Found 5 matching results

(CN → US)

| HS Code | Official Doc | Tariff Rate | Origin | Destination | Effective Date |

|---|---|---|---|---|---|

| 3918902000 | Doc | 61.5% | CN | US | 2025-05-12 |

| 3921904010 | Doc | 34.2% | CN | US | 2025-05-12 |

| 3921902100 | Doc | 61.5% | CN | US | 2025-05-12 |

| 3918105000 | Doc | 59.2% | CN | US | 2025-05-12 |

| 4411923000 | Doc | 55.0% | CN | US | 2025-05-12 |

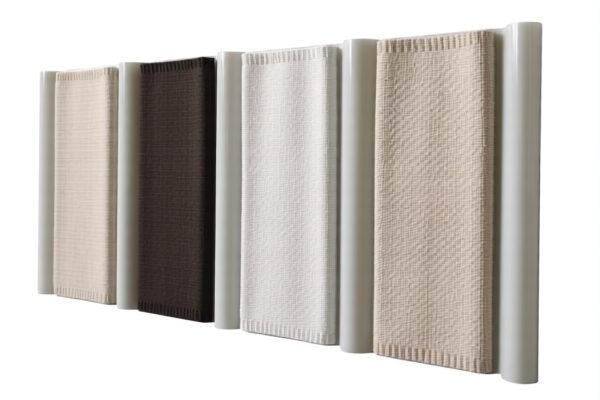

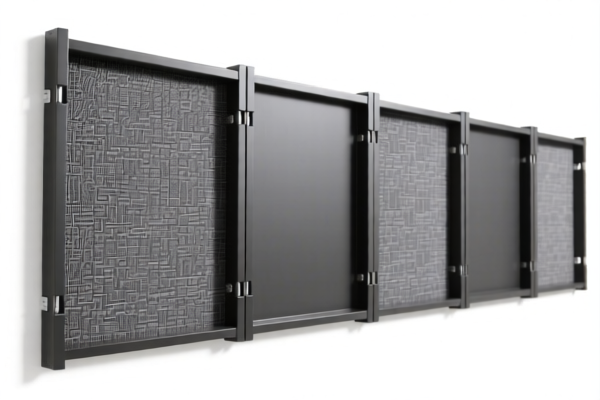

Here is the structured classification and tariff information for Textile Reinforced Plastic Wall Panels, based on the provided HS codes and tariff details:

✅ Product Classification Overview: Textile Reinforced Plastic Wall Panels

🔢 HS CODE: 3918902000

- Description: Plastic wall coverings, especially those with textile fiber or synthetic fiber backing.

- Total Tax Rate: 61.5%

- Breakdown:

- Base Tariff: 6.5%

- Additional Tariff: 25.0%

- April 11, 2025 Special Tariff: 30.0% (applies after April 11, 2025)

- Key Note: This is the most likely correct classification for textile-reinforced plastic wall panels.

🔢 HS CODE: 3921904010

- Description: Plastic sheets, films, foils, and strips, including those reinforced with paper.

- Total Tax Rate: 34.2%

- Breakdown:

- Base Tariff: 4.2%

- Additional Tariff: 0.0%

- April 11, 2025 Special Tariff: 30.0%

- Key Note: This code applies to plastic sheets but not specifically to wall panels with textile reinforcement.

🔢 HS CODE: 3921902100

- Description: Plastic sheets combined with other textile materials.

- Total Tax Rate: 61.5%

- Breakdown:

- Base Tariff: 6.5%

- Additional Tariff: 25.0%

- April 11, 2025 Special Tariff: 30.0%

- Key Note: This is a possible alternative if the product is classified as a plastic sheet combined with textile.

🔢 HS CODE: 3918105000

- Description: Plastic wall coverings.

- Total Tax Rate: 59.2%

- Breakdown:

- Base Tariff: 4.2%

- Additional Tariff: 25.0%

- April 11, 2025 Special Tariff: 30.0%

- Key Note: This is a general category for plastic wall coverings, but not specific to textile-reinforced products.

🔢 HS CODE: 4411923000

- Description: Fiberboard made of wood or cellulose materials, for building walls, ceilings, etc.

- Total Tax Rate: 55.0%

- Breakdown:

- Base Tariff: 0.0%

- Additional Tariff: 25.0%

- April 11, 2025 Special Tariff: 30.0%

- Key Note: This is not applicable to plastic products.

📌 Proactive Advice for Importers

- Verify Material Composition: Ensure the product is plastic-based with textile reinforcement (e.g., fabric backing or woven fibers).

- Check Unit Price and Certification: Confirm if any certifications (e.g., fire resistance, environmental compliance) are required for import.

- Monitor Tariff Changes: The April 11, 2025 special tariff will increase the total tax by 30% for all listed codes. Plan accordingly.

- Consult Customs Broker: For accurate classification and to avoid delays, especially if the product is borderline between categories.

📅 Important Date Reminder

- April 11, 2025: A 30% additional tariff will be applied to all listed HS codes. Ensure your import timeline accounts for this.

Let me know if you need help with certification requirements or customs documentation for this product. Here is the structured classification and tariff information for Textile Reinforced Plastic Wall Panels, based on the provided HS codes and tariff details:

✅ Product Classification Overview: Textile Reinforced Plastic Wall Panels

🔢 HS CODE: 3918902000

- Description: Plastic wall coverings, especially those with textile fiber or synthetic fiber backing.

- Total Tax Rate: 61.5%

- Breakdown:

- Base Tariff: 6.5%

- Additional Tariff: 25.0%

- April 11, 2025 Special Tariff: 30.0% (applies after April 11, 2025)

- Key Note: This is the most likely correct classification for textile-reinforced plastic wall panels.

🔢 HS CODE: 3921904010

- Description: Plastic sheets, films, foils, and strips, including those reinforced with paper.

- Total Tax Rate: 34.2%

- Breakdown:

- Base Tariff: 4.2%

- Additional Tariff: 0.0%

- April 11, 2025 Special Tariff: 30.0%

- Key Note: This code applies to plastic sheets but not specifically to wall panels with textile reinforcement.

🔢 HS CODE: 3921902100

- Description: Plastic sheets combined with other textile materials.

- Total Tax Rate: 61.5%

- Breakdown:

- Base Tariff: 6.5%

- Additional Tariff: 25.0%

- April 11, 2025 Special Tariff: 30.0%

- Key Note: This is a possible alternative if the product is classified as a plastic sheet combined with textile.

🔢 HS CODE: 3918105000

- Description: Plastic wall coverings.

- Total Tax Rate: 59.2%

- Breakdown:

- Base Tariff: 4.2%

- Additional Tariff: 25.0%

- April 11, 2025 Special Tariff: 30.0%

- Key Note: This is a general category for plastic wall coverings, but not specific to textile-reinforced products.

🔢 HS CODE: 4411923000

- Description: Fiberboard made of wood or cellulose materials, for building walls, ceilings, etc.

- Total Tax Rate: 55.0%

- Breakdown:

- Base Tariff: 0.0%

- Additional Tariff: 25.0%

- April 11, 2025 Special Tariff: 30.0%

- Key Note: This is not applicable to plastic products.

📌 Proactive Advice for Importers

- Verify Material Composition: Ensure the product is plastic-based with textile reinforcement (e.g., fabric backing or woven fibers).

- Check Unit Price and Certification: Confirm if any certifications (e.g., fire resistance, environmental compliance) are required for import.

- Monitor Tariff Changes: The April 11, 2025 special tariff will increase the total tax by 30% for all listed codes. Plan accordingly.

- Consult Customs Broker: For accurate classification and to avoid delays, especially if the product is borderline between categories.

📅 Important Date Reminder

- April 11, 2025: A 30% additional tariff will be applied to all listed HS codes. Ensure your import timeline accounts for this.

Let me know if you need help with certification requirements or customs documentation for this product.

Customer Reviews

No reviews yet.