| HS Code | Official Doc | Tariff Rate | Origin | Destination | Effective Date |

|---|---|---|---|---|---|

| 3921901100 | Doc | 59.2% | CN | US | 2025-05-12 |

| 3921901950 | Doc | 60.3% | CN | US | 2025-05-12 |

| 3921902550 | Doc | 61.5% | CN | US | 2025-05-12 |

| 3921902510 | Doc | 61.5% | CN | US | 2025-05-12 |

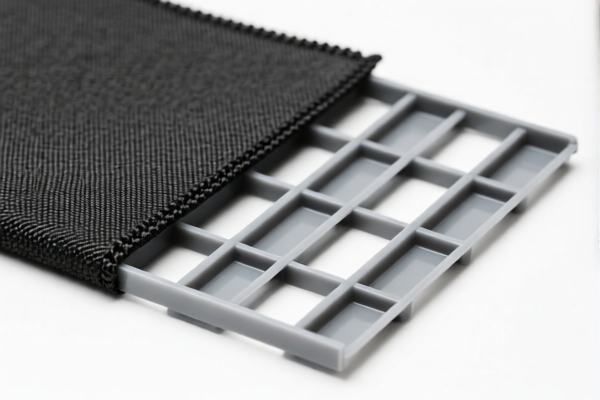

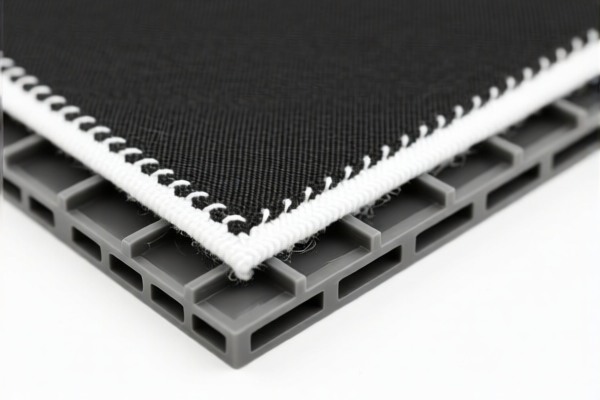

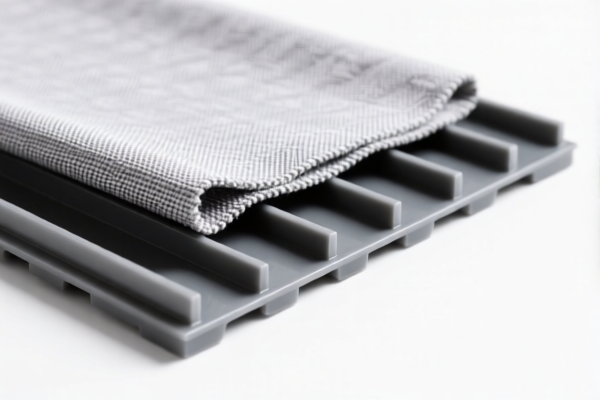

Product Classification: Textile Reinforced Plastic Toy Housing Panels

HS CODEs and Tax Details:

- HS CODE: 3921901100

- Description: Textile-reinforced plastic panels, with weight less than 1.492 kg/m², where synthetic fibers make up the majority of the textile component, and plastic constitutes more than 70% of the total weight.

- Total Tax Rate: 59.2%

- Breakdown:

- Base Tariff: 4.2%

- Additional Tariff: 25.0%

- Tariff after April 11, 2025: 30.0%

-

Note: This code is suitable if the product meets the specific weight and composition criteria.

-

HS CODE: 3921901950

- Description: Textile-reinforced plastic display or packaging films, where plastic sheets, films, etc., are combined with textile materials, with a weight not exceeding 1.492 kg/m², and classified under the "Other" category.

- Total Tax Rate: 60.3%

- Breakdown:

- Base Tariff: 5.3%

- Additional Tariff: 25.0%

- Tariff after April 11, 2025: 30.0%

-

Note: This code applies to thinner, film-like products used for display or packaging.

-

HS CODE: 3921902550

- Description: Textile-reinforced plastic films, where plastic sheets, films, etc., are combined with textile materials, with a weight exceeding 1.492 kg/m², synthetic fibers are the dominant textile component, and plastic constitutes more than 70% of the total weight.

- Total Tax Rate: 61.5%

- Breakdown:

- Base Tariff: 6.5%

- Additional Tariff: 25.0%

- Tariff after April 11, 2025: 30.0%

-

Note: This code is for heavier, more substantial textile-reinforced plastic films.

-

HS CODE: 3921902510

- Description: Textile-reinforced plastic sheets, where plastic sheets, films, etc., are combined with textile materials, with the textile component being the majority by weight, and synthetic fibers are the dominant textile fiber, with plastic making up more than 70% of the total weight.

- Total Tax Rate: 61.5%

- Breakdown:

- Base Tariff: 6.5%

- Additional Tariff: 25.0%

- Tariff after April 11, 2025: 30.0%

- Note: This code is for heavier, sheet-like products where the textile component is the primary weight contributor.

📌 Important Notes and Recommendations:

-

April 11, 2025 Tariff Increase:

All four HS codes will see an additional 30.0% tariff applied after April 11, 2025. Ensure your import timeline is planned accordingly. -

Material Verification:

Confirm the exact composition of your product (e.g., weight of plastic vs. textile, type of fibers used) to ensure correct classification. -

Certifications:

Check if any certifications (e.g., safety, environmental compliance) are required for import into the destination country. -

Unit Price and Classification:

The unit price may affect the classification, especially if the product is considered a "toy" or "housing panel" rather than a general industrial product. -

Anti-Dumping Duties:

While not explicitly mentioned in the data, be aware that anti-dumping duties may apply to certain plastic or textile products, depending on the country of origin and current trade policies.

✅ Proactive Action Steps:

- Verify the exact weight and composition of your product.

- Confirm the intended use (e.g., toy housing, packaging, display) to determine the most accurate HS code.

- Check for any additional duties or trade agreements that may affect your import costs.

-

Ensure compliance documentation is ready for customs clearance. Product Classification: Textile Reinforced Plastic Toy Housing Panels

HS CODEs and Tax Details: -

HS CODE: 3921901100

- Description: Textile-reinforced plastic panels, with weight less than 1.492 kg/m², where synthetic fibers make up the majority of the textile component, and plastic constitutes more than 70% of the total weight.

- Total Tax Rate: 59.2%

- Breakdown:

- Base Tariff: 4.2%

- Additional Tariff: 25.0%

- Tariff after April 11, 2025: 30.0%

-

Note: This code is suitable if the product meets the specific weight and composition criteria.

-

HS CODE: 3921901950

- Description: Textile-reinforced plastic display or packaging films, where plastic sheets, films, etc., are combined with textile materials, with a weight not exceeding 1.492 kg/m², and classified under the "Other" category.

- Total Tax Rate: 60.3%

- Breakdown:

- Base Tariff: 5.3%

- Additional Tariff: 25.0%

- Tariff after April 11, 2025: 30.0%

-

Note: This code applies to thinner, film-like products used for display or packaging.

-

HS CODE: 3921902550

- Description: Textile-reinforced plastic films, where plastic sheets, films, etc., are combined with textile materials, with a weight exceeding 1.492 kg/m², synthetic fibers are the dominant textile component, and plastic constitutes more than 70% of the total weight.

- Total Tax Rate: 61.5%

- Breakdown:

- Base Tariff: 6.5%

- Additional Tariff: 25.0%

- Tariff after April 11, 2025: 30.0%

-

Note: This code is for heavier, more substantial textile-reinforced plastic films.

-

HS CODE: 3921902510

- Description: Textile-reinforced plastic sheets, where plastic sheets, films, etc., are combined with textile materials, with the textile component being the majority by weight, and synthetic fibers are the dominant textile fiber, with plastic making up more than 70% of the total weight.

- Total Tax Rate: 61.5%

- Breakdown:

- Base Tariff: 6.5%

- Additional Tariff: 25.0%

- Tariff after April 11, 2025: 30.0%

- Note: This code is for heavier, sheet-like products where the textile component is the primary weight contributor.

📌 Important Notes and Recommendations:

-

April 11, 2025 Tariff Increase:

All four HS codes will see an additional 30.0% tariff applied after April 11, 2025. Ensure your import timeline is planned accordingly. -

Material Verification:

Confirm the exact composition of your product (e.g., weight of plastic vs. textile, type of fibers used) to ensure correct classification. -

Certifications:

Check if any certifications (e.g., safety, environmental compliance) are required for import into the destination country. -

Unit Price and Classification:

The unit price may affect the classification, especially if the product is considered a "toy" or "housing panel" rather than a general industrial product. -

Anti-Dumping Duties:

While not explicitly mentioned in the data, be aware that anti-dumping duties may apply to certain plastic or textile products, depending on the country of origin and current trade policies.

✅ Proactive Action Steps:

- Verify the exact weight and composition of your product.

- Confirm the intended use (e.g., toy housing, packaging, display) to determine the most accurate HS code.

- Check for any additional duties or trade agreements that may affect your import costs.

- Ensure compliance documentation is ready for customs clearance.

Customer Reviews

No reviews yet.