the data, but anti-dumping duties may apply depending on the origin of the product and market conditions. Verify with customs or a trade compliance expert if the product is subject to such duties. -

Material and Certification Requirements:

Confirm the exact composition of the textile and plastic components, as this determines the correct HS code.

Check if certifications (e.g., safety, environmental compliance) are required for import into the destination country.

✅ Proactive Advice for Importers

- Verify the exact weight per square meter of the panels to determine the correct HS code.

- Confirm the fiber composition (e.g., synthetic vs. natural fibers) and plastic content.

- Review the unit price and total tax impact before finalizing the import plan.

- Consult with customs brokers or trade compliance experts to ensure full compliance with local regulations and avoid delays or penalties.

Let me know if you need help determining which HS code applies to your specific product.

Customer Reviews

No reviews yet.