| HS Code | Official Doc | Tariff Rate | Origin | Destination | Effective Date |

|---|---|---|---|---|---|

| 3911909110 | Doc | 61.5% | CN | US | 2025-05-12 |

| 3911902500 | Doc | 61.1% | CN | US | 2025-05-12 |

| 3911100000 | Doc | 61.1% | CN | US | 2025-05-12 |

| 3911904500 | Doc | 60.8% | CN | US | 2025-05-12 |

| 3911909110 | Doc | 61.5% | CN | US | 2025-05-12 |

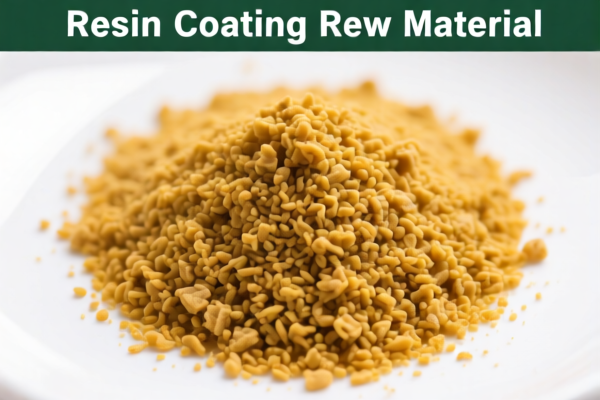

Product Classification: Thermoplastic Petroleum Resin Road Marking Paint Raw Material

HS CODE: 3911909110 (for "Thermoplastic Petroleum Resin" and "Petroleum-Based Thermoplastic Resin")

🔍 HS Code Details and Tax Rates

- HS CODE: 3911909110

- Description: Thermoplastic petroleum resin (raw material for road marking paint)

- Total Tax Rate: 61.5%

- Base Tariff Rate: 6.5%

- Additional Tariff: 25.0%

- Special Tariff after April 2, 2025: 30.0%

- Note: This is a time-sensitive policy. Ensure compliance with updated tariffs after this date.

📌 Key Tax Rate Changes and Alerts

- April 2, 2025 Special Tariff:

- A 30.0% additional tariff will be applied after April 2, 2025.

- This is a significant increase from the current 25.0% additional tariff.

-

Action Required: If your import schedule includes shipments after this date, re-calculate your total costs and update your customs documentation accordingly.

-

No Anti-Dumping Duties Mentioned:

- No specific anti-dumping duties on iron or aluminum are applicable for this product classification.

📦 Proactive Advice for Importers

- Verify Material Specifications:

-

Confirm that the product is indeed classified under HS CODE 3911909110 and not under other similar codes (e.g., 3911902500 or 3911100000), which may have slightly different tax rates.

-

Check Unit Price and Certification Requirements:

- Ensure that the unit price and product description match the HS code classification.

-

Confirm if certifications (e.g., RoHS, REACH, or specific customs documentation) are required for import into your destination country.

-

Monitor Tariff Updates:

- Stay informed about tariff changes and trade policy updates, especially around the April 2, 2025 deadline.

📊 Comparison with Similar HS Codes

| HS CODE | Description | Total Tax Rate | Notes |

|---|---|---|---|

| 3911909110 | Thermoplastic petroleum resin | 61.5% | Your product |

| 3911902500 | Thermoplastic petroleum resin | 61.1% | Similar, but slightly lower tax |

| 3911100000 | Petroleum resin | 61.1% | May apply to different resin types |

| 3911904500 | Thermosetting petroleum resin | 60.8% | Different chemical properties |

✅ Summary

- HS CODE: 3911909110

- Total Tax Rate: 61.5% (6.5% base + 25% additional + 30% after April 2, 2025)

- Critical Action: Verify product classification and prepare for increased tariffs after April 2, 2025.

- Certifications: Confirm if any are required for your destination market.

Product Classification: Thermoplastic Petroleum Resin Road Marking Paint Raw Material

HS CODE: 3911909110 (for "Thermoplastic Petroleum Resin" and "Petroleum-Based Thermoplastic Resin")

🔍 HS Code Details and Tax Rates

- HS CODE: 3911909110

- Description: Thermoplastic petroleum resin (raw material for road marking paint)

- Total Tax Rate: 61.5%

- Base Tariff Rate: 6.5%

- Additional Tariff: 25.0%

- Special Tariff after April 2, 2025: 30.0%

- Note: This is a time-sensitive policy. Ensure compliance with updated tariffs after this date.

📌 Key Tax Rate Changes and Alerts

- April 2, 2025 Special Tariff:

- A 30.0% additional tariff will be applied after April 2, 2025.

- This is a significant increase from the current 25.0% additional tariff.

-

Action Required: If your import schedule includes shipments after this date, re-calculate your total costs and update your customs documentation accordingly.

-

No Anti-Dumping Duties Mentioned:

- No specific anti-dumping duties on iron or aluminum are applicable for this product classification.

📦 Proactive Advice for Importers

- Verify Material Specifications:

-

Confirm that the product is indeed classified under HS CODE 3911909110 and not under other similar codes (e.g., 3911902500 or 3911100000), which may have slightly different tax rates.

-

Check Unit Price and Certification Requirements:

- Ensure that the unit price and product description match the HS code classification.

-

Confirm if certifications (e.g., RoHS, REACH, or specific customs documentation) are required for import into your destination country.

-

Monitor Tariff Updates:

- Stay informed about tariff changes and trade policy updates, especially around the April 2, 2025 deadline.

📊 Comparison with Similar HS Codes

| HS CODE | Description | Total Tax Rate | Notes |

|---|---|---|---|

| 3911909110 | Thermoplastic petroleum resin | 61.5% | Your product |

| 3911902500 | Thermoplastic petroleum resin | 61.1% | Similar, but slightly lower tax |

| 3911100000 | Petroleum resin | 61.1% | May apply to different resin types |

| 3911904500 | Thermosetting petroleum resin | 60.8% | Different chemical properties |

✅ Summary

- HS CODE: 3911909110

- Total Tax Rate: 61.5% (6.5% base + 25% additional + 30% after April 2, 2025)

- Critical Action: Verify product classification and prepare for increased tariffs after April 2, 2025.

- Certifications: Confirm if any are required for your destination market.

Customer Reviews

No reviews yet.