| HS Code | Official Doc | Tariff Rate | Origin | Destination | Effective Date |

|---|---|---|---|---|---|

| 3911909110 | Doc | 61.5% | CN | US | 2025-05-12 |

| 3911902500 | Doc | 61.1% | CN | US | 2025-05-12 |

| 3911100000 | Doc | 61.1% | CN | US | 2025-05-12 |

| 3911904500 | Doc | 60.8% | CN | US | 2025-05-12 |

| 3907992000 | Doc | 55.0% | CN | US | 2025-05-12 |

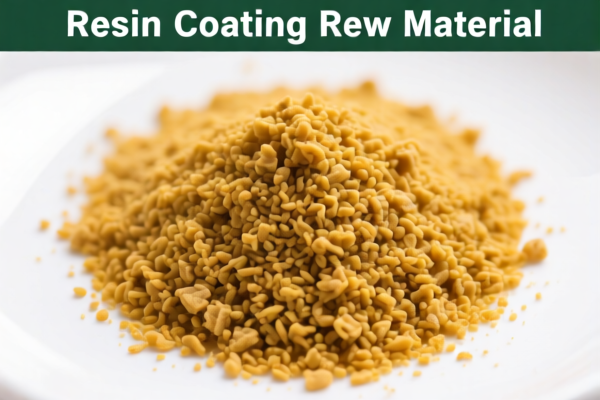

Product Classification: Thermoplastic Petroleum Resin Sealant Raw Material

Based on the provided HS codes and descriptions, the most appropriate classifications for thermoplastic petroleum resin sealant raw material are as follows:

✅ Recommended HS Code: 3911909110

Description: Thermoplastic petroleum resin raw material

Total Tax Rate: 61.5%

Breakdown of Tax Rates:

- Base Tariff Rate: 6.5%

- Additional Tariff (General): 25.0%

- Additional Tariff (After April 11, 2025): 30.0%

- Anti-dumping duties on iron and aluminum: Not applicable (not related to this product category)

📌 Other Possible HS Codes and Notes:

- HS Code: 3911902500

- Description: Thermoplastic petroleum resin

- Total Tax Rate: 61.1%

- Tax Breakdown: 6.1% + 25.0% + 30.0% (after April 11, 2025)

-

Note: This code may be more suitable for finished thermoplastic petroleum resin rather than raw material.

-

HS Code: 3911100000

- Description: Thermoplastic petroleum resin

- Total Tax Rate: 61.1%

- Tax Breakdown: 6.1% + 25.0% + 30.0% (after April 11, 2025)

-

Note: This code is for thermoplastic petroleum resin, but may not be specific to raw material.

-

HS Code: 3911904500

- Description: Thermosetting molding material based on petroleum resin

- Total Tax Rate: 60.8%

- Tax Breakdown: 5.8% + 25.0% + 30.0% (after April 11, 2025)

-

Note: This is for thermosetting materials, not thermoplastic raw material.

-

HS Code: 3907992000

- Description: Thermoplastic polyester resin raw material

- Total Tax Rate: 55.0%

- Tax Breakdown: 0.0% + 25.0% + 30.0% (after April 11, 2025)

- Note: This is for polyester resin, not petroleum resin. Not suitable for this product.

⚠️ Important Alerts:

-

April 11, 2025 Special Tariff:

A 30.0% additional tariff will be applied to this product after April 11, 2025. This is a time-sensitive policy and must be considered in cost planning. -

Anti-dumping duties:

Not applicable for this product category.

📌 Proactive Advice:

- Verify Material Specifications: Ensure the product is indeed thermoplastic petroleum resin raw material and not a finished product or a different type of resin (e.g., polyester).

- Check Unit Price and Certification: Confirm the unit price and whether certifications (e.g., RoHS, REACH, or customs documentation) are required for import.

- Consult Customs Broker: For accurate classification and compliance, especially if the product is close to multiple HS codes.

✅ Conclusion:

The most accurate HS code for thermoplastic petroleum resin sealant raw material is 3911909110, with a total tax rate of 61.5%. Be mindful of the April 11, 2025 tariff increase and ensure proper documentation and classification.

Product Classification: Thermoplastic Petroleum Resin Sealant Raw Material

Based on the provided HS codes and descriptions, the most appropriate classifications for thermoplastic petroleum resin sealant raw material are as follows:

✅ Recommended HS Code: 3911909110

Description: Thermoplastic petroleum resin raw material

Total Tax Rate: 61.5%

Breakdown of Tax Rates:

- Base Tariff Rate: 6.5%

- Additional Tariff (General): 25.0%

- Additional Tariff (After April 11, 2025): 30.0%

- Anti-dumping duties on iron and aluminum: Not applicable (not related to this product category)

📌 Other Possible HS Codes and Notes:

- HS Code: 3911902500

- Description: Thermoplastic petroleum resin

- Total Tax Rate: 61.1%

- Tax Breakdown: 6.1% + 25.0% + 30.0% (after April 11, 2025)

-

Note: This code may be more suitable for finished thermoplastic petroleum resin rather than raw material.

-

HS Code: 3911100000

- Description: Thermoplastic petroleum resin

- Total Tax Rate: 61.1%

- Tax Breakdown: 6.1% + 25.0% + 30.0% (after April 11, 2025)

-

Note: This code is for thermoplastic petroleum resin, but may not be specific to raw material.

-

HS Code: 3911904500

- Description: Thermosetting molding material based on petroleum resin

- Total Tax Rate: 60.8%

- Tax Breakdown: 5.8% + 25.0% + 30.0% (after April 11, 2025)

-

Note: This is for thermosetting materials, not thermoplastic raw material.

-

HS Code: 3907992000

- Description: Thermoplastic polyester resin raw material

- Total Tax Rate: 55.0%

- Tax Breakdown: 0.0% + 25.0% + 30.0% (after April 11, 2025)

- Note: This is for polyester resin, not petroleum resin. Not suitable for this product.

⚠️ Important Alerts:

-

April 11, 2025 Special Tariff:

A 30.0% additional tariff will be applied to this product after April 11, 2025. This is a time-sensitive policy and must be considered in cost planning. -

Anti-dumping duties:

Not applicable for this product category.

📌 Proactive Advice:

- Verify Material Specifications: Ensure the product is indeed thermoplastic petroleum resin raw material and not a finished product or a different type of resin (e.g., polyester).

- Check Unit Price and Certification: Confirm the unit price and whether certifications (e.g., RoHS, REACH, or customs documentation) are required for import.

- Consult Customs Broker: For accurate classification and compliance, especially if the product is close to multiple HS codes.

✅ Conclusion:

The most accurate HS code for thermoplastic petroleum resin sealant raw material is 3911909110, with a total tax rate of 61.5%. Be mindful of the April 11, 2025 tariff increase and ensure proper documentation and classification.

Customer Reviews

No reviews yet.