| HS Code | Official Doc | Tariff Rate | Origin | Destination | Effective Date |

|---|---|---|---|---|---|

| 3907992000 | Doc | 55.0% | CN | US | 2025-05-12 |

| 3907995050 | Doc | 61.5% | CN | US | 2025-05-12 |

| 8477109050 | Doc | 58.1% | CN | US | 2025-05-12 |

| 8477109060 | Doc | 58.1% | CN | US | 2025-05-12 |

| 8480799090 | Doc | 58.1% | CN | US | 2025-05-12 |

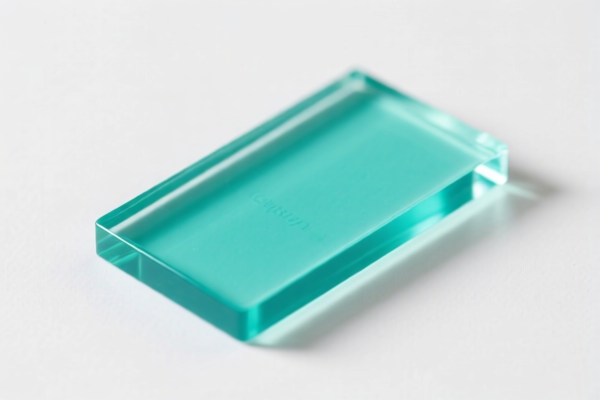

Product Classification: Thermoplastic Liquid Crystal Polyester Molding Grade Raw Material

HS CODE: 3907992000 (Primary Classification)

🔍 HS Code Breakdown and Tax Details

- HS CODE: 3907992000

- Description: Applicable to thermoplastic liquid crystal polyester resin raw materials, such as high-gloss liquid crystal polyester resin, liquid crystal polyester masterbatch, industrial-grade liquid crystal polyester raw materials, etc.

- Total Tax Rate: 55.0%

- Base Tariff Rate: 0.0%

- Additional Tariff: 25.0%

- Special Tariff after April 11, 2025: 30.0%

📌 Key Tax Rate Changes and Notes

-

April 11, 2025 Special Tariff:

A 30.0% additional tariff will be imposed on this product after April 11, 2025. This is a time-sensitive policy and must be accounted for in cost estimation and customs clearance planning. -

No Anti-Dumping Duties:

No specific anti-dumping duties on iron or aluminum are applicable for this product classification.

📦 Proactive Advice for Importers

-

Verify Material Specifications:

Ensure the product is indeed classified under 3907992000 and not misclassified under other HS codes such as 3907995050 (for other polyester resins). -

Check Unit Price and Certification:

Confirm the unit price and whether any certifications (e.g., RoHS, REACH, or specific customs documentation) are required for import. -

Monitor Tariff Updates:

Stay informed about tariff changes after April 11, 2025, as this could significantly impact the total import cost. -

Consider Alternative HS Codes:

If the product is used in machinery or molds, consider whether 8477109050, 8477109060, or 8480799090 might be more appropriate, depending on the end-use and product form.

📊 Comparison with Other HS Codes (for Reference)

| HS CODE | Description | Total Tax Rate | Base Tariff | Additional Tariff | April 11 Special Tariff |

|---|---|---|---|---|---|

| 3907992000 | Thermoplastic liquid crystal polyester | 55.0% | 0.0% | 25.0% | 30.0% |

| 3907995050 | Other polyester resins | 61.5% | 6.5% | 25.0% | 30.0% |

| 8477109050 | Plastic injection molding machines | 58.1% | 3.1% | 25.0% | 30.0% |

| 8477109060 | Large plastic injection molding machines | 58.1% | 3.1% | 25.0% | 30.0% |

| 8480799090 | Plastic molds | 58.1% | 3.1% | 25.0% | 30.0% |

✅ Summary of Actions Required

- Confirm the correct HS code based on the product's material and end-use.

- Be aware of the 30.0% additional tariff after April 11, 2025.

- Ensure customs documentation and certifications are in order.

- Consider tariff planning and cost estimation with the updated rates.

Let me know if you need help with customs declaration forms or tariff calculation tools.

Product Classification: Thermoplastic Liquid Crystal Polyester Molding Grade Raw Material

HS CODE: 3907992000 (Primary Classification)

🔍 HS Code Breakdown and Tax Details

- HS CODE: 3907992000

- Description: Applicable to thermoplastic liquid crystal polyester resin raw materials, such as high-gloss liquid crystal polyester resin, liquid crystal polyester masterbatch, industrial-grade liquid crystal polyester raw materials, etc.

- Total Tax Rate: 55.0%

- Base Tariff Rate: 0.0%

- Additional Tariff: 25.0%

- Special Tariff after April 11, 2025: 30.0%

📌 Key Tax Rate Changes and Notes

-

April 11, 2025 Special Tariff:

A 30.0% additional tariff will be imposed on this product after April 11, 2025. This is a time-sensitive policy and must be accounted for in cost estimation and customs clearance planning. -

No Anti-Dumping Duties:

No specific anti-dumping duties on iron or aluminum are applicable for this product classification.

📦 Proactive Advice for Importers

-

Verify Material Specifications:

Ensure the product is indeed classified under 3907992000 and not misclassified under other HS codes such as 3907995050 (for other polyester resins). -

Check Unit Price and Certification:

Confirm the unit price and whether any certifications (e.g., RoHS, REACH, or specific customs documentation) are required for import. -

Monitor Tariff Updates:

Stay informed about tariff changes after April 11, 2025, as this could significantly impact the total import cost. -

Consider Alternative HS Codes:

If the product is used in machinery or molds, consider whether 8477109050, 8477109060, or 8480799090 might be more appropriate, depending on the end-use and product form.

📊 Comparison with Other HS Codes (for Reference)

| HS CODE | Description | Total Tax Rate | Base Tariff | Additional Tariff | April 11 Special Tariff |

|---|---|---|---|---|---|

| 3907992000 | Thermoplastic liquid crystal polyester | 55.0% | 0.0% | 25.0% | 30.0% |

| 3907995050 | Other polyester resins | 61.5% | 6.5% | 25.0% | 30.0% |

| 8477109050 | Plastic injection molding machines | 58.1% | 3.1% | 25.0% | 30.0% |

| 8477109060 | Large plastic injection molding machines | 58.1% | 3.1% | 25.0% | 30.0% |

| 8480799090 | Plastic molds | 58.1% | 3.1% | 25.0% | 30.0% |

✅ Summary of Actions Required

- Confirm the correct HS code based on the product's material and end-use.

- Be aware of the 30.0% additional tariff after April 11, 2025.

- Ensure customs documentation and certifications are in order.

- Consider tariff planning and cost estimation with the updated rates.

Let me know if you need help with customs declaration forms or tariff calculation tools.

Customer Reviews

No reviews yet.