| HS Code | Official Doc | Tariff Rate | Origin | Destination | Effective Date |

|---|---|---|---|---|---|

| 3907992000 | Doc | 55.0% | CN | US | 2025-05-12 |

| 3907995050 | Doc | 61.5% | CN | US | 2025-05-12 |

| 3911902500 | Doc | 61.1% | CN | US | 2025-05-12 |

| 3911909110 | Doc | 61.5% | CN | US | 2025-05-12 |

| 3909390000 | Doc | 61.5% | CN | US | 2025-05-12 |

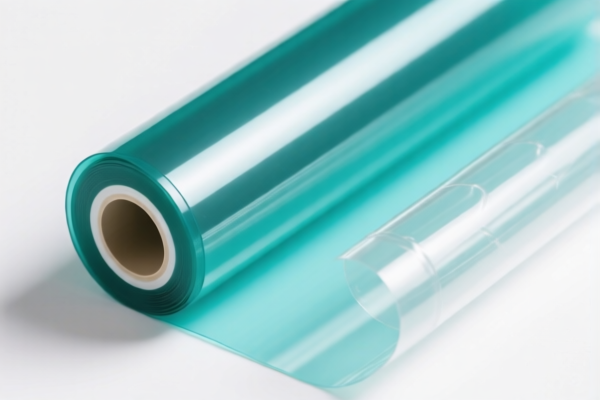

Product Classification: Thermoplastic Liquid Crystal Polyester Raw Material

Below is the detailed HS code classification and tariff information for your product:

1. HS Code: 3907992000

Description:

- Applicable to raw materials of thermoplastic liquid crystal polyester resins, such as high-gloss liquid crystal polyester resins and thermoplastic polyester resin raw materials.

Tariff Summary:

- Base Tariff Rate: 0.0%

- Additional Tariff: 25.0%

- Special Tariff after April 11, 2025: 30.0%

- Total Tax Rate: 55.0%

Key Notes:

- This code is specifically for liquid crystal polyester resins.

- The additional tariffs are standard for certain materials under China's customs regulations.

- The special tariff after April 11, 2025, is a time-sensitive policy and may be subject to change.

2. HS Code: 3907995050

Description:

- Applicable to polyester resin raw materials, classified under other polyester categories.

Tariff Summary:

- Base Tariff Rate: 6.5%

- Additional Tariff: 25.0%

- Special Tariff after April 11, 2025: 30.0%

- Total Tax Rate: 61.5%

Key Notes:

- This code is for general polyester resins, not specifically liquid crystal types.

- The base tariff is higher than 3907992000, so this may be more costly for similar products.

3. HS Code: 3909390000

Description:

- Applicable to polyurethane raw materials, classified under primary forms of amino resins, phenolic resins, and polyurethanes.

Tariff Summary:

- Base Tariff Rate: 6.5%

- Additional Tariff: 25.0%

- Special Tariff after April 11, 2025: 30.0%

- Total Tax Rate: 61.5%

Key Notes:

- This code is not suitable for thermoplastic liquid crystal polyester resins.

- It is for polyurethane and related resins, which are a different chemical category.

4. HS Code: 3911902500

Description:

- Applicable to thermoplastic petroleum resins or thermoplastic polyterpene resins, classified under polyterpenes.

Tariff Summary:

- Base Tariff Rate: 6.1%

- Additional Tariff: 25.0%

- Special Tariff after April 11, 2025: 30.0%

- Total Tax Rate: 61.1%

Key Notes:

- This code is for polyterpene resins, which are not thermoplastic liquid crystal polyester resins.

- The base tariff is slightly lower than other polyester-related codes.

5. HS Code: 3911909110

Description:

- Applicable to thermoplastic petroleum resins or thermoplastic polyterpene resins, classified under other forms of polyterpenes.

Tariff Summary:

- Base Tariff Rate: 6.5%

- Additional Tariff: 25.0%

- Special Tariff after April 11, 2025: 30.0%

- Total Tax Rate: 61.5%

Key Notes:

- This code is for other forms of polyterpene resins.

- Again, not suitable for thermoplastic liquid crystal polyester resins.

✅ Proactive Advice for You:

- Verify the material composition of your product to ensure it is thermoplastic liquid crystal polyester resin and not a different type of resin (e.g., polyurethane or polyterpene).

- Check the unit price and total tax cost based on the HS code that best fits your product.

- Confirm the required certifications (e.g., REACH, RoHS, or other import compliance documents) for customs clearance.

- Monitor the April 11, 2025, deadline for the special tariff increase — this could significantly impact your import costs.

- If in doubt, consult a customs broker or classification expert to ensure accurate HS code selection and compliance.

Let me know if you need help with HS code selection or customs documentation.

Product Classification: Thermoplastic Liquid Crystal Polyester Raw Material

Below is the detailed HS code classification and tariff information for your product:

1. HS Code: 3907992000

Description:

- Applicable to raw materials of thermoplastic liquid crystal polyester resins, such as high-gloss liquid crystal polyester resins and thermoplastic polyester resin raw materials.

Tariff Summary:

- Base Tariff Rate: 0.0%

- Additional Tariff: 25.0%

- Special Tariff after April 11, 2025: 30.0%

- Total Tax Rate: 55.0%

Key Notes:

- This code is specifically for liquid crystal polyester resins.

- The additional tariffs are standard for certain materials under China's customs regulations.

- The special tariff after April 11, 2025, is a time-sensitive policy and may be subject to change.

2. HS Code: 3907995050

Description:

- Applicable to polyester resin raw materials, classified under other polyester categories.

Tariff Summary:

- Base Tariff Rate: 6.5%

- Additional Tariff: 25.0%

- Special Tariff after April 11, 2025: 30.0%

- Total Tax Rate: 61.5%

Key Notes:

- This code is for general polyester resins, not specifically liquid crystal types.

- The base tariff is higher than 3907992000, so this may be more costly for similar products.

3. HS Code: 3909390000

Description:

- Applicable to polyurethane raw materials, classified under primary forms of amino resins, phenolic resins, and polyurethanes.

Tariff Summary:

- Base Tariff Rate: 6.5%

- Additional Tariff: 25.0%

- Special Tariff after April 11, 2025: 30.0%

- Total Tax Rate: 61.5%

Key Notes:

- This code is not suitable for thermoplastic liquid crystal polyester resins.

- It is for polyurethane and related resins, which are a different chemical category.

4. HS Code: 3911902500

Description:

- Applicable to thermoplastic petroleum resins or thermoplastic polyterpene resins, classified under polyterpenes.

Tariff Summary:

- Base Tariff Rate: 6.1%

- Additional Tariff: 25.0%

- Special Tariff after April 11, 2025: 30.0%

- Total Tax Rate: 61.1%

Key Notes:

- This code is for polyterpene resins, which are not thermoplastic liquid crystal polyester resins.

- The base tariff is slightly lower than other polyester-related codes.

5. HS Code: 3911909110

Description:

- Applicable to thermoplastic petroleum resins or thermoplastic polyterpene resins, classified under other forms of polyterpenes.

Tariff Summary:

- Base Tariff Rate: 6.5%

- Additional Tariff: 25.0%

- Special Tariff after April 11, 2025: 30.0%

- Total Tax Rate: 61.5%

Key Notes:

- This code is for other forms of polyterpene resins.

- Again, not suitable for thermoplastic liquid crystal polyester resins.

✅ Proactive Advice for You:

- Verify the material composition of your product to ensure it is thermoplastic liquid crystal polyester resin and not a different type of resin (e.g., polyurethane or polyterpene).

- Check the unit price and total tax cost based on the HS code that best fits your product.

- Confirm the required certifications (e.g., REACH, RoHS, or other import compliance documents) for customs clearance.

- Monitor the April 11, 2025, deadline for the special tariff increase — this could significantly impact your import costs.

- If in doubt, consult a customs broker or classification expert to ensure accurate HS code selection and compliance.

Let me know if you need help with HS code selection or customs documentation.

Customer Reviews

No reviews yet.