| HS Code | Official Doc | Tariff Rate | Origin | Destination | Effective Date |

|---|---|---|---|---|---|

| 3911909110 | Doc | 61.5% | CN | US | 2025-05-12 |

| 3911902500 | Doc | 61.1% | CN | US | 2025-05-12 |

| 3911100000 | Doc | 61.1% | CN | US | 2025-05-12 |

| 3911909110 | Doc | 61.5% | CN | US | 2025-05-12 |

| 3911909110 | Doc | 61.5% | CN | US | 2025-05-12 |

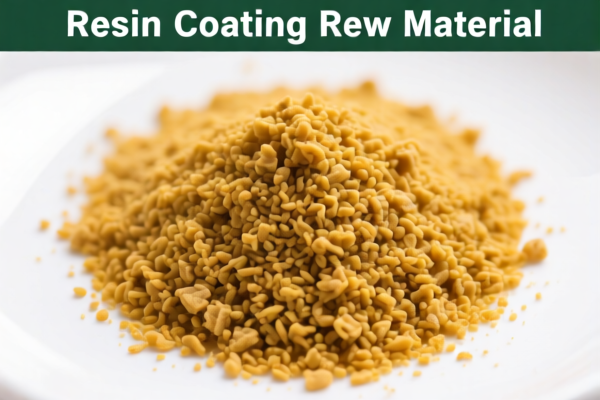

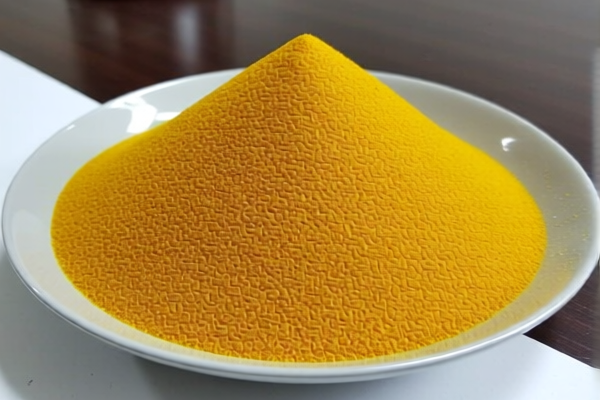

Product Classification: Thermoplastic Petroleum Resin Coating Raw Material

HS CODE: 3911909110 (most frequently used for this product)

Tariff Overview (as of current regulations):

- Base Tariff Rate: 6.5%

- Additional Tariff (General): 25.0%

- Special Tariff after April 2, 2025: 30.0%

- Total Tariff Rate: 61.5%

Key Notes on Tax Rates:

-

April 11 Special Tariff:

A 30.0% additional tariff will be applied after April 2, 2025, increasing the total tax burden significantly. This is a time-sensitive policy and should be closely monitored. -

No Anti-Dumping Duties Mentioned:

There are no specific anti-dumping duties listed for this product category (iron or aluminum-related), but always verify with the latest customs updates.

Classification Considerations:

- HS CODE 3911909110 is the most commonly used for thermoplastic petroleum resin raw materials, including films and composite materials.

- Other HS codes such as 3911902500 and 3911100000 may also apply depending on the specific form (e.g., pure resin, film, composite), but 3911909110 is the most accurate for raw material use.

Proactive Advice for Importers:

- Verify Material Specifications: Ensure the product is classified as a raw material and not a finished product or composite, which may fall under different HS codes.

- Check Unit Price and Certification: Confirm the unit price and whether certifications (e.g., RoHS, REACH, or customs documentation) are required for import.

- Monitor Tariff Changes: Keep track of April 2, 2025, as the special tariff will increase the total tax rate by 4.5%.

- Consult Customs Authority: For customs clearance, it is recommended to confirm the classification with local customs or a qualified customs broker.

Summary Table:

| HS CODE | Description | Base Tariff | Additional Tariff | Special Tariff (after 2025.4.2) | Total Tariff |

|---|---|---|---|---|---|

| 3911909110 | Thermoplastic petroleum resin raw material, film, composite | 6.5% | 25.0% | 30.0% | 61.5% |

| 3911902500 | Thermoplastic petroleum resin (other) | 6.1% | 25.0% | 30.0% | 61.1% |

| 3911100000 | Thermoplastic petroleum resin (other) | 6.1% | 25.0% | 30.0% | 61.1% |

If you have more details about the specific form or end-use of the product, I can help refine the classification further.

Product Classification: Thermoplastic Petroleum Resin Coating Raw Material

HS CODE: 3911909110 (most frequently used for this product)

Tariff Overview (as of current regulations):

- Base Tariff Rate: 6.5%

- Additional Tariff (General): 25.0%

- Special Tariff after April 2, 2025: 30.0%

- Total Tariff Rate: 61.5%

Key Notes on Tax Rates:

-

April 11 Special Tariff:

A 30.0% additional tariff will be applied after April 2, 2025, increasing the total tax burden significantly. This is a time-sensitive policy and should be closely monitored. -

No Anti-Dumping Duties Mentioned:

There are no specific anti-dumping duties listed for this product category (iron or aluminum-related), but always verify with the latest customs updates.

Classification Considerations:

- HS CODE 3911909110 is the most commonly used for thermoplastic petroleum resin raw materials, including films and composite materials.

- Other HS codes such as 3911902500 and 3911100000 may also apply depending on the specific form (e.g., pure resin, film, composite), but 3911909110 is the most accurate for raw material use.

Proactive Advice for Importers:

- Verify Material Specifications: Ensure the product is classified as a raw material and not a finished product or composite, which may fall under different HS codes.

- Check Unit Price and Certification: Confirm the unit price and whether certifications (e.g., RoHS, REACH, or customs documentation) are required for import.

- Monitor Tariff Changes: Keep track of April 2, 2025, as the special tariff will increase the total tax rate by 4.5%.

- Consult Customs Authority: For customs clearance, it is recommended to confirm the classification with local customs or a qualified customs broker.

Summary Table:

| HS CODE | Description | Base Tariff | Additional Tariff | Special Tariff (after 2025.4.2) | Total Tariff |

|---|---|---|---|---|---|

| 3911909110 | Thermoplastic petroleum resin raw material, film, composite | 6.5% | 25.0% | 30.0% | 61.5% |

| 3911902500 | Thermoplastic petroleum resin (other) | 6.1% | 25.0% | 30.0% | 61.1% |

| 3911100000 | Thermoplastic petroleum resin (other) | 6.1% | 25.0% | 30.0% | 61.1% |

If you have more details about the specific form or end-use of the product, I can help refine the classification further.

Customer Reviews

No reviews yet.