| HS Code | Official Doc | Tariff Rate | Origin | Destination | Effective Date |

|---|---|---|---|---|---|

| 3921131500 | Doc | 61.5% | CN | US | 2025-05-12 |

| 3921131950 | Doc | 60.3% | CN | US | 2025-05-12 |

| 3921131100 | Doc | 59.2% | CN | US | 2025-05-12 |

| 3921131910 | Doc | 60.3% | CN | US | 2025-05-12 |

| 3921131950 | Doc | 60.3% | CN | US | 2025-05-12 |

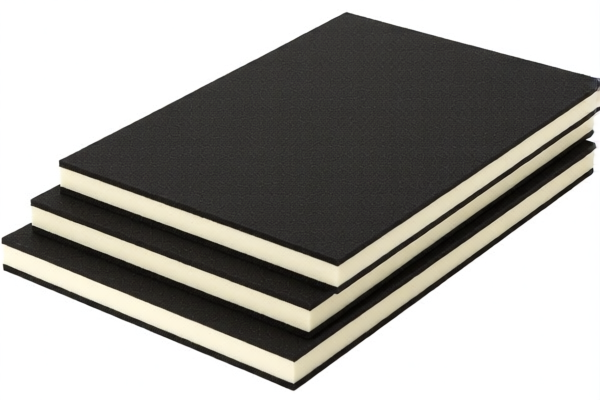

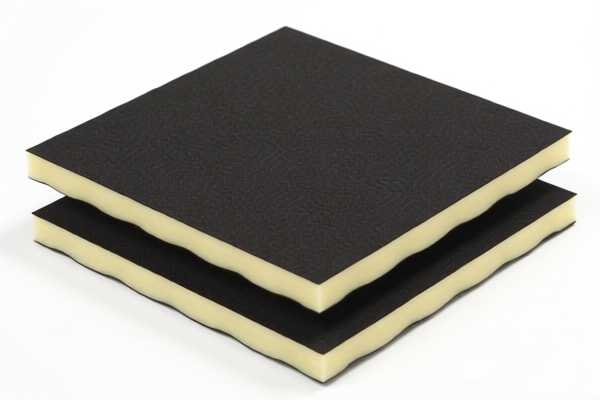

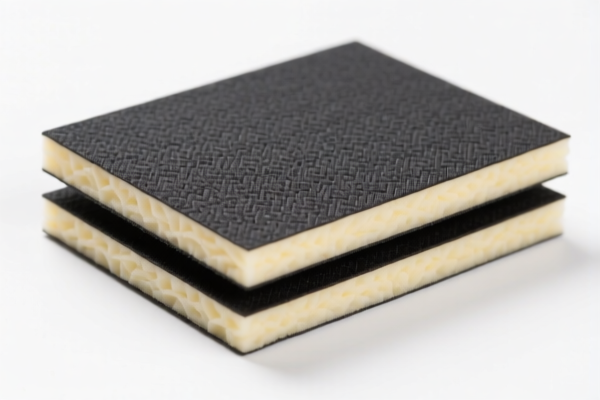

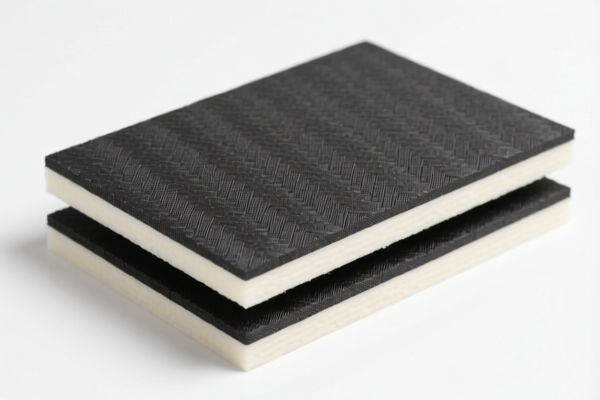

Product Name: Thermal Insulation Polyurethane Textile Composite Plates

Classification HS Codes and Tax Details:

🔍 HS Code: 3921131500

Description:

- Polyurethane plastic composite plates, sheets, films, foils, and strips combined with textile materials, where synthetic fibers weigh more than any other single textile fiber.

Tariff Breakdown:

- Base Tariff: 6.5%

- Additional Tariff: 25.0%

- Special Tariff after April 11, 2025: 30.0%

- Total Tax Rate: 61.5%

🔍 HS Code: 3921131950

Description:

- Honeycomb polyurethane plastic plates, sheets, films, foils, and strips combined with textile materials.

Tariff Breakdown:

- Base Tariff: 5.3%

- Additional Tariff: 25.0%

- Special Tariff after April 11, 2025: 30.0%

- Total Tax Rate: 60.3%

🔍 HS Code: 3921131100

Description:

- Polyurethane plastic combined with textile materials, where synthetic fibers weigh more than any other single textile fiber, and plastic content exceeds 70%.

Tariff Breakdown:

- Base Tariff: 4.2%

- Additional Tariff: 25.0%

- Special Tariff after April 11, 2025: 30.0%

- Total Tax Rate: 59.2%

🔍 HS Code: 3921131910

Description:

- Polyurethane combined with textile materials, where textile components weigh more than any single textile fiber.

Tariff Breakdown:

- Base Tariff: 5.3%

- Additional Tariff: 25.0%

- Special Tariff after April 11, 2025: 30.0%

- Total Tax Rate: 60.3%

⚠️ Important Notes:

-

April 11, 2025 Special Tariff:

A 30% additional tariff will be imposed on all the above HS codes after April 11, 2025. This is a time-sensitive policy and must be accounted for in cost planning. -

Anti-Dumping Duties:

If the product contains iron or aluminum components, anti-dumping duties may apply. Confirm the composition of the product and check for any applicable anti-dumping measures. -

Certifications Required:

Ensure the product meets all required certifications (e.g., material safety, fire resistance, etc.) for import compliance.

✅ Proactive Advice:

-

Verify Material Composition:

Confirm the exact percentage of synthetic vs. natural fibers and the plastic content to determine the correct HS code. -

Check Unit Price and Tax Impact:

The high total tax rate (59.2% to 61.5%) can significantly affect the final cost. Consider this in pricing and sourcing strategies. -

Consult Customs Broker:

For accurate classification and compliance, especially if the product has multiple components or is a composite material. -

Monitor Policy Updates:

Stay informed about any changes in tariff policies, especially the April 11, 2025 deadline. Product Name: Thermal Insulation Polyurethane Textile Composite Plates

Classification HS Codes and Tax Details:

🔍 HS Code: 3921131500

Description:

- Polyurethane plastic composite plates, sheets, films, foils, and strips combined with textile materials, where synthetic fibers weigh more than any other single textile fiber.

Tariff Breakdown:

- Base Tariff: 6.5%

- Additional Tariff: 25.0%

- Special Tariff after April 11, 2025: 30.0%

- Total Tax Rate: 61.5%

🔍 HS Code: 3921131950

Description:

- Honeycomb polyurethane plastic plates, sheets, films, foils, and strips combined with textile materials.

Tariff Breakdown:

- Base Tariff: 5.3%

- Additional Tariff: 25.0%

- Special Tariff after April 11, 2025: 30.0%

- Total Tax Rate: 60.3%

🔍 HS Code: 3921131100

Description:

- Polyurethane plastic combined with textile materials, where synthetic fibers weigh more than any other single textile fiber, and plastic content exceeds 70%.

Tariff Breakdown:

- Base Tariff: 4.2%

- Additional Tariff: 25.0%

- Special Tariff after April 11, 2025: 30.0%

- Total Tax Rate: 59.2%

🔍 HS Code: 3921131910

Description:

- Polyurethane combined with textile materials, where textile components weigh more than any single textile fiber.

Tariff Breakdown:

- Base Tariff: 5.3%

- Additional Tariff: 25.0%

- Special Tariff after April 11, 2025: 30.0%

- Total Tax Rate: 60.3%

⚠️ Important Notes:

-

April 11, 2025 Special Tariff:

A 30% additional tariff will be imposed on all the above HS codes after April 11, 2025. This is a time-sensitive policy and must be accounted for in cost planning. -

Anti-Dumping Duties:

If the product contains iron or aluminum components, anti-dumping duties may apply. Confirm the composition of the product and check for any applicable anti-dumping measures. -

Certifications Required:

Ensure the product meets all required certifications (e.g., material safety, fire resistance, etc.) for import compliance.

✅ Proactive Advice:

-

Verify Material Composition:

Confirm the exact percentage of synthetic vs. natural fibers and the plastic content to determine the correct HS code. -

Check Unit Price and Tax Impact:

The high total tax rate (59.2% to 61.5%) can significantly affect the final cost. Consider this in pricing and sourcing strategies. -

Consult Customs Broker:

For accurate classification and compliance, especially if the product has multiple components or is a composite material. -

Monitor Policy Updates:

Stay informed about any changes in tariff policies, especially the April 11, 2025 deadline.

Customer Reviews

No reviews yet.