| HS Code | Official Doc | Tariff Rate | Origin | Destination | Effective Date |

|---|---|---|---|---|---|

| 3911909110 | Doc | 61.5% | CN | US | 2025-05-12 |

| 3911902500 | Doc | 61.1% | CN | US | 2025-05-12 |

| 3911100000 | Doc | 61.1% | CN | US | 2025-05-12 |

| 3911909110 | Doc | 61.5% | CN | US | 2025-05-12 |

| 3911909110 | Doc | 61.5% | CN | US | 2025-05-12 |

| 3907992000 | Doc | 55.0% | CN | US | 2025-05-12 |

Product Classification and Customs Tariff Analysis for Thermoplastic Petroleum Resin Plastic Modification Raw Material

Below is a structured breakdown of the HS codes and associated tariffs for the declared product "Thermoplastic Petroleum Resin Plastic Modification Raw Material" and related items.

1. HS Code: 3911909110

Product Description:

- Thermoplastic petroleum resin raw material

- Thermoplastic petroleum resin film material

- Thermoplastic petroleum resin composite material

Tariff Breakdown:

- Base Tariff Rate: 6.5%

- Additional Tariff: 25.0%

- Special Tariff after April 2, 2025: 30.0%

- Total Tax Rate: 61.5%

Notes:

- This code applies to raw materials, films, and composites made from thermoplastic petroleum resin.

- The April 2, 2025 special tariff is a key date to note for import planning.

2. HS Code: 3911902500

Product Description:

- Thermoplastic petroleum resin

Tariff Breakdown:

- Base Tariff Rate: 6.1%

- Additional Tariff: 25.0%

- Special Tariff after April 2, 2025: 30.0%

- Total Tax Rate: 61.1%

Notes:

- This code is for finished thermoplastic petroleum resin, not raw materials.

- The April 2, 2025 special tariff applies here as well.

3. HS Code: 3911100000

Product Description:

- Thermoplastic petroleum resin

Tariff Breakdown:

- Base Tariff Rate: 6.1%

- Additional Tariff: 25.0%

- Special Tariff after April 2, 2025: 30.0%

- Total Tax Rate: 61.1%

Notes:

- This code is also for thermoplastic petroleum resin, but may differ slightly in product form or application from 3911902500.

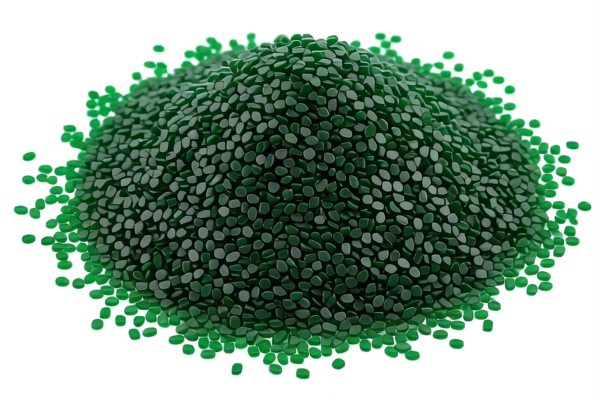

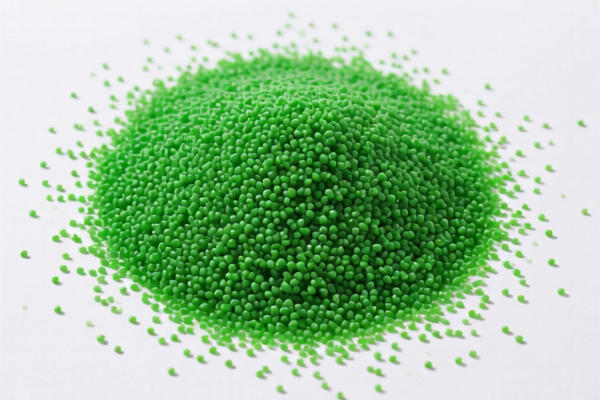

- Confirm the product form (e.g., powder, pellets, etc.) to ensure correct classification.

4. HS Code: 3907992000

Product Description:

- Thermoplastic polyester resin raw material

Tariff Breakdown:

- Base Tariff Rate: 0.0%

- Additional Tariff: 25.0%

- Special Tariff after April 2, 2025: 30.0%

- Total Tax Rate: 55.0%

Notes:

- This code is for polyester resin raw materials, not petroleum-based resins.

- The base tariff is 0%, but the additional and special tariffs still apply.

- Be cautious of misclassification if the product is actually a petroleum resin.

Key Tariff Changes and Alerts

- April 2, 2025 Special Tariff:

- Applies to all listed HS codes.

- Increases the total tax rate by 5% (from 56.1% to 61.1% or 61.5% depending on the code).

-

Critical Action: Plan import timelines before this date to avoid higher costs.

-

Anti-Dumping Duties:

- Not explicitly mentioned in the data, but always verify if the product is subject to anti-dumping or countervailing duties, especially for imported goods from certain countries.

Proactive Advice for Importers

- Verify Material Specifications:

-

Confirm whether the product is a raw material, film, composite, or finished resin to ensure correct HS code selection.

-

Check Unit Price and Certification Requirements:

-

Some products may require technical specifications, certifications, or origin documentation for customs clearance.

-

Monitor Tariff Updates:

-

Stay informed about tariff changes, especially around April 2, 2025, and any new trade policies that may affect your product.

-

Consult a Customs Broker or Expert:

- For complex classifications or high-value imports, seek professional assistance to avoid delays or penalties.

Let me know if you need help with certification requirements, customs documentation, or tariff calculation tools.

Product Classification and Customs Tariff Analysis for Thermoplastic Petroleum Resin Plastic Modification Raw Material

Below is a structured breakdown of the HS codes and associated tariffs for the declared product "Thermoplastic Petroleum Resin Plastic Modification Raw Material" and related items.

1. HS Code: 3911909110

Product Description:

- Thermoplastic petroleum resin raw material

- Thermoplastic petroleum resin film material

- Thermoplastic petroleum resin composite material

Tariff Breakdown:

- Base Tariff Rate: 6.5%

- Additional Tariff: 25.0%

- Special Tariff after April 2, 2025: 30.0%

- Total Tax Rate: 61.5%

Notes:

- This code applies to raw materials, films, and composites made from thermoplastic petroleum resin.

- The April 2, 2025 special tariff is a key date to note for import planning.

2. HS Code: 3911902500

Product Description:

- Thermoplastic petroleum resin

Tariff Breakdown:

- Base Tariff Rate: 6.1%

- Additional Tariff: 25.0%

- Special Tariff after April 2, 2025: 30.0%

- Total Tax Rate: 61.1%

Notes:

- This code is for finished thermoplastic petroleum resin, not raw materials.

- The April 2, 2025 special tariff applies here as well.

3. HS Code: 3911100000

Product Description:

- Thermoplastic petroleum resin

Tariff Breakdown:

- Base Tariff Rate: 6.1%

- Additional Tariff: 25.0%

- Special Tariff after April 2, 2025: 30.0%

- Total Tax Rate: 61.1%

Notes:

- This code is also for thermoplastic petroleum resin, but may differ slightly in product form or application from 3911902500.

- Confirm the product form (e.g., powder, pellets, etc.) to ensure correct classification.

4. HS Code: 3907992000

Product Description:

- Thermoplastic polyester resin raw material

Tariff Breakdown:

- Base Tariff Rate: 0.0%

- Additional Tariff: 25.0%

- Special Tariff after April 2, 2025: 30.0%

- Total Tax Rate: 55.0%

Notes:

- This code is for polyester resin raw materials, not petroleum-based resins.

- The base tariff is 0%, but the additional and special tariffs still apply.

- Be cautious of misclassification if the product is actually a petroleum resin.

Key Tariff Changes and Alerts

- April 2, 2025 Special Tariff:

- Applies to all listed HS codes.

- Increases the total tax rate by 5% (from 56.1% to 61.1% or 61.5% depending on the code).

-

Critical Action: Plan import timelines before this date to avoid higher costs.

-

Anti-Dumping Duties:

- Not explicitly mentioned in the data, but always verify if the product is subject to anti-dumping or countervailing duties, especially for imported goods from certain countries.

Proactive Advice for Importers

- Verify Material Specifications:

-

Confirm whether the product is a raw material, film, composite, or finished resin to ensure correct HS code selection.

-

Check Unit Price and Certification Requirements:

-

Some products may require technical specifications, certifications, or origin documentation for customs clearance.

-

Monitor Tariff Updates:

-

Stay informed about tariff changes, especially around April 2, 2025, and any new trade policies that may affect your product.

-

Consult a Customs Broker or Expert:

- For complex classifications or high-value imports, seek professional assistance to avoid delays or penalties.

Let me know if you need help with certification requirements, customs documentation, or tariff calculation tools.

Customer Reviews

No reviews yet.