| HS Code | Official Doc | Tariff Rate | Origin | Destination | Effective Date |

|---|---|---|---|---|---|

| 3911902500 | Doc | 61.1% | CN | US | 2025-05-12 |

| 3911909110 | Doc | 61.5% | CN | US | 2025-05-12 |

| 3911100000 | Doc | 61.1% | CN | US | 2025-05-12 |

| 3911901000 | Doc | 55.0% | CN | US | 2025-05-12 |

| 3911909150 | Doc | 61.5% | CN | US | 2025-05-12 |

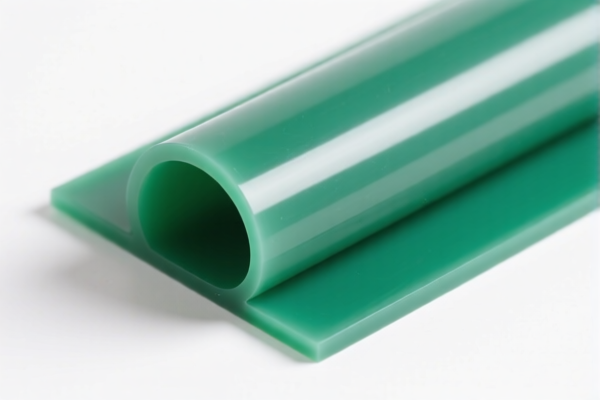

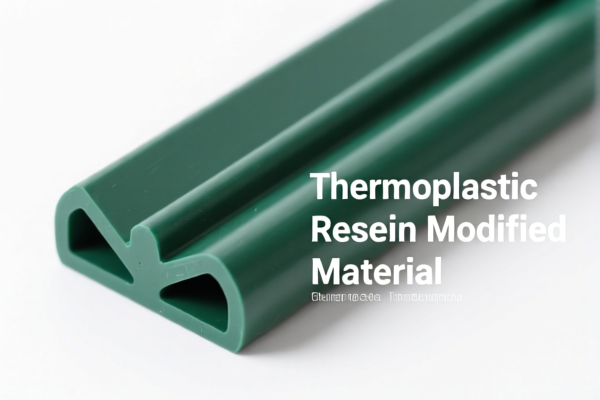

Here is the structured and professional breakdown of the customs classification and tariff details for Thermoplastic Petroleum Resin Rubber Modifier based on the provided HS codes:

🔍 Product Classification Overview

The product "Thermoplastic Petroleum Resin Rubber Modifier" falls under Chapter 39 of the HS code, specifically 3911 for thermoplastic resins. Below are the relevant HS codes and their associated tariff details:

📦 HS Code Breakdown

1. HS Code: 3911902500

- Description: Thermoplastic petroleum resin

- Total Tax Rate: 61.1%

- Tariff Breakdown:

- Base Tariff: 6.1%

- Additional Tariff: 25.0%

- Special Tariff after April 11, 2025: 30.0%

- Note: This code is for general thermoplastic petroleum resin.

2. HS Code: 3911909110

- Description: Thermoplastic petroleum resin additive

- Total Tax Rate: 61.5%

- Tariff Breakdown:

- Base Tariff: 6.5%

- Additional Tariff: 25.0%

- Special Tariff after April 11, 2025: 30.0%

- Note: This code applies to additives used in thermoplastic petroleum resin.

3. HS Code: 3911100000

- Description: Thermoplastic petroleum resin

- Total Tax Rate: 61.1%

- Tariff Breakdown:

- Base Tariff: 6.1%

- Additional Tariff: 25.0%

- Special Tariff after April 11, 2025: 30.0%

- Note: This is another general code for thermoplastic petroleum resin.

4. HS Code: 3911901000

- Description: Thermoplastic petroleum resin elastomer

- Total Tax Rate: 55.0%

- Tariff Breakdown:

- Base Tariff: 0.0%

- Additional Tariff: 25.0%

- Special Tariff after April 11, 2025: 30.0%

- Note: This code is for elastomers made from thermoplastic petroleum resin.

5. HS Code: 3911909150

- Description: Petroleum resin modifier

- Total Tax Rate: 61.5%

- Tariff Breakdown:

- Base Tariff: 6.5%

- Additional Tariff: 25.0%

- Special Tariff after April 11, 2025: 30.0%

- Note: This code is for modifiers used in petroleum resin.

⚠️ Important Notes and Alerts

-

April 11, 2025 Special Tariff:

A 30.0% additional tariff will be applied to all the above HS codes after April 11, 2025. This is a time-sensitive policy and must be accounted for in cost planning. -

No Anti-Dumping Duties Mentioned:

There are no specific anti-dumping duties listed for this product category in the provided data. -

Certifications Required:

Ensure that your product meets all customs and import compliance requirements, including material specifications, unit price verification, and certifications (e.g., REACH, RoHS, or other relevant standards).

✅ Proactive Advice for Importers

- Verify Product Description: Confirm the exact product name and technical specifications to ensure correct HS code classification.

- Check Unit Price: The total tax rate is heavily influenced by the base tariff and additional tariffs, so ensure accurate unit pricing for customs valuation.

- Review Certification Requirements: Some products may require technical documentation or certifications for import compliance.

- Plan for April 11, 2025 Tariff Increase: If your import schedule includes shipments after this date, adjust your pricing and logistics strategy accordingly.

Let me know if you need help with customs documentation, tariff calculation, or HS code verification for your specific product. Here is the structured and professional breakdown of the customs classification and tariff details for Thermoplastic Petroleum Resin Rubber Modifier based on the provided HS codes:

🔍 Product Classification Overview

The product "Thermoplastic Petroleum Resin Rubber Modifier" falls under Chapter 39 of the HS code, specifically 3911 for thermoplastic resins. Below are the relevant HS codes and their associated tariff details:

📦 HS Code Breakdown

1. HS Code: 3911902500

- Description: Thermoplastic petroleum resin

- Total Tax Rate: 61.1%

- Tariff Breakdown:

- Base Tariff: 6.1%

- Additional Tariff: 25.0%

- Special Tariff after April 11, 2025: 30.0%

- Note: This code is for general thermoplastic petroleum resin.

2. HS Code: 3911909110

- Description: Thermoplastic petroleum resin additive

- Total Tax Rate: 61.5%

- Tariff Breakdown:

- Base Tariff: 6.5%

- Additional Tariff: 25.0%

- Special Tariff after April 11, 2025: 30.0%

- Note: This code applies to additives used in thermoplastic petroleum resin.

3. HS Code: 3911100000

- Description: Thermoplastic petroleum resin

- Total Tax Rate: 61.1%

- Tariff Breakdown:

- Base Tariff: 6.1%

- Additional Tariff: 25.0%

- Special Tariff after April 11, 2025: 30.0%

- Note: This is another general code for thermoplastic petroleum resin.

4. HS Code: 3911901000

- Description: Thermoplastic petroleum resin elastomer

- Total Tax Rate: 55.0%

- Tariff Breakdown:

- Base Tariff: 0.0%

- Additional Tariff: 25.0%

- Special Tariff after April 11, 2025: 30.0%

- Note: This code is for elastomers made from thermoplastic petroleum resin.

5. HS Code: 3911909150

- Description: Petroleum resin modifier

- Total Tax Rate: 61.5%

- Tariff Breakdown:

- Base Tariff: 6.5%

- Additional Tariff: 25.0%

- Special Tariff after April 11, 2025: 30.0%

- Note: This code is for modifiers used in petroleum resin.

⚠️ Important Notes and Alerts

-

April 11, 2025 Special Tariff:

A 30.0% additional tariff will be applied to all the above HS codes after April 11, 2025. This is a time-sensitive policy and must be accounted for in cost planning. -

No Anti-Dumping Duties Mentioned:

There are no specific anti-dumping duties listed for this product category in the provided data. -

Certifications Required:

Ensure that your product meets all customs and import compliance requirements, including material specifications, unit price verification, and certifications (e.g., REACH, RoHS, or other relevant standards).

✅ Proactive Advice for Importers

- Verify Product Description: Confirm the exact product name and technical specifications to ensure correct HS code classification.

- Check Unit Price: The total tax rate is heavily influenced by the base tariff and additional tariffs, so ensure accurate unit pricing for customs valuation.

- Review Certification Requirements: Some products may require technical documentation or certifications for import compliance.

- Plan for April 11, 2025 Tariff Increase: If your import schedule includes shipments after this date, adjust your pricing and logistics strategy accordingly.

Let me know if you need help with customs documentation, tariff calculation, or HS code verification for your specific product.

Customer Reviews

No reviews yet.