| HS Code | Official Doc | Tariff Rate | Origin | Destination | Effective Date |

|---|---|---|---|---|---|

| 3911909110 | Doc | 61.5% | CN | US | 2025-05-12 |

| 3911902500 | Doc | 61.1% | CN | US | 2025-05-12 |

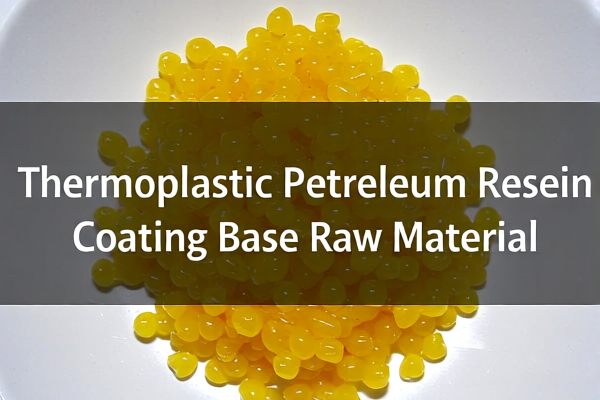

Product Name: Thermoplastic Petroleum Resin Coating Base Raw Material

Classification: HS Code 3911.90.91.10 or 3911.90.25.00

Classification Summary:

- Both HS codes fall under Chapter 39 (Plastics and articles thereof), Heading 3911 (Resins and other polymers, thermoplastic, of polyolefins, etc.), and Subheading 3911.90 (Other).

- The difference lies in the specific sub-subheadings (91.10 vs. 25.00), which may reflect variations in the chemical structure, processing, or intended use of the material.

🔍 HS Code Details and Tax Rates

HS Code: 3911909110

- Description: Thermoplastic Petroleum Resin Coating Base Raw Material

- Base Tariff Rate: 6.5%

- Additional Tariff (General): 25.0%

- Special Tariff (After April 11, 2025): 30.0%

- Total Tax Rate: 61.5%

HS Code: 3911902500

- Description: Thermoplastic Petroleum Resin Coating Base Raw Material

- Base Tariff Rate: 6.1%

- Additional Tariff (General): 25.0%

- Special Tariff (After April 11, 2025): 30.0%

- Total Tax Rate: 61.1%

⚠️ Important Notes on Tariff Changes

-

April 11, 2025 Special Tariff:

A 30.0% additional tariff will be imposed on both HS codes after April 11, 2025. This is likely part of a broader trade policy or anti-dumping measure. -

Anti-Dumping Duties:

While not explicitly mentioned, anti-dumping duties may apply depending on the origin of the product and whether it is subject to existing dumping investigations. You should verify if the product is listed in any anti-dumping duty schedules.

📌 Proactive Advice for Importers

-

Verify Material Specifications:

Ensure the product is indeed thermoplastic petroleum resin and not misclassified as a different polymer or resin type. -

Check Unit Price and Tax Calculation:

The total tax rate is based on the sum of base, additional, and special tariffs. Confirm the correct HS code for your specific product to avoid overpayment. -

Certifications and Documentation:

Be prepared to provide technical specifications, material safety data sheets (MSDS), and origin documentation if required by customs. -

Monitor Policy Updates:

Stay informed about tariff changes, especially the April 11, 2025 deadline, to avoid unexpected costs.

✅ Summary of Key Actions

- Confirm the correct HS code (3911909110 vs. 3911902500) based on product composition and use.

- Calculate total tax considering base + additional + special tariffs.

- Be aware of April 11, 2025 tariff increase.

- Prepare technical and origin documents for customs clearance.

Let me know if you need help determining which HS code applies to your specific product.

Product Name: Thermoplastic Petroleum Resin Coating Base Raw Material

Classification: HS Code 3911.90.91.10 or 3911.90.25.00

Classification Summary:

- Both HS codes fall under Chapter 39 (Plastics and articles thereof), Heading 3911 (Resins and other polymers, thermoplastic, of polyolefins, etc.), and Subheading 3911.90 (Other).

- The difference lies in the specific sub-subheadings (91.10 vs. 25.00), which may reflect variations in the chemical structure, processing, or intended use of the material.

🔍 HS Code Details and Tax Rates

HS Code: 3911909110

- Description: Thermoplastic Petroleum Resin Coating Base Raw Material

- Base Tariff Rate: 6.5%

- Additional Tariff (General): 25.0%

- Special Tariff (After April 11, 2025): 30.0%

- Total Tax Rate: 61.5%

HS Code: 3911902500

- Description: Thermoplastic Petroleum Resin Coating Base Raw Material

- Base Tariff Rate: 6.1%

- Additional Tariff (General): 25.0%

- Special Tariff (After April 11, 2025): 30.0%

- Total Tax Rate: 61.1%

⚠️ Important Notes on Tariff Changes

-

April 11, 2025 Special Tariff:

A 30.0% additional tariff will be imposed on both HS codes after April 11, 2025. This is likely part of a broader trade policy or anti-dumping measure. -

Anti-Dumping Duties:

While not explicitly mentioned, anti-dumping duties may apply depending on the origin of the product and whether it is subject to existing dumping investigations. You should verify if the product is listed in any anti-dumping duty schedules.

📌 Proactive Advice for Importers

-

Verify Material Specifications:

Ensure the product is indeed thermoplastic petroleum resin and not misclassified as a different polymer or resin type. -

Check Unit Price and Tax Calculation:

The total tax rate is based on the sum of base, additional, and special tariffs. Confirm the correct HS code for your specific product to avoid overpayment. -

Certifications and Documentation:

Be prepared to provide technical specifications, material safety data sheets (MSDS), and origin documentation if required by customs. -

Monitor Policy Updates:

Stay informed about tariff changes, especially the April 11, 2025 deadline, to avoid unexpected costs.

✅ Summary of Key Actions

- Confirm the correct HS code (3911909110 vs. 3911902500) based on product composition and use.

- Calculate total tax considering base + additional + special tariffs.

- Be aware of April 11, 2025 tariff increase.

- Prepare technical and origin documents for customs clearance.

Let me know if you need help determining which HS code applies to your specific product.

Customer Reviews

No reviews yet.